Ever wonder how you can make your money work harder for you? Or how you can start building wealth? And do it quickly? Maybe you’ve wondered if you’re making the right financial choices, or you’ve been trying to figure out how to build wealth passively.

These questions may make you feel confused, frustrated, or even overwhelmed. Where do you even find answers for all this?

No need to worry. You’re not alone.

Here at Stepwise, we’ve come up with an actionable step-by-step guide that shows you the best ways to save money, invest money, and build wealth. In this guide, we’ll cover everything you need to kick off your personal finance journey.

Remember: it’s never too late to get started. Ten years from today, you will thank yourself for taking action.

Table of Contents

Building Wealth in 6 Steps

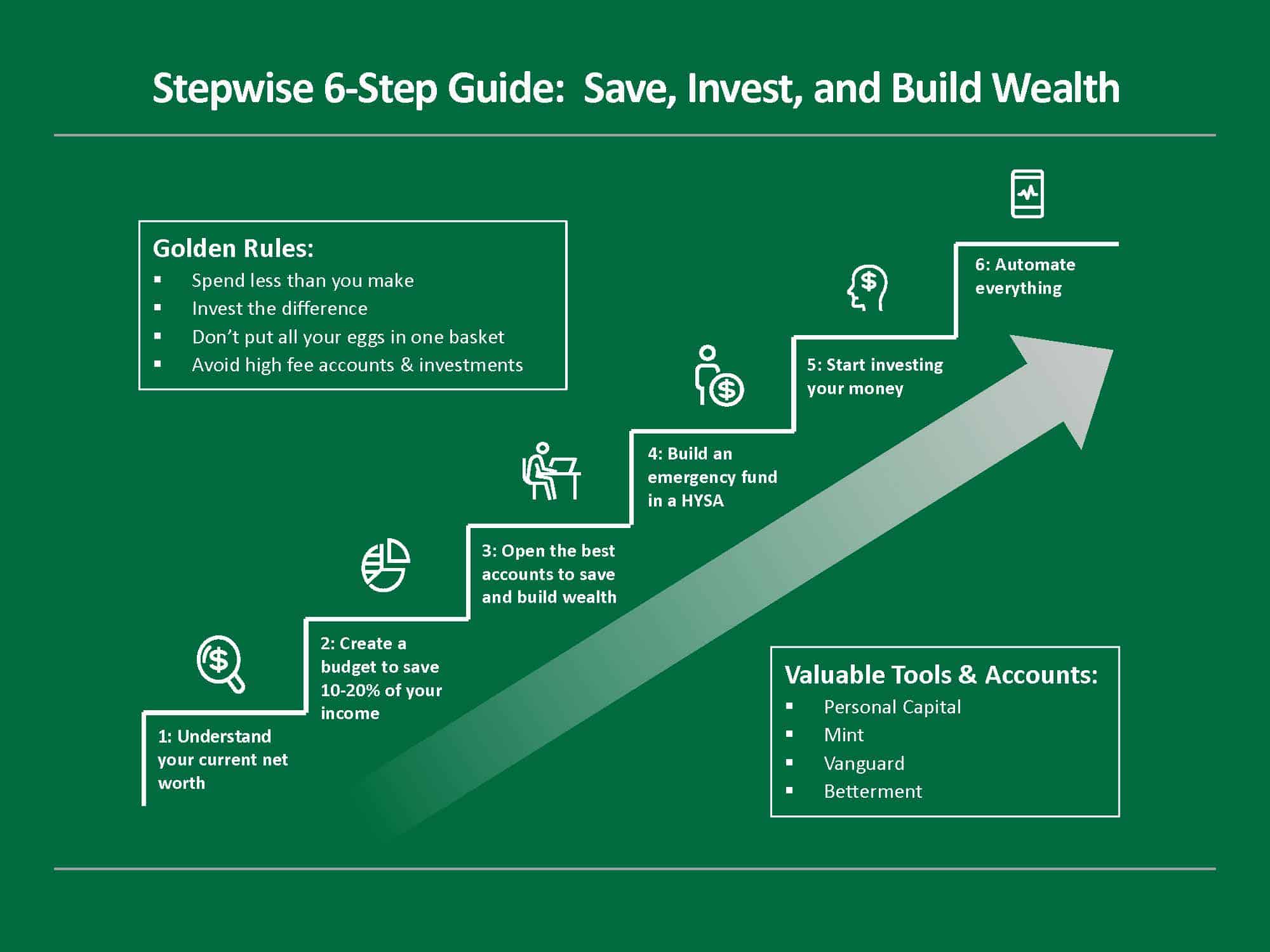

Let’s get started with an overview of the 6 steps you can take to build wealth and achieve financial freedom:

