We often hear the question, “how do you invest in real estate?” Most people think real estate investing requires them to buy and manage a home or apartment building.

While owning rental properties is one way to invest in real estate, there are actually many ways to become a real estate investor, some of which require a lot less upfront money than buying a property outright.

In this article, we breakdown the property investment landscape by answering these 5 real estate investing questions:

Table of Contents

What are the different ways you can invest in real estate?

There are many ways to earn money from real estate. If you are new to real estate investing, some of the best places to start include:

- Own Rental Properties

- Flip Houses

- Turn Your Primary Residence Into an Investment

- Invest via Crowdsourced Real Estate Investment Platforms

- Buy Shares in a Real Estate Investment Trust (REIT)

Below is a deep-dive on each method.

1. Own Rental Properties

Rental properties allow you to build wealth by collecting rental income. Rental property investments aim to generate consistent monthly income via rent, either with long-term renters, vacation rentals, or short-term-stay platforms like Airbnb or Vrbo.

Best for:

- People who want control over their real estate investment and the ability to choose a specific type or location of investment property

- People who are able to cultivate relationships and build a support team (realtor, property manager, inspector, lawyer, contractor, etc.)

- People who want to diversify their income with a tangible investment

Pros:

- You pay less tax on rental income vs. earned income from a job, due to the ability to deduct depreciation and other real estate tax benefits

- You have many different loan options, most of which have low-interest rates

- Residential rental properties, especially single-family homes, are in high demand and can usually be sold quickly

Cons:

- Finding good property management to deal with tenant issues or repairs can be challenging

- Your income will be highly dependent on finding quality tenants and how often the unit is rented

- The rental property search, diligence, purchase, and sales process can be time-consuming and costly

Next steps:

Here is a list of property types you can invest in and how you can get started:

- Single-Family Homes: Use Roofstock to search for single-family properties that are already occupied and generating rent

- Vacation Rentals: Use sites like Zillow to search for homes or apartments in your desired location

- Small Multi-Family Homes: Use sites like Zillow, filtering by property type, to search for multifamily properties

- Commercial Properties: Use Loopnet to search across commercial property categories

2. Flip Houses

House flippers make money by buying a property at a discount and then selling it to the next buyer at a higher market value. This typically is done by some combination of:

- Price appreciation resulting from a hot real estate market in which home values are rising

- Making improvements to the property that are ultimately worth more than the work costs

Best for:

- People who have the ability to find or get access to off-market or underpriced houses

- People who have general contracting or construction skills and want to use “sweat equity” to make home improvements

- People who have unique insight into market conditions (e.g., realtors or contractors)

Pros:

- Your money is typically only tied up in an individual property for a short period of time (~6-12 months)

- Profit from the sale of a flipped house can be re-invested without paying any taxes on the gains via a 1031 exchange tax deferral

- Can be a very efficient and effective way to generate investment income

Cons:

- Income comes via a one-time event when you sell the property and is not a long-term income-producing investment (in contrast to owning a rental property)

- Often relies on market timing in “hot” markets to produce a profit, which can be risky

- Home improvement work can be difficult to budget or estimate accurately, and higher costs can eat away at any investment gains

Next steps:

If you think that flipping houses is something you want to do, first reflect on these questions:

- Do you have a unique angle on the market, construction skill set, or connections who can help you make money flipping houses?

- Do you have the risk tolerance and cash reserves to deal with unexpected expenses, a property not selling, or the market changing?

If you cannot answer yes to either of these questions (and you should ideally be able to say yes to both), then house flipping may not be for you.

If you do have connections, market insight, and/or the ability to deal with uncertainty, house flipping may be a good way to invest in real estate. Reach out to your connections and develop a plan to get started!

