Let’s face it: personal finance can be overwhelming. With so much jargon, information and tips out there, it can be difficult to know where to begin — not to mention how to get started.

That’s why we’ve created Stepwise. Because it’s one thing to learn about personal finance and another thing entirely to actually implement it into your life.

Our articles and guides are designed not just to educate you, but to equip you with actionable steps for saving, investing and building wealth — all on your own.

The truth is that you don’t need a financial advisor or complicated investment advice — you can take control of your own finances, learn to make decisions with confidence, and create a financial future you’re excited about.

There’s one thing worth noting, though: the idea that you can simply get rich overnight is nice in theory, but it’s simply not true. The reality is that building wealth takes time, intentionality and consistency. But by following the actionable steps we provide, you can set yourself up to build wealth over time.

With that in mind, here’s where – and how – you can get started:

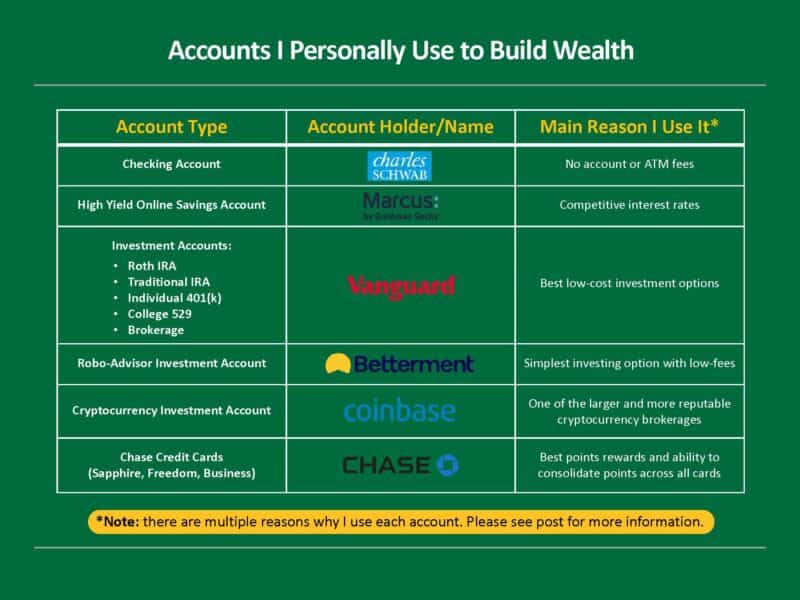

- Just like you can’t apply for a job without a resume, you can’t build wealth without the right accounts. Our Personal Finance Starter Kit walks you through the 5 most important accounts for saving and investing. You’ll want to set these up before doing anything else.

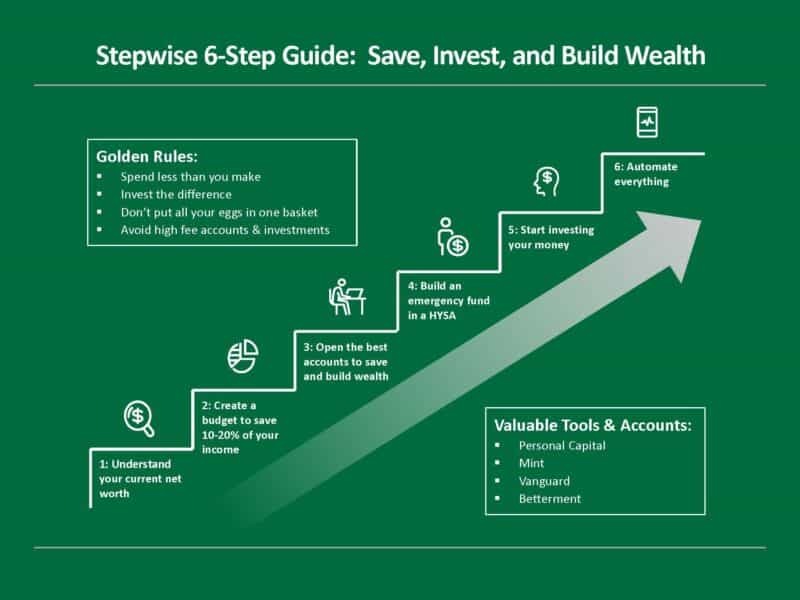

- With the right accounts in place, you can turn to our 6-Step Guide: How to Save, Invest, and Build Wealth. This guide walks you through 6 important steps to take for building wealth and achieving financial freedom.

- Now it’s time to dive into the fundamentals of investing. It’s important to learn why you should invest in the first place and what investing actually is (and the different types of investments). Once you have a handle on that, you can move onto how to get started investing.

- Since investing is such a big part of building wealth, we’ve created guides that get more specific by looking different types of investments: how to invest in index funds, how to invest in real estate, and whether you should invest in cryptocurrency.

- Once you have these personal finance essentials under your belt, you can start exploring other topics, such as:

- How to Choose Between Paying Down Debt and Investing

- 3 Types of Income: What You Need to Know

- How to Set Financial Goals: 3 Simple Steps

Keep in mind that, regardless of where you are on your personal finance journey, it’s never too late to get started. But the earlier you start implementing these steps, the better off you’ll be. If you’re in your 20s, be sure to check out these 8 tips for building wealth in your 20s.

Finally, as you work your way through these steps, we’re here to support you. If you have any questions, we invite you to reach out. Remember: our goal is not just to help you build knowledge, but to equip you with actionable step-by-step advice that puts you in the driver seat of your own financial future.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.