- Understand your current net worth

- Create a plan to save 10-20% of your income

- Open the best accounts to save and build wealth

- Build an emergency fund in a high-yield online savings account

- Start investing your money

- Automate everything

Now let’s turn to each step in more detail.

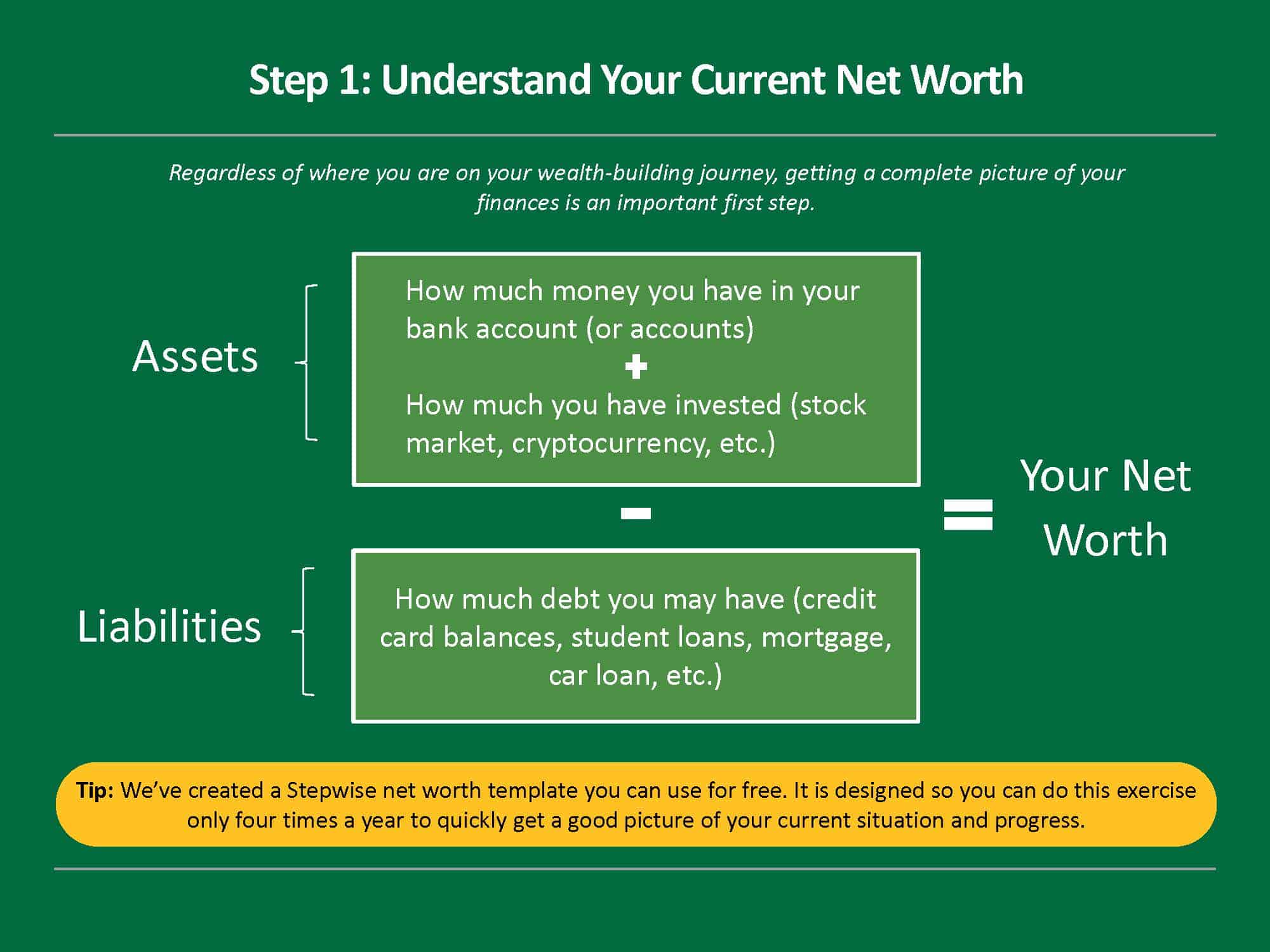

Step 1: Understand your current net worth

Do you know how much money you have? Yes? No? Kind of?