3. Turn Your Primary Residence Into an Investment

Also known as “house hacking,” you can generate additional income from your home in a variety of ways. Some examples are:

- Renting out extra rooms or in-law units in your home

- Buying a 2-4 unit property, living in one unit, and renting the others

- Adding to the value of the home with targeted upgrades or improvements

- Intentionally buying in an area that is receiving infrastructure or other investments from the local government so it’s value increases over time

Best for:

- People who are just getting started with real estate and willing to share space with renters

- People who live in an area where home prices are lower or the cost of a mortgage is comparable to rent

- People who want a more “hands-on” experience with their real estate investment, such as making improvements

Pros:

- Access to the best financing options, since primary residences get the lowest home loan interest rates

- The ability to reduce your living expenses and put money towards other investments

- Unique tax benefits like deductions for mortgage interest and depreciation, as well as the ability to defer capital gains when you sell

Cons:

- It can be difficult to find properties that meet both your personal criteria and investing criteria (e.g., too expensive relative to your expected cash flow)

- Living with or near your tenants can be messy (E.g., how you handle the rent being late)

- It can be tempting to rely too heavily on market factors or believe renovations will increase the value of the property (e.g., a new pool that costs $50k but won’t add $50k to the property price when you sell)

Next steps:

If you want to make your primary residence an intentional investment, it is important to treat it like one.

This means doing your homework by researching factors like:

- Rental rates for similar spaces in your area using https://www.rentometer.com/

- Crime statistics with: https://www.crimemapping.com/

- School quality with: https://www.greatschools.org/

- Municipal matters such as financial stability, job diversity, or migration patterns with the town’s most recent Comprehensive Annual Financial Report (CAFR)

|

PSA: While an owned primary residence is an asset, it may not always be a good investment. Factor in all of the costs (maintenance, property taxes, mortgage interest, etc.) to project whether the property will actually generate income or appreciate enough in value to be a good investment in the medium to long term. Always run the numbers! |

4. Online Real Estate Investment Platforms

Real estate crowdfunding platforms pool investor funds to let individuals participate in the real estate market through private real estate investment trusts (a.k.a. REITs) or investments in specific properties. A REIT is a company that owns, operates, or finances income-generating real estate. These online investment platforms provide access to investments that aren’t available through traditional brokerages.

Best for:

- People who want to invest in commercial or other types of properties that are not normally accessible to individual investors

- People who want more control over their specific investments, desire higher returns and are comfortable with higher risk

- People who want to build a diversified real estate portfolio without having to buy properties directly

Pros:

- Access to commercial properties and unique investment opportunities that can generate above-market returns

- May offer lower initial investment amounts (as low as $500) and limited fees, due to a lack of closing costs or other expenses

- Simple online user interfaces for performance tracking and portfolio oversight

Cons:

- Many platforms require you to be an accredited investor

- Can be difficult to properly conduct diligence on every aspect of a given investment opportunity (sponsor, property, market, terms, etc.)

- Less control and liquidity: many investments have a 5-to-7-year hold period which limits your ability to sell

Next steps:

There are a number of reputable real estate crowdfunding platforms to invest in, including:

Before committing any funds, be sure to do your homework by researching your target investment’s market dynamics, deal sponsor, property type, and terms.

5. Public Real Estate Investment Trusts (REITs)

A public Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Public REIT funds can be bought and sold in your IRA, 401(k), or brokerage account, much like a mutual fund.

Best for:

- People with smaller amounts of money to invest or those who aren’t an accredited investor

- People who do not want to actively engage with the real estate search, management, or sales process

- People who want access to a diversified slate of properties and locations

Pros:

- A great way to quickly diversify your exposure to real estate

- The best liquidity of any real estate investment option, with the ability to sell public REIT shares like any other investment fund

- The option to pick a specific focus area or sub-sector for investment (E.g., Office, Industrial, Retail, Hotel, Multifamily, or Healthcare)

Cons:

- Public REIT funds can come with higher fees than mutual funds or exchange-traded funds (ETFs)

- Because you have no direct control over the investments in a REIT, it can be difficult to select specific property types or locationsLower growth potential, since REITs are mandated by law to payout 90% of their profits as dividends to investors

Next steps:

You can invest in specific REITs through your IRA, 401(k), or brokerage account. Here are three examples of well-respected REIT funds:

- Vanguard Real Estate Index Fund ETF (VNQ)

- Real Estate Select Sector SPDR ETF (XLRE)

- Schwab US REIT ETF (SCHH)

There are many other ways to start investing in real estate, such as privately syndicated deals or partnerships, hard money lending, and tax lien investing. However, these methods demand a lot of knowledge and expertise, or require you to be an accredited investor, and generally have much higher minimum investment amounts than the options we list here.

