Wouldn’t it be great to “get rich quick” or become a financial success overnight?

While our society loves to glorify this model, the reality is that building wealth takes time and consistency. Although it is technically possible to make millions of dollars overnight, your odds of doing so are VERY slim. You can, however, follow a series of steps that can help you get rich over time.

With that in mind, and in the spirit of the new year, I want to offer a more practical approach and share the best four ways I know of to get rich.

Let me be clear: it is unlikely that any of these will make you rich in 2022 alone, but every one of them will enable you to build wealth in the long run well before the typical retirement age of 65.

Before we dive in, it’s worth noting that “getting rich” is different for everyone. It is very important to assess both your current financial situation and financial goals to determine which path to take. What we are outlining here are some of the best ways to earn an above average income that will result in a greater path to financial freedom IF you save and invest well.

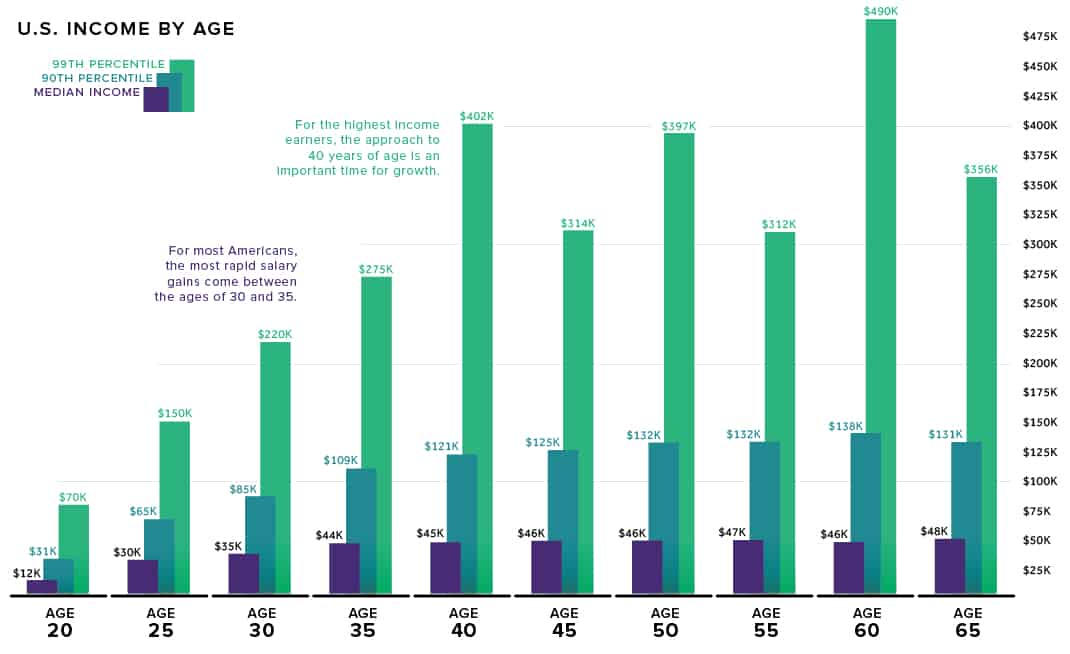

And just as an FYI, if you’re making over $100k by the time you’re 30, your salary is higher than 90% of Americans in your age group (so, well done!).

Also keep in mind that if you have the opportunity and drive to take one of the career paths below, you are already incredibly fortunate.

Here are four very effective ways to get rich:

1. Take on a high end sales job

A high end sales job is classified as selling high priced goods or services typically purchased by businesses. Example careers include enterprise technology sales, commercial real estate agents, IT infrastructure sales, medical device sales, and insurance sales. Partnership roles in consulting, law, and investment banks are actually sales jobs as well. To move up the ranks, you essentially have to bring in business.

Salary:

- Dependent on how well you sell.

- Base average salaries are likely moderate, between $75k-$150k, in your early years, but the bonus potential is often very high (50%+ of base salary or more).

- As you progress into more senior sales roles, you can easily make a $1M+ a year.

What to be aware of:

- For people with the right personality traits and competitive drive, this is one of most viable paths, especially if you join a company with a strong sales training program.

- Entry level sales jobs don’t require advanced degrees or high education levels.

- The highest paying jobs in sales usually require investing a lot of time in relationship building with potential clients.

2. Start a company or be an early stage employee

This includes being the founder, co-founder or key employee (leadership or important role) early on in a company that receives a large grant of equity or options. In other words, it can’t just be any company: it needs to be one with high-growth potential or scale. Really scope out the job market! Opportunities at companies who have barely begun their future growth are out there.

Salary:

- If you start your own company, expect little to no salary early on (less than $50k) and potentially many years of very low salary as you work to get your business off the ground. However, if successful, your own salary can increase as your company starts making money and your equity may become worth millions of dollars. It’s also worth noting that your venture may end up somewhere in between a major success and failure (i.e. a relatively small business that is self-sustaining). Many initial chief executives relinquish their role later on while holding onto their equity so they can focus on their family and children, other low stress endeavors, or move into a related field.

- If you join an early stage company, your salary may be relatively low ($50k-$100k), but if you wind up owning 0.5%-5% of a company that does well, you could easily be looking at millions of dollars of equity.

- As a founder or early stage employee, your salary will be quite low, and your timeline for payout may be very long, but if it works your equity can be very valuable.

What to be aware of:

- While it is very difficult to say which ideas will be successful, generally speaking, starting or joining business that have a lot of leverage or network effects (internet, technology, marketplaces) makes the most sense.