At this stage, it’s perfectly normal not to know your net worth. But if you do (and maybe you know your net worth down to the cents), skip to step 2.

To better understand your financial picture, use this simple formula:

Your net worth = assets – liabilities

- Assets: Money that you have saved and/or invested

- Liabilities: Money that you owe

Make sense so far? Let’s break this down even further. To know your true net worth, create a list of the following:

- How much money you have in your bank account (or accounts)

- How much you have invested (stock market, cryptocurrency, etc.)

- How much debt you may have (credit card balances, student loans, mortgage, car loan, etc).

We recommend using a spreadsheet for this list.

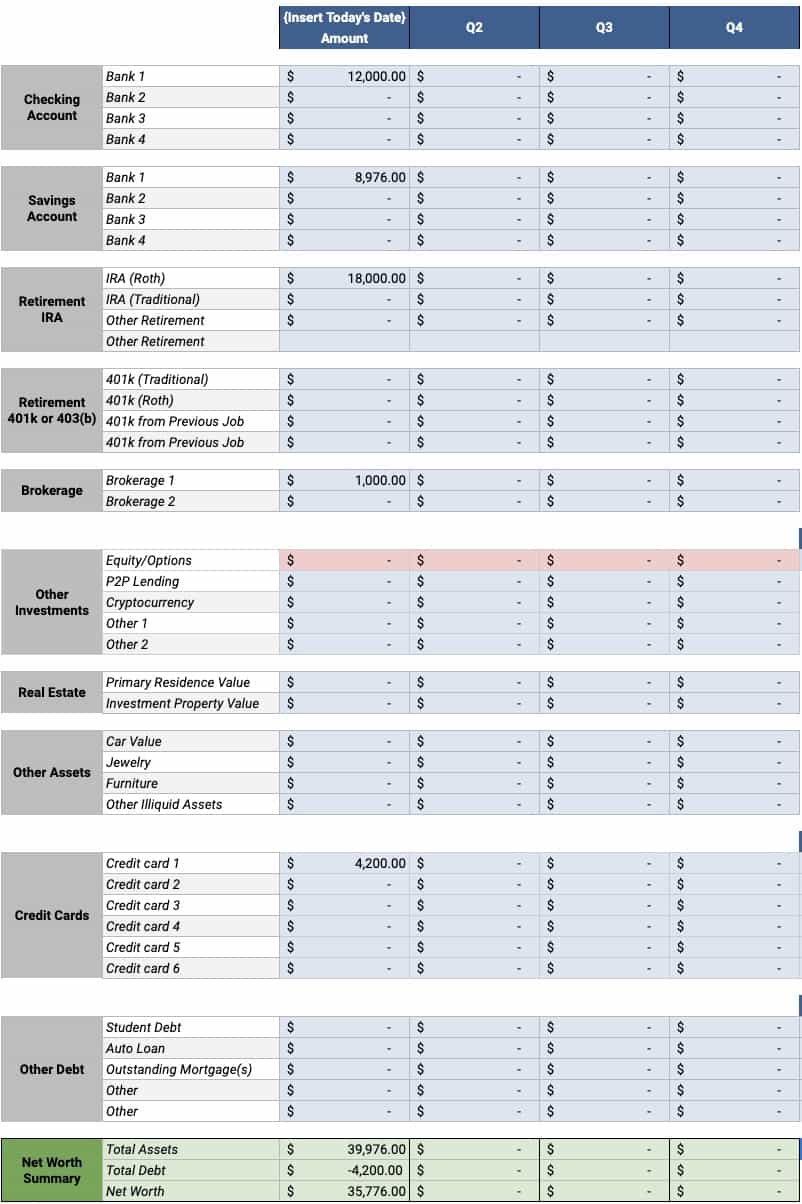

To simplify this, we have created a Stepwise net worth template you can use for free. It is designed so you can do this exercise only four times a year to quickly get a good picture of your current situation and assess your financial health. You can download our net worth template here.