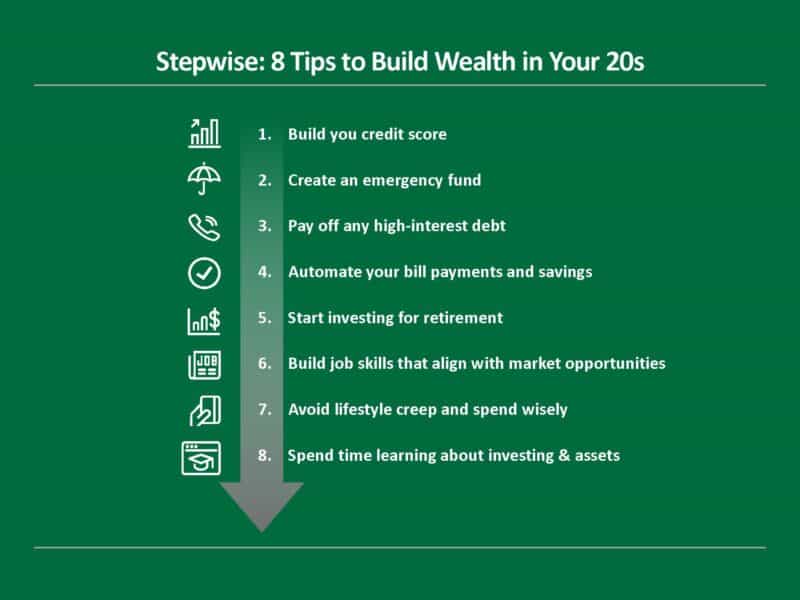

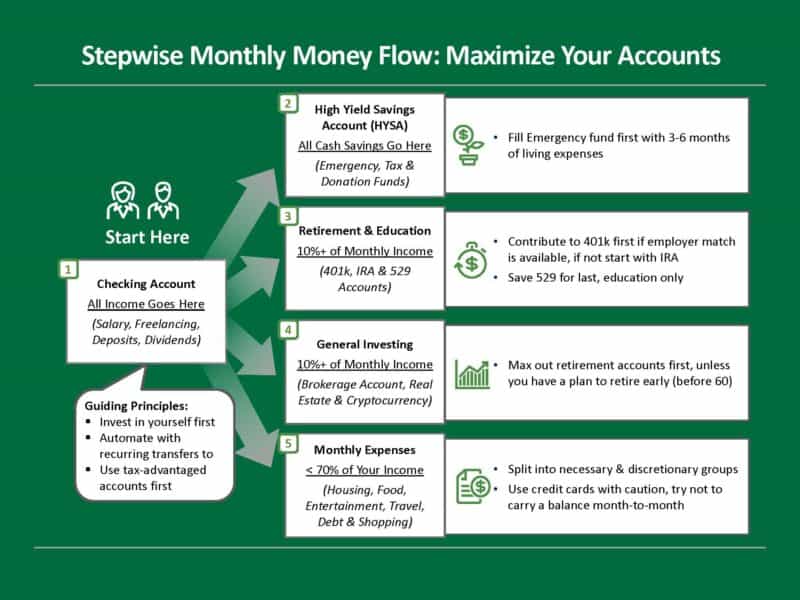

Are you prepared to invest in real estate?

Just like with any other investment, making sure you’re prepared to invest in real estate is vitally important. Below are a few things we recommend doing before you decide to make any substantial investments in real estate:

- Save at least 6 months of living expenses in an emergency fund

- Start contributing to your retirement accounts like your IRA and 401(k) before making more speculative investments, being sure to take advantage of any employer matching programs

- Save enough for a 20% down payment if you are considering buying real estate directly

- Build a large enough investment portfolio that your first foray into real estate investing does not exceed 20% of your total net worth

What should you consider before you start investing in real estate?

