Part II: The What: Investing, Key Concepts and Types of Investments

Now that we understand why investing is so valuable and how it can help you build wealth, let’s start looking at some of the fundamentals of investing: what investing is, key investing terms, and basic investment types.

Building wealth can be challenging because there are innumerable ways to succeed and fail. Long-term wealth generation is about succeeding more often than you fail and, for that to happen, it is important to have some basic financial education.

Financial literacy means not only monitoring and managing your spending, but knowing how to invest intelligently for the long-term. Learning investing basics is important so you can contextualize your financial goals and needs, risk tolerance, and overall situation.

What is Investing?

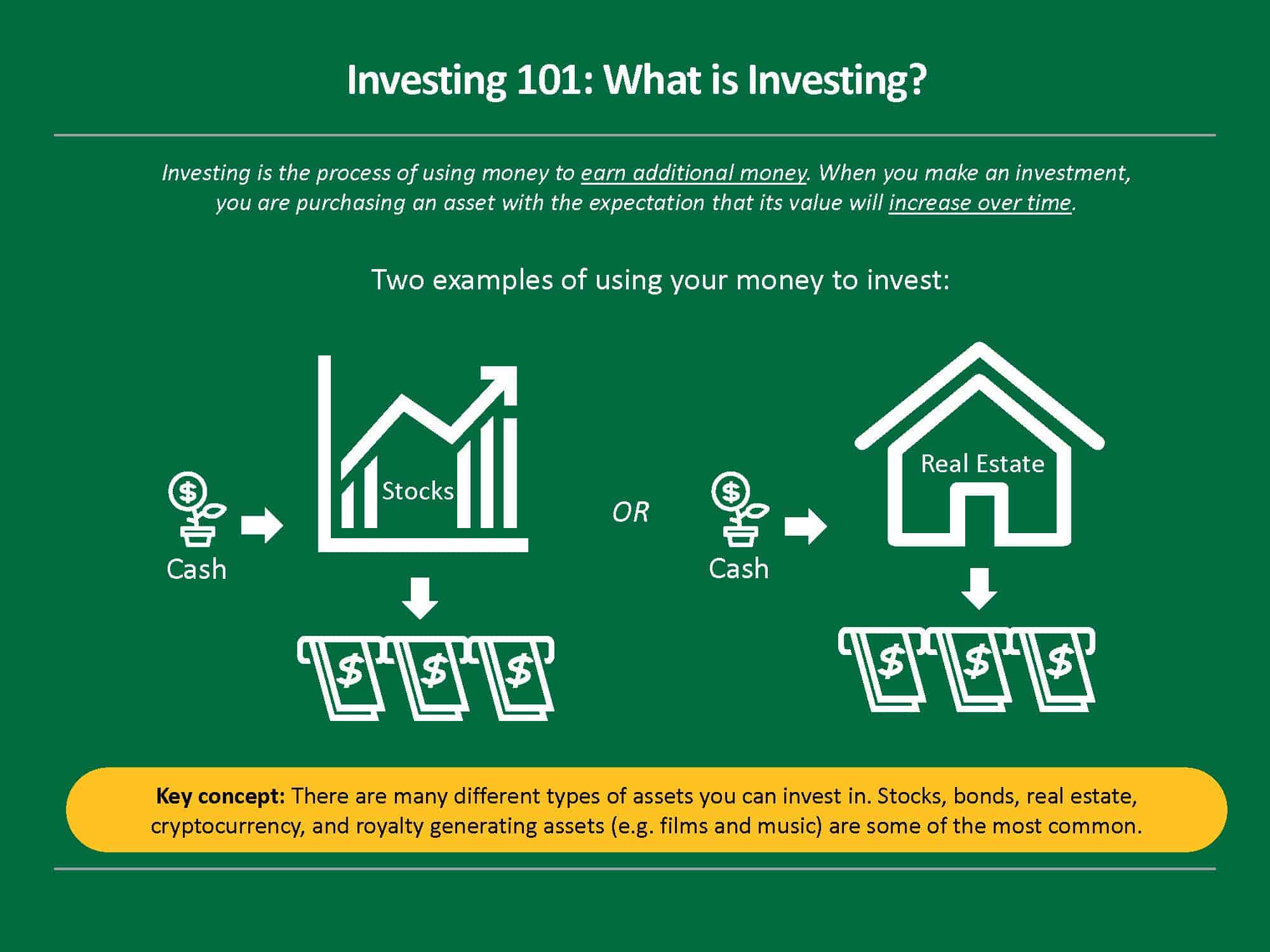

Investing is the process of using money to earn additional money. While saving is an important component of financial literacy, it is investing that helps people best prepare for retirement, build wealth, or increase their net worth.

Generally speaking, when you make an investment, you are purchasing an asset with the expectation that its value will increase over time (i.e. appreciate). The initial investment is known as the “principal.”

Investments typically help you make more money by doing some combination of:

Producing regular returns for you in the form of cash

-

- E.g., rental income, dividends, distributions, interest, etc.

Increasing in value over time

-

- E.g., buying a home for $200k and selling it for $250k, or investing $25k in a cryptocurrency that you later sell for $50k

There are many different types of assets you can invest in: stocks, bonds, real estate, cryptocurrency, and royalty generating assets (e.g. films and music) are some of the most common. Some investments are easy to buy and sell, like mutual funds, stocks, and bonds. Other investment types are less fungible and may require the assistance of a broker to sell (e.g. real estate).

Key Investing Concepts

There are lots of different investing terms that get thrown around, making financial know-how seem a bit overwhelming. To help simplify things, we have put together a list of the investing basics to kick off your investing journey.

Being able to understand and evaluate the risks of an investment is critical. As such, understanding your own risk tolerance is also important. For example, you might consider what type of lifestyle you want, what debt obligations you may have, and whether you have any dependents, when building an investment strategy.

