Disclaimer: this article covers some pretty advanced concepts and topics. These can be really impactful on your life and wealth, but they require a solid financial foundation to fully understand and implement.

Have you ever felt like the money that actually hits your bank account is a lot less than you expected? Wondered why the difference is so big, or why so much is taken out for taxes? A lot of it has to do with the source of your money and type of income you are receiving.

Most people think that all income is the same: you work and earn money, you may pay some taxes on it, and at the end of the day you are left with something.

This basic understanding of income couldn’t be more wrong.

One of the secrets of the wealthy is that not all income is treated the same. Some types of income are much more attractive because they are taxed at lower rates than income from a traditional w-2 job, aka “earned income.”

Bear with me here: there are two key concepts that underpin your ability to create the best forms of income: the relationship between time and money, and income taxation.

This article isn’t about taxes, it’s about equipping you with some advanced financial knowledge that will enable you to keep more of your earnings. Our goal is to highlight what you really need to know about the different types of income so you can be smart about how you make and invest your money.

Understanding the Relationship Between Your Time and Money

Let’s start by simplifying how our society works from an income perspective. Most people are leveraging their time for money in one form or another to receive income. Whether you are working an 8 hour shift at a restaurant or an 8 hour shift as a doctor, you are trading your time for money.

One of the best ways to reach financial freedom is to change this relationship and break the direct or linear link between your time and income. The key to success here is to find ways to create income that better leverage the hours you put in.

For example, although a doctor may make a higher hourly wage, a tech employee typically has equity in the company. Why does this matter?

The hourly wage of the tech employee may only be equivalent to $150 an hour (vs. the $500 an hour of the doctor) but if they can increase the value of the company through hard work (or even just good timing), their equity value will multiply and give them a very large payday. More importantly, this increased income (sometimes as much as millions of dollars) was an exponential gain relative to the hours they worked.

The breakthrough here is that the tech employee has fundamentally broken the time-dependent nature of income. In short, they made more money while working less!

The moral of the story isn’t that you shouldn’t be a doctor, but rather that you should find ways to earn income that is not tied directly to your time.

This could happen lots of different ways, for example:

- You are a doctor that invests in index funds with your extra money from your high salary so you can create an income source over time that isn’t tied to your day job hours

- You work for a startup company that gives you some equity in addition to a salary; if the company performs well you will get rewarded via the increase in the equity value

- You invest in a rental property, where the income is based on the improvements you make and how much the rent can increase vs. your direct time

Taxation and How Much of Your Income You Keep

Not all income is treated the same. So, different types of income are taxed…you guessed it…differently.

Assuming your income tax rate is 30%, earning $100k as a W-2 employee, classified as “earned income,” in a year means you’ll end up with $70k after taxes. However, if you earn $100k from long-term capital gains on your stock investments via “portfolio income”, at a tax rate of 20%, you’ll end up with $80k after taxes.

Both scenarios start with the same amount of income, but in the second scenario you get to keep $10k more of it. That is a pretty big difference. This is why it is so important to understand the different types of income.

3 Main Types of Income

While there are many different ways to classify income, for the purposes of this article, we are using three common buckets to help you think strategically about income:

- Earned income generally includes the taxable income and wages you get from being an employee who is working for someone else.

Examples: wages (paychecks), salary, bonuses, tips, commissions - Passive income typically includes earnings from a rental property, limited partnership, or other enterprise in which a person is not actively involved.

Examples: royalties, rent/lease payments, affiliate marketing - Portfolio income (a form of passive income) usually refers to income you receive from investments you make in the stock or bond markets.

Examples: interest you receive from savings or loans, dividends (in the form of either cash or investments in companies), and capital gains

Is One Type of Income Better Than Another?

All of the above types of income have pros/cons. However, a source of income that is not classified as “earned income” is typically taxed at a lower rate, so you keep more of it. This should be your goal.

Consider stocks and real estate. One reason people like stocks is that they are generally treated as “portfolio income”. Any stock you invest in via your brokerage account and hold for more than 12 months gets the increase in value classified as “long-term capital gains” when you sell it, and has a maximum tax rate of 20%.