Before you invest in real estate, there are three important questions you need to consider:

- Does learning about real estate investing excite or at least interest you?

- How much money do you have to invest?

- What is your desired involvement and time commitment?

Of all the questions, number one is the most important to answer. The decision to invest in real estate is very personal and should first include an honest answer to this question:

Does learning about real estate investing excite or at least interest you?

If not, then just don’t do it.

It doesn’t matter what the newspaper, your uncle, or your co-worker says. Many people have built wealth, invested well, lived happy lives, and even retired early without ever owning any real estate.

If you’re interested in real estate primarily to diversify your investments, you can always buy a REIT ETF or index fund in your brokerage or retirement accounts. This may be a better option than investing in real estate directly if simplicity is something you value.

Note: If you have not read our post, 6-Step Guide: How To Save, Invest, And Build Wealth, we highly recommend doing so before deciding to invest in any real estate. |

What are the benefits and drawbacks of investing in real estate?

Investing in real estate can help you build wealth, as long as you are aware of its advantages and disadvantages relative to other kinds of investments.

Many investors add real estate to their portfolios because it offers greater control than many other investment types. It is very difficult to sway the direction of a major corporation’s stock, but you can control what you do with a property you own.

The benefits and drawbacks of real estate investing are as follows:

Benefits of Investing in Real Estate:

- Cash flow: Many real estate investments produce consistent rental income every month that translates into valuable cash flow for the owner

- Appreciation: Real estate generally appreciates over time, due either to market factors or improvements you make to the property

- Tax advantages: Owning property offers many tax advantages, such as the ability to deduct depreciation from your rental income and shelter gains from taxes via 1031 exchanges

- Inflation Hedge: Real estate tends to be a good inflation hedge because its value and rents generally increase at the same rate as inflation

- Leverage: Leverage (i.e., a loan) can multiply your returns and limit the cash you use by enabling you to buy property without needing the full purchase price

- Stability: Real estate prices tend to be quite stable, typically swinging up or down far less than stocks or cryptocurrency

Drawbacks of Investing in Real Estate:

- Time-intensive: Real estate investing can be time-intensive (particularly during the upfront purchase process)

- Less liquid: Real estate investments are typically less liquid than stocks and bonds (i.e., you cannot always sell real estate quickly)

- Market knowledge: Real estate investments often require a bit more financial intelligence and market knowledge than picking a mutual fund or ETF

- Complexity: There is some administrative complexity (not to mention emotional involvement) when using your primary residence as an investment

Important Note: Not all real estate is a good investment. You must be comfortable with doing some math and reviewing the details of an opportunity before investing. You may even have to devote some expenses to conducting diligence on a property or fund. Like anything, it is best to start small, learn the process, and make bigger investments as you get more comfortable over time. |

What are the next steps for you to start investing in real estate?