As a general rule of thumb, though, if you don’t understand how an investment works, you probably shouldn’t make it.

6 Key Investing Concepts

Investment: the purchase of an asset with the expectation that its value will increase over time

- There are many different types of asset classes you can invest in: stocks (including actively managed mutual funds, index funds, and exchange traded funds), real estate (including real estate investment trusts), bonds, cryptocurrency, royalties, mutual funds etc.

Return on investment (ROI): an economic measure of how much value an investment will generate over time

- ROI, which is usually expressed as a percentage, is a key metric that helps investors compare returns across different asset classes and investments

Capital gain or loss: terms for the profit/gain or loss/decrease of an investment’s value

- Capital gains/losses can be realized (i.e., when funds actually get exchanged and an investor gains or loses money) or unrealized (on paper only)

Interest: the rate someone pays to borrow another person’s money, or the return you make lending your money out

- Credit cards are interest-bearing debt, meaning that you will owe interest on any unpaid balance you carry from month to month (these interest payments are distinct from the other fees a bank may charge you for credit card related services)

- E. g., you can earn interest on your deposits in a certificate of deposit or savings account

Compound interest: compound interest can be thought of as “interest on interest,” in contrast to simple interest

- When interest is compounded, you earn interest every year on your principal PLUS any interest you’ve already earned

- It serves as a multiplier over long periods of time and can dramatically increase your gains or debt (if money you owe on a credit card)

Dividend: A cash distribution of profits made periodically to stockholders by a corporation

- Dividends are optional, but a valuable form of income; when offered, they are typically paid quarterly or annually

Types of Investments: Assets & Asset Allocation

There are many different types of assets you can invest in.

So then, what is an asset?

Broadly speaking, an asset is an economic resource that can be owned and that has value. There are many different asset classes: a piece of art, a car, a stock, a property, and intellectual property are all examples. Some asset classes like fixed income securities are considered low-risk, while others may be more conducive to large price swings.