3. Join a scaling well-funded business during the series C or D funding rounds that goes public

This means joining a company that has already proven their business model and product market fit at the specific time before it takes and it gets major public recognition. This is hard to do because it is difficult to know exactly what company is going to skyrocket to success and which companies will fail.

To get meaningful equity at this stage in a company, you must typically be joining at a senior manager level position or higher. Ideally, you would be a director or VP level.

Salary:

- $100k-$200k + some equity (likely less than 0.25%).

- Note that with a series C/D company, your salary is likely higher than an early stage company and the return on your equity is less (although you could see a return on that investment faster because it’s a later stage company).

What to be aware of:

- While it may seem easy, in practice it is very difficult to identify which of the thousands of companies at this stage are on the path of going public or selling for a high-profit.

- It’s important to note that not all equity is created equal. Depending on the company, you could make a couple hundred thousand to $1M if all goes well, or if you’re really lucky, you could make many millions. As with all startups, however, the company could fail and your equity could be worthless.

- One way to hedge your bets on joining a good company is looking at the portfolio companies of major venture capital firms but again, few companies still succeed.

4. Have a consistent job/income while saving and investing wisely

Having a consistent job and income should not be underestimated! The key point here is that as long as you save and invest wisely and consistently each month, you can become rich over time with low stress. This applies to many different types of jobs, from the trades (construction, electrical, plumbing, and medical, for example) to government and education work, in addition to the more commonly referenced tech or engineering fields.

This is a viable option for many people since it is not industry specific or limited by a certain education level or technical degree. College or specialized degrees are required for some jobs, but not all options in this realm.

In other words, an investment in education like a bachelor’s degree is not always necessary. And it doesn’t matter whether we’re janitors, airline pilots, political scientists, nurse anesthetists, or travel agents – anyone can practice good financial habits to build wealth.

Salary:

- Salaries can range dramatically ($50K-$250K) based on the industry and unique skills required. Jobs that require more technical training or are more highly valued in companies that pay well will reach the higher end of this range.

- Some career paths can include the option of either a bonus structure or smaller amount of equity. With this path, typically they are not going to be life changing amounts.

What to be aware of:

- While this path may seem less “sexy” compared to being the founder of your own company, it is a much more tried and true path to get rich and be able to retire well before your 60s. As the saying goes, slow and steady wins the race and can still get you rich a lot faster than you realize.

- Most people reading this article can become rich in this way; this is what Stepwise teaches because it is the most accessible and proven path to wealth.

- This requires discipline and consistency over a longer period of time (e.g. 20-30 years).

After reading this, you may have FOMO. You might be thinking things like…

- “Omg I’m on the wrong career path!”

- “Wait my job isn’t listed and I do pretty well!”

- “I’m screwed because I’m not at a growing company”

- “Oh shit, I need to start my own company!”

But, hear me out: you DO NOT need to dramatically change the path you’re on. In fact, I recommend that you don’t.

The reality is you can get rich in almost any line of work if you consistently save and invest well. Rather than wasting a bunch of time and effort questioning your entire career path, you are much better off spending your time learning how to invest wisely.

If you’re genuinely unhappy, however, you should absolutely consider a career or job change. And if you are contemplating a career move, it’s important to be patient and choose wisely. But, if you’re just thinking that you could or should be doing more, but the reality is that you’re happy and your skills are valued in your current job, you are better off focusing on other things.

How to apply this and have a prosperous 2022:

Here’s the bottom line: we all want to get rich or, at the very least, be financially secure. But, it doesn’t just magically happen. And unfortunately, there truly are no shortcuts (despite what our culture promotes). But, you can take actions now that set you up for financial success. You just have to be consistent and intentional!

So, even if you’re not someone who wants to get into sales (option 1), start a company (option 2), or join a well funded business (option 3), everyone is capable of saving and investing right now (option 4).

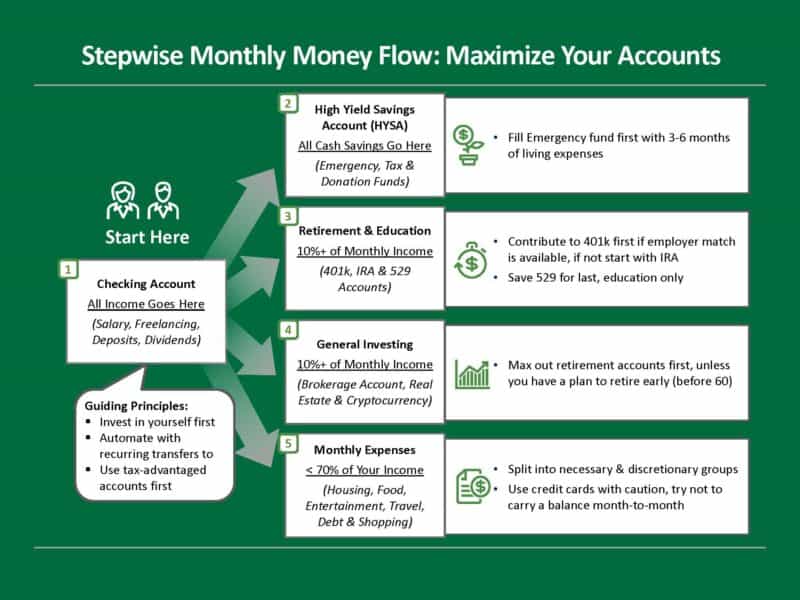

Even without financial expertise or a high paying job, you can develop a strategy for increasing your savings in a way that works for you. You can start by checking out our 6-step guide on how to save, invest and build wealth, or read our beginner’s guide to investing.

Here’s to a happy, healthy and prosperous 2022!

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.

Thanks for the fantastic summary Seavron!