Part I: Why You Should Invest

Investing and building wealth take more than just knowing the best accounts to have and what steps you should follow.

At its core, wealth-building starts with two essential financial habits:

- Spending less than you earn

- Saving and investing the money that is left over

This investing 101 guide is designed to break down the fundamentals of investing, including the what, why and how of investing.

Part I, looks at the why behind investing and helps you understand why investments are important. Learning why investing even matters to begin with gives you the incentive to know more and get started on your investing journey.

Part II, “The What: Investing, Key Concepts, and Types of Investments”, defines key investment terms and gives examples of the most important concepts related to investing and building wealth. Understanding these concepts will help you make better choices regardless of your age, goals, or personal financial situation.

Part III, “The How: Ways to Invest, What to Consider and How to Apply”, breaks down ways to invest, what to consider before investing, and provides clear actionable steps for you to get started.

So, let’s begin…

Why Invest?

Simply put, it is critical to invest if you want to be able to retire, buy a home, pay for your kids’ education, or travel the world (among many other things). Saving is a good first step, but investing is critical for actually growing wealth.

One of the very best reasons to invest is the value of your time. Truly, it’s life’s most valuable resource – one of the few things that you cannot get more of once it is gone. Most people spend the majority of their lives trading their time for money, in the form of a job. While a job can be a good thing, you may want to do things with your life other than work.

This is why investing is so valuable. If you invest well, you can put your money to work and break the cycle of needing to trade your time for income.

If you intelligently invest even small amounts early in life, this money is likely to grow over the years. The key is to invest your money so that it works for you.

If you invest wisely, you’ll be able to stop working earlier, get better medical care, donate to causes you believe in, see family, and eat well – among other things.

Ultimately, investing creates freedom. It gives you the ability to choose what you want to do with your life. Money may not bring happiness on its own, but it can give you more options and opportunities to enjoy your life.

Saving vs. Investing

Practically speaking, you need to be investing instead of just saving. Due to inflation, your money actually loses value over time if it’s just sitting under your mattress, in the bank, or in a savings account. While it is very important to have savings in reserve for short-term needs and emergency situations, you must also invest for the future.

Let’s break down the two terms to make sure the difference is clear.

Saving: is the process of setting money aside for the short-term, typically less than 5 years out. Your savings should be in a place you can access easily that’s also secure; such as a high-yield online savings account.

Investing: is the process of allocating money for growth and financial return over a longer-term, typically at least 5 years out, and often 10, 20, or 30+ years out. While it entails more risk, it also entails more reward; investing is required if you want a consistent way to increase your wealth.

Making your money work for you

You might be wondering, what’s wrong with simply playing it safe with your money and keeping it in cash and savings accounts?