In the context of investing, you should focus on building a diversified portfolio of the main asset classes that have a record of good past performance, historically increasing in value or producing cash for their owner, in order to maximize your investment returns.

Each asset type has different characteristics and can serve a different purpose in an investment portfolio. For example, instead of picking individual stocks, many investors looking toward retirement can pick lower risk options like a mutual fund, index fund, or bond fund.

Common investment assets

Stock:

- A share of ownership, often called equity, issued by a publicly traded company. Owning a stock entitles you to vote on key management decisions at the company, as well as a share of its potential profits

- Stocks can increase or decrease in value and may pay out regular distributions, also known as dividend payments (dividends)

- The stock market is the place where investors sell and buy stocks

Bond:

- A bond is a fixed income instrument that represents a share of a loan made to the borrower (typically a company or a government entity) and has an attached interest rate

- Bond ownership entitles you to repayment of the initial amount you invested PLUS any interest earned over the bond’s term (i.e., lifetime) which comes in a fixed amount of cash

Cash:

- Cash or “money” refers to legal tender (coins or bills) that can be exchanged for goods or services

- Cash in its physical form is the simplest, most broadly accepted, and reliable form of payment

Commodities:

- A commodity is a basic good used in commerce and the production of other materials. Since they are widely usable and in demand, they are common investable assets.

- Examples of commodities include barrels of oil, precious metal, bushels of wheat, or megawatt-hours of electricity

Cryptocurrency:

- A cryptocurrency is a digital asset that exists on a global network of computers (i.e., decentralized)

- The first blockchain-based cryptocurrency was Bitcoin, which is the most popular and most valuable form of crypto

- Some investors see crypto as an unregulated, quick way to make money, but crypto is very complicated and novel compared to other asset classes. You can learn more about investing in crypto here.

Real Estate:

- Real estate, including land and properties can serve as either an income-generating investment or an investment that is expected to increase in value

- Residential property refers to homes, townhouses, and condominiums

- Commercial property includes retail stores, office buildings, or storage facilities like warehouses

- Many investors start investing in more common asset classes like stocks and index funds before turning toward other investments like real estate. You can learn more about real estate investing here.