After you get everything in one place, you can now automate the tracking of your net worth using free personal finance tools available like Personal Capital.

You can also use Mint to automate the tracking of your spending and budgeting (we know Mint used to be terrible, but they recently updated the platform and it’s super helpful now).

Regardless of where you are on your wealth building journey, just remember that knowledge is power. Taking this first step to get a complete picture of your finances in one place is a big accomplishment.

To recap, here are some action items:

Make a list of all of your financial accounts to understand your net worth and personal situation. You can do this by following these steps:

- Download and fill out Stepwise’s free net worth template.

- Sign up for Personal Capital and link your accounts.

- Sign up for Mint and link your accounts.

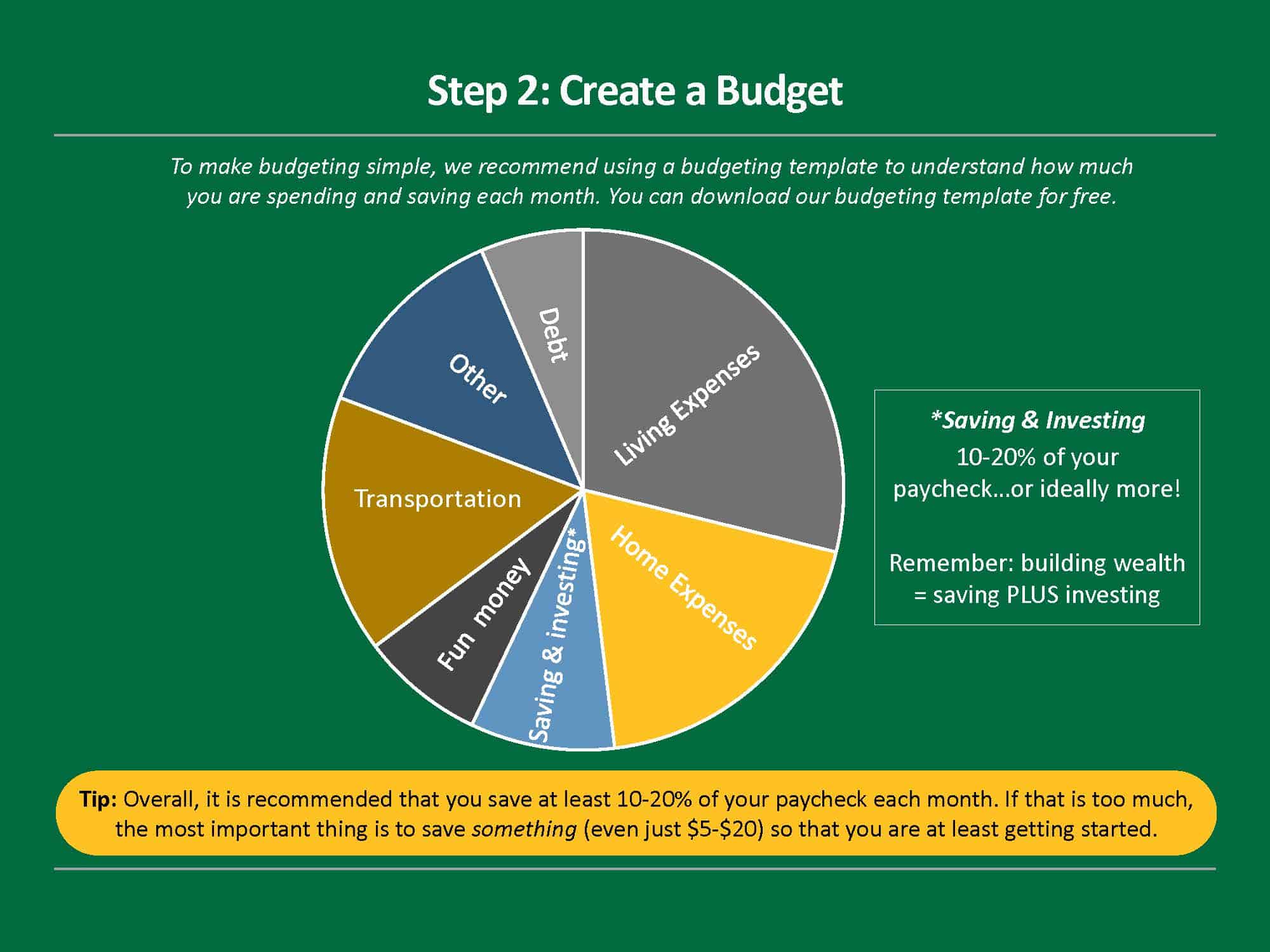

Step 2: Create a plan to save 10-20% of your income

The more you save, the faster you build wealth. In order to save, you first need to understand what you are spending.

To do this, we recommend you track your expenses and build a budget. Before you freak out, we can help with that.

To make planning simple, we recommend using a budgeting template to understand how much you are spending and saving each month. You can download Stepwise’s monthly plan and budget template and use this for free.

After you update your plan, you can easily identify what you are spending money on and see how much you can save each month.

Overall, it is recommended that you save at least 10-20% of your paycheck each month.

However, if that is too much for you, the most important thing is to save something so that you are at least getting started. This can be as little as $5-$20 a month (this is where we started, too, back in 2011). Even if this seems small, it will add up over the course of a year.

The money you save each month is the money you will have for an emergency fund or investing, which will enable you to build wealth and get rich over time.

Eventually, as you earn more over time, you can start saving and investing more, too.

To recap, here are some action items:

- Download and fill out Stepwise’s monthly plan template to understand how much you are spending and saving each month.

- Sign up for Mint (which is free) and link your checking and credit card accounts. Within Mint, use the Trends tab to see what you are spending money on and how you can save more.

- Try to save at least 10-20% of your paycheck each month. If that’s too much, start small and try to save as little as $5.

Step 3: Open the best accounts to save and build wealth

You often hear people say: “make your money work for you.”

When it comes to saving and investing money, it’s all about picking the right accounts, which will make your personal finances much simpler and help lead you to financial independence.

These accounts will both save you money by avoiding unnecessary fees AND help you earn more money from higher interest.

What makes for a good savings and investment account?