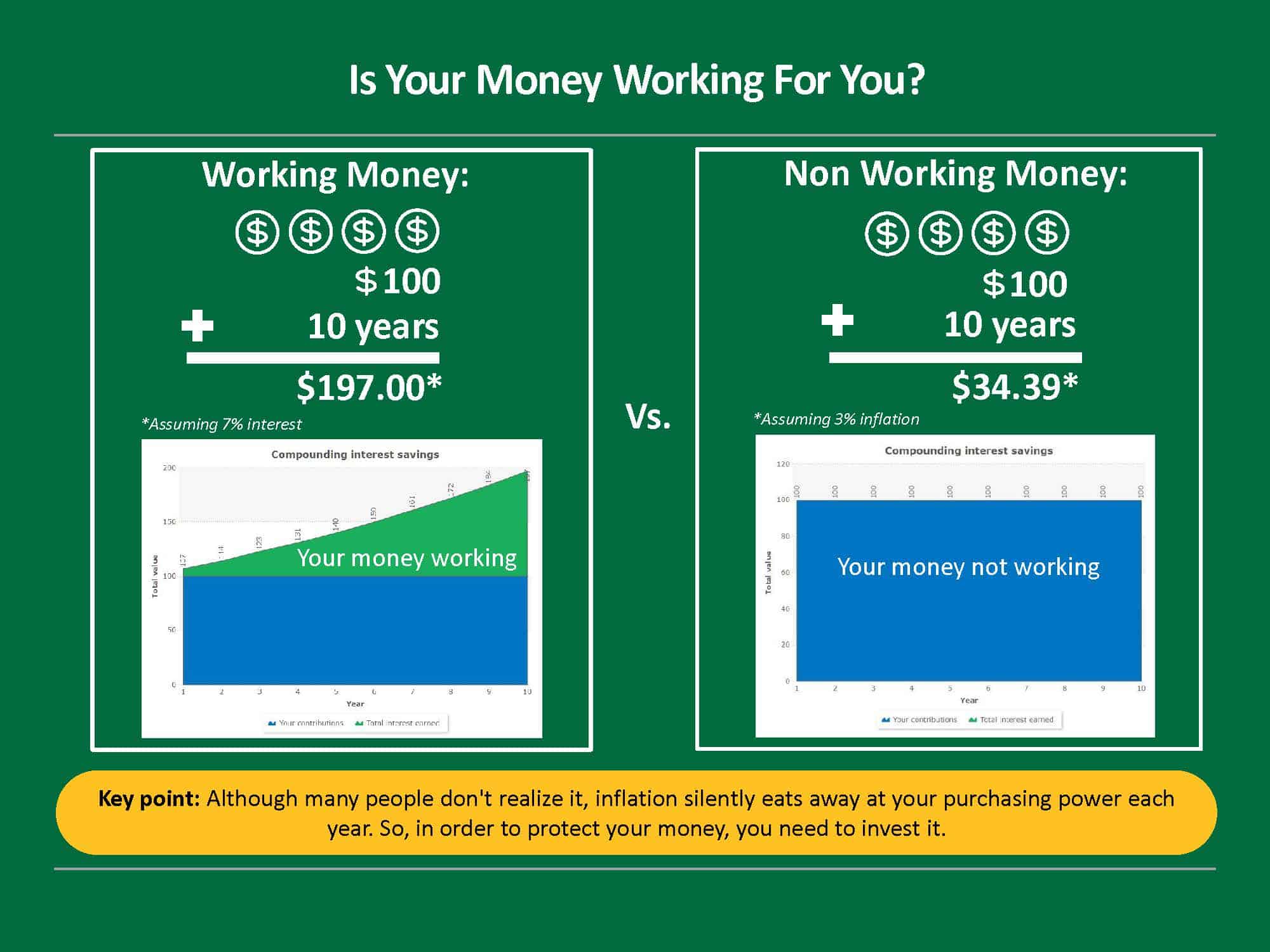

Enter inflation, an often unseen force.

Inflation: is an economic force that silently erodes your purchasing power and increases the price of everything you buy. It is the reason that a gallon of milk or gas costs more today than it did 10 years ago.

Over time, inflation reduces the purchasing power of a given amount of cash, making your savings worth a little bit less every year.

If the current inflation rate is 3% and you save $100 in a drawer for a year, that money will only get you $97 worth of groceries when the year is up. Said differently, the cash you’ve been sitting on won’t buy as much as it used to because everything has gotten 3% more expensive.

This is why the phrase “savers are losers” exists. If you only save your money, your wealth actually declines in value over time. Unfortunately, the current inflation rate is higher than 3% – making it even more imperative to invest for wealth preservation and growth.

Why you should invest in the stock market

When most people hear the term investing, they think of stocks: fractional shares in companies like Apple, Procter & Gamble, Microsoft, Tesla, or Coca-Cola. While you may enjoy investing in companies you know and like, picking individual stocks is typically not the best place for a new investor to start. Instead, aim to invest in the overall stock market via an index fund.