Asset Allocation

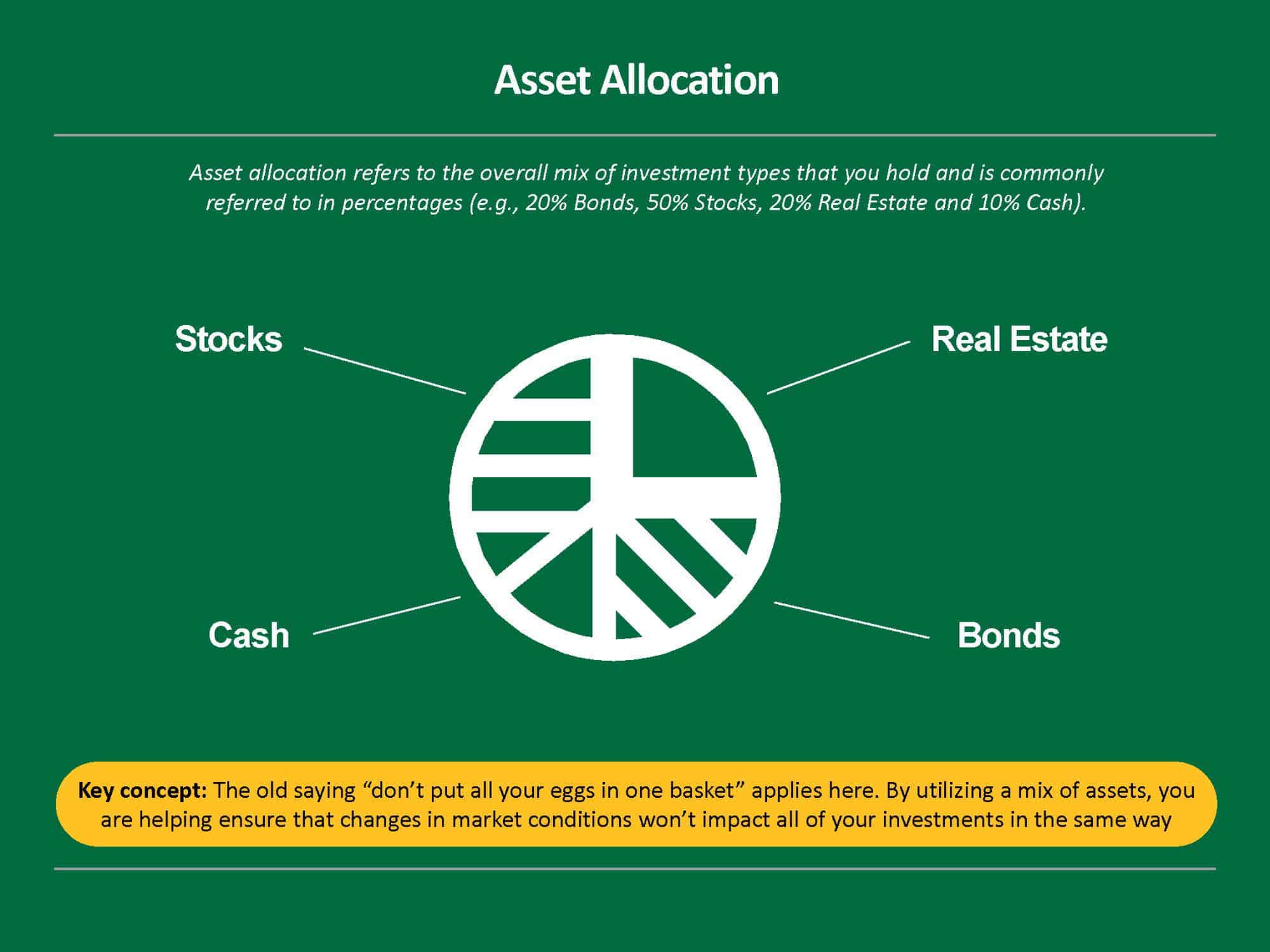

Asset allocation refers to the overall mix of investment types that you hold and is commonly referred to in percentages (e.g., 20% cash, 70% stocks, and 10% bonds). The goal of allocation is to maximize your potential returns while limiting risk through diversification. Having a strategic mix of different assets (not just the most common asset classes) that reflects your goals and investment time horizon is one of the best ways to optimize how you build wealth.

A publicly traded company is supposed to act in the best interest of its shareholders and a company’s earnings should be a reflection of this, but new investors should know that an expected return on any asset class cannot be guaranteed. Thus, building a diversified portfolio of investments and investing over a long period is very important. For example, owning multiple, different stocks as opposed to one stock or stocks with similar characteristics is a good way to mitigate risk in the face of economic and political changes. There’s no need to expose yourself to higher risk unnecessarily.

The old saying “don’t put all your eggs in one basket” applies here. By balancing out the mix of assets you invest in, you’re helping ensure that if market conditions change, those changes won’t impact all of your investments the same way.

So, what is investing?

Let’s recap. Essentially, investing is the process of using money to earn additional money, which helps you:

- Prepare for retirement

- Build wealth

- Increase your net worth

- Live a life full of the activities and things you love

There are various types of investments and assets you can invest in, such as:

- Stocks

- Bonds

- Cash

- Commodities

- Cryptocurrency

- Real Estate

And remember, as we learned in Part 1 of this investing 101 guide, all of this is important because, at the end of the day, investing:

- Helps you grow wealth (i.e. get rich!)

- Makes your money work for you

- Creates personal and financial freedom

Continue reading part III to learn more about ways to invest, what to consider before investing and how to apply all this knowledge.

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.