- It is free or very low cost to open

- It does not charge transaction, account balance, or other fees

- It is easy to use and link or integrate with your other accounts

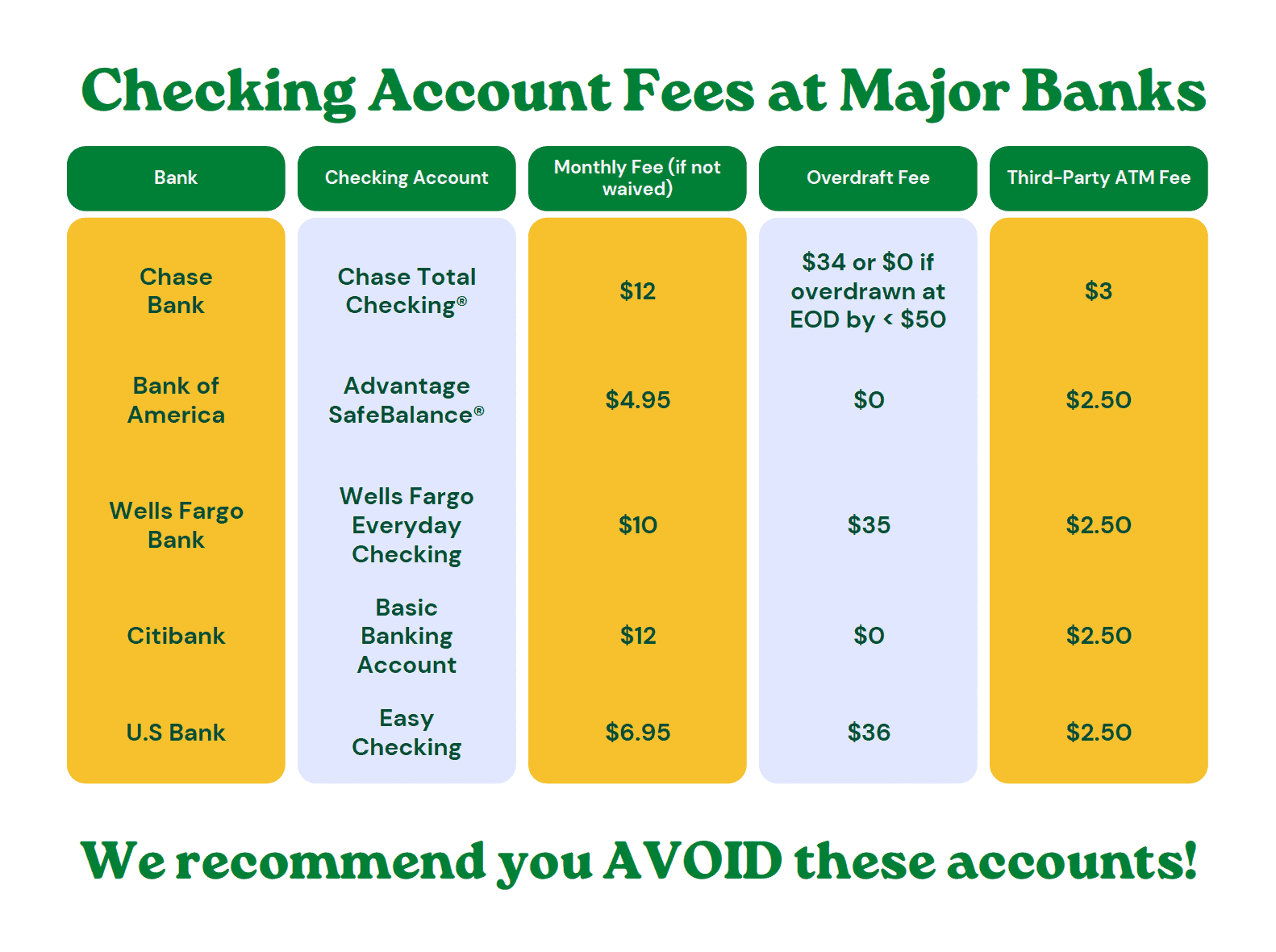

Fees can add up over time. A 2014 study by the Consumer Financial Protection Bureau (CFPB) found that checking accounts have an average annual cost of $97.80 in fees. In 10 years, the average cost is $978, and in 20 years it’s $1,956.