That is much better than typical individual tax rates on earned income, which can be as high as 37%, depending on how much money you make in a year. Note: your tax rate on any earned income varies based on how much you make; to see the current tax brackets for 2023/2024 and learn more, check out this IRS article.

Real estate is a bit more complex because the rental income is technically taxed at your ordinary “earned income” rates, but the capital gains due to appreciation when you sell are not. Additionally, because real estate is treated more like a business, you are able to subtract your expenses from your real estate income, effectively lowering the amount of income that you have to pay taxes on.

Another reason people like stocks and real estate, beyond the fact that they generate income you pay less tax on, is that they tend to appreciate and act as a hedge against inflation. Unfortunately, wages have not historically kept up with inflation, so with most forms of earned income, you are losing purchasing power over time.

At the end of the day, any income you can earn without having to put in a direct 1:1 hour of your time to earn it, or any income that is taxed at a lower rate, is better. Your goal should be to find ways to do both of these things over time.

Extra Credit: Advanced Income Strategies

Sometimes we hear about how the wealthy pay almost no tax. A classic example of this came during Trump’s campaign and presidency. Politics aside, there are some fully legal advanced strategies you can put to use over time to reduce your taxes.

One version of this is taking out debt against assets you own. This enables you to receive cash you can use to fund your life, make other investments, etc. without paying any tax on it since technically it’s considered debt.

Here are two examples of ways the wealthy often do this:

Real Estate example:

- Buy a rental property for $100k, fix it up over time, wait 10 years; it has now appreciated in value and is $200k

- At year 10, you do a cash-out refinance on the property valued at $200k, take out $140k (70% of the value) as debt

- Your rental income should cover the interest payments on the debt and you are left with $140k in your bank account tax-free

Stock example:

- You build up a portfolio of $500k in a S&P 500 index fund over 20 years

- At year 20, you call up your bank/brokerage and ask about a margin line of credit (aka a loan against your stock assets) and put one in place taking out 30% of the value, or $150k

- You now have $150k in cash, tax-free, and you use the gains/dividends from your stock portfolio to pay the interest payments on your margin loan debt

In both of the above examples, you have received a sum of cash that you paid no taxes on and can use for other purposes (ideally to invest into other assets). Even better, you have kept the original asset intact and under your ownership so it can continue to grow in value as well.

That is the magic of how debt and assets can be used to create something known as “phantom income,” aka money that you receive and pay zero tax on.

Strategies like these as some of the ways that you can dramatically lower your taxes and still have money to cover your life expenses.

Important note: for the above strategies to work and not put you in risky financial situations, you need to do a few things:

- Do not over leverage yourself, aka take out too much debt against the asset

- Have the rental income or dividends from the stocks fully cover the monthly interest costs on your debt

- Use the extra cash to invest in other assets, ideally with a return higher than the interest rate on your debt, to create good financial arbitrage (e.g., the interest rate on your new loan is 6% but you can use that cash to buy more index funds that return 8%+)

How Do You Apply All of This?