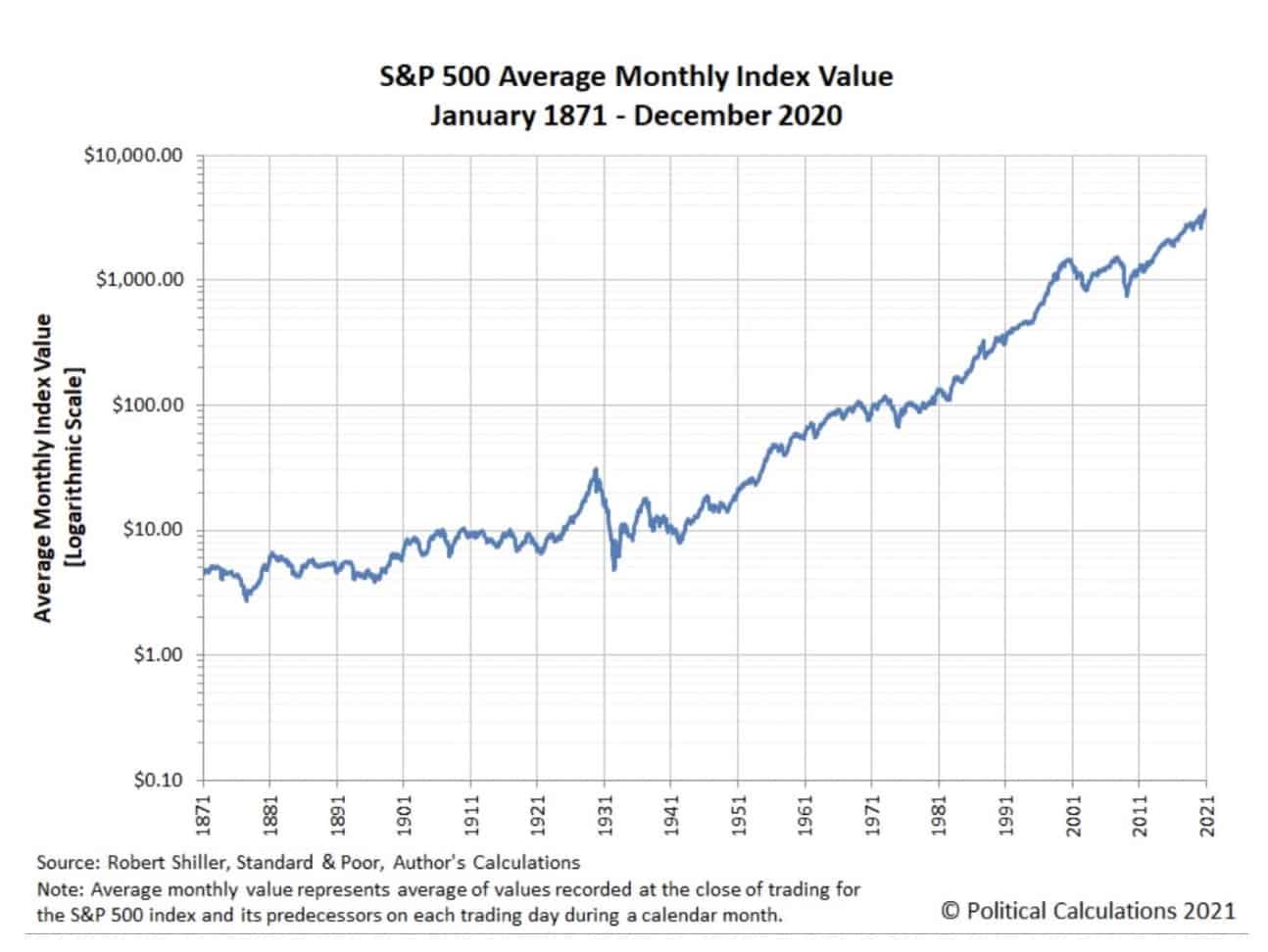

You might be wondering why stocks are a good place to focus your investments – and what kind you should consider.

If you look at the historic rates of return of the major asset classes, the stock market has on average performed the best. A $10,000 investment in the S&P 500 index 50 years ago would be worth nearly $1.2 million today.

Investing in stocks, if done wisely, is a very effective way to build long-term wealth. It is also one of the simplest and least time-consuming ways to invest.

We recommend starting your investing journey by picking just one index fund or ETF and then building from there over time. The best place to start is with a low-cost and diversified index fund or equivalent ETF something like VTSAX from Vanguard or FXAIX from Fidelity.

So, why should you invest?

Let’s recap. Investing is valuable for multiple reasons. Some of the most pertinent are that investing:

- Helps you grow wealth (i.e. get rich!)

- Makes your money work for you

- Creates personal and financial freedom

And truthfully, who wouldn’t want those things? If you have the opportunity to increase your wealth based solely on taking the money you already have and allowing it to generate more money, why wouldn’t you?

The thing is, you have that opportunity. So take it!

Continue reading part II to learn more about what investing is, key investing concepts and types of investments.

Disclosure: This article may contain references to products or services that we use and recommend. At no cost to you, we may receive compensation when you click on the links to those products or services. This helps us keep the site free for everyone.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.

Great content! Keep up the good work!