Another study by the CFPB found that banks reached an estimated $15.47 billion in overdraft and non-sufficient funds fees in 2019.

Here is an example of some accounts you likely would NOT want to use due to their fee structures:

The types of fees banks might charge include:

- Monthly service fees

- Transaction fees

- ATM fees

- Overdraft fees

- Any fees related to online or mobile banking

- Any fees related to online or mobile bill pay

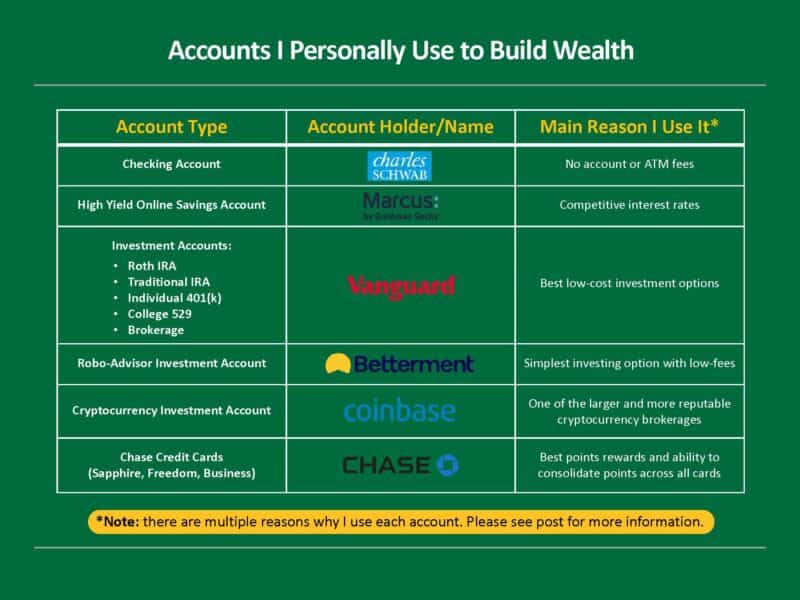