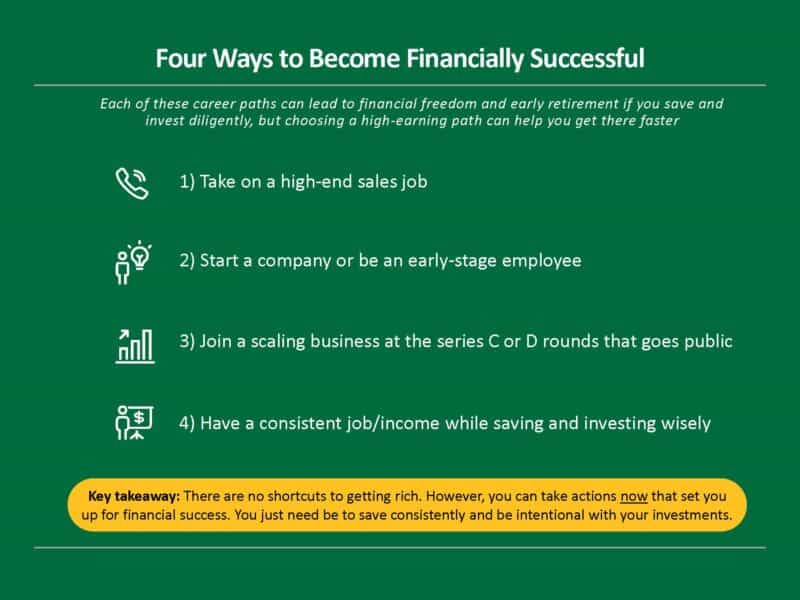

Unless you are one of the lucky few that inherits money, most everyone starts by making money via earned income — and that’s ok. Remember this and be kind to yourself if you are just starting out on your wealth building journey.

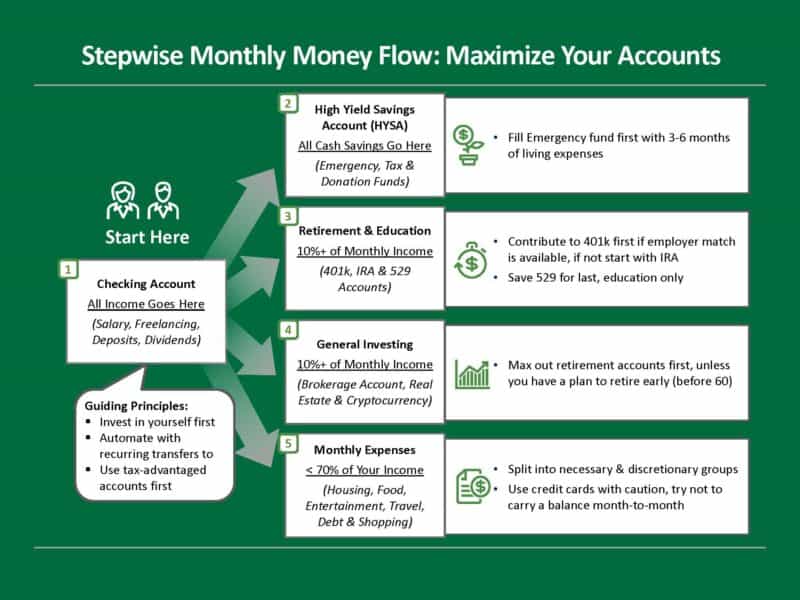

Out of the gates, the main goal is just to save consistently and start investing any left over earned income each month into assets that produce passive income and portfolio income. For many years, this may just look like putting $100 each month into a total stock market index fund like VTSAX from Vanguard. This is a great place to start.

Over time, as you build wealth, you will have more opportunities to build passive income through real estate, private investments, etc. The important thing is that you are intentional about finding ways to break the relationship between your time and earned income: either by saving and investing in assets that are taxed at lower rates, buying real estate, or by finding ways to get equity in a business.

Conclusion & Key Takeaways

At the end of the day, the most important thing is that you find ways to increase your income and spend less than you make — ideally a lot less. This is the foundation for everything else.

By doing this, you can invest more of your money each month into assets that will produce passive income (e.g., rental real estate) and portfolio income (e.g., index funds) so that you won’t need to work a regular job to support your life. By doing this, you will also keep more of your income since they are generally taxed at lower rates.

It is important to remember that these concepts take time to implement, and are generally things that come later in your wealth building journey, after you have a lot of the basics already in place, as covered in this article.

Regardless of where you are in your journey, here are two actions you can take now:

- If you are in earlier in your career, or at an inflection point, consider focusing on jobs where you do not only work for an hourly wage, but instead have a disproportionate upside potential (sales, commissions, equity in a business, profit sharing, intellectual property rights, etc.)

- Regardless of your career path or stage, focus on saving and investing a portion of your income each month into assets that have more attractive tax treatment and don’t require your time to grow (stocks, bonds, real estate, etc.)

Here’s to building income in ways that enable you to keep more of your hard-earned money!

To your financial future,

Seavron

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.