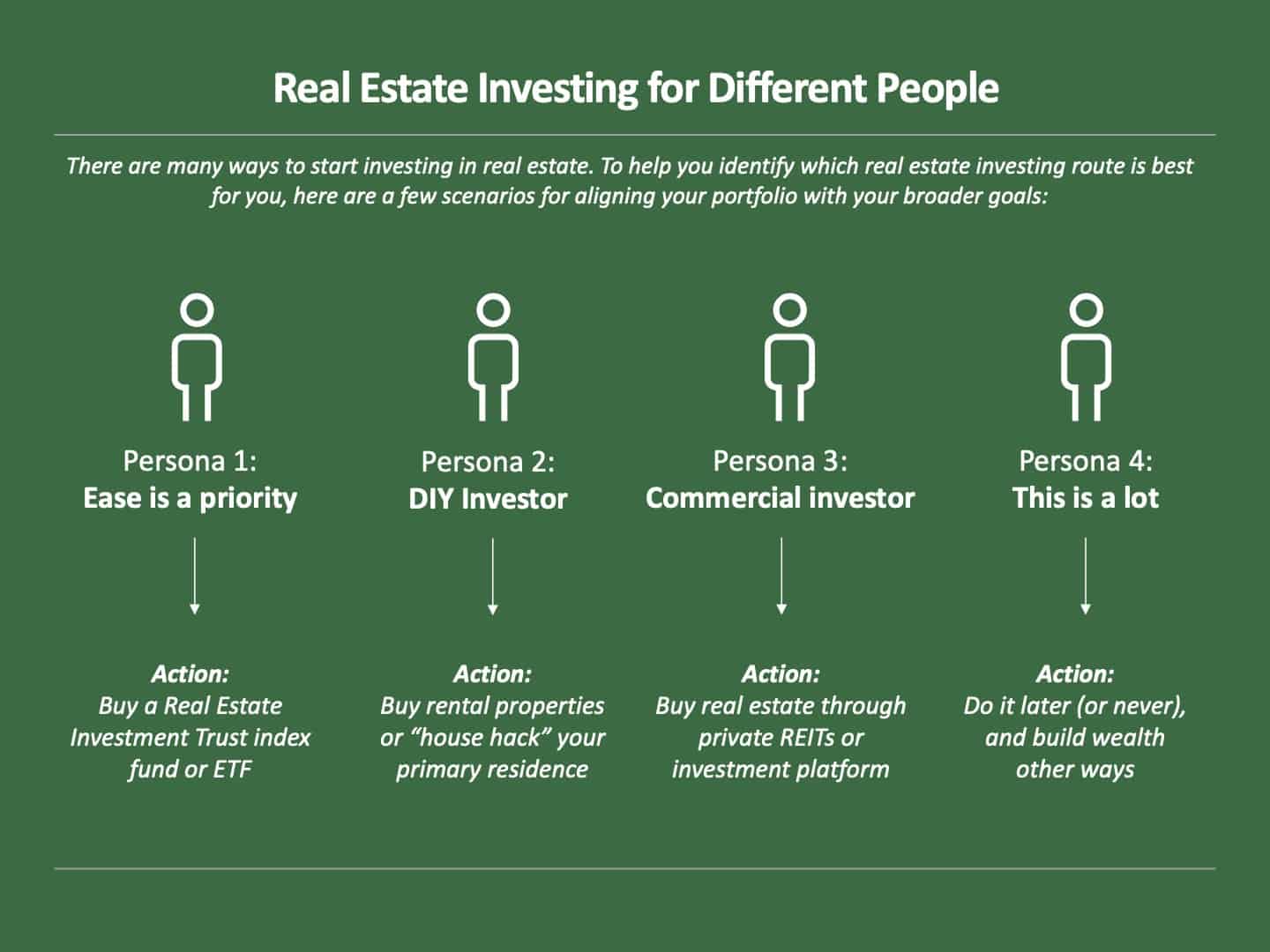

There are many ways to start investing in real estate. To help you identify which real estate investing route is best for you, we have created a few scenarios for aligning your portfolio with your broader goals.

Here are some scenarios to help you decide what’s best for you:

Persona 1: Ease is a Priority

- Who You Are: You have a smaller amount of money, highly value being able to buy or sell at any time, or don’t want to be involved in the investment selection process

- Recommended Action: Buy a REIT index fund or ETF

Persona 2: DIY Investor

- Who You Are: You want more control, are looking to maximize your returns, can save for a down payment, and are able to build relationships with a support team

- Recommended Action: Buy rental properties or “house hack” your primary residence

Persona 3: Seeking Commercial Properties

- Who You Are: You want access to the commercial real estate market, are interested in larger property types, and are comfortable doing thorough diligence to pick good investments

- Recommended Action: Buy real estate through private REITs or via a crowdsourced investment platform

Persona 4: This Is A Lot

- Who You Are: You find all of this overwhelming, are just starting your investing journey, or are still working on saving up an emergency fund

- Recommended Action: Come back to real estate later on (or never!) and sleep well at night knowing you can still build wealth and have a great life without real estate investing

If you want deeper insight into what it takes to be successful as a real estate investor, here are a few resources we highly recommend:

What else in the world of real estate would you like to learn about? Don’t be shy! Leave us a comment below and let us know what you would like us to write about next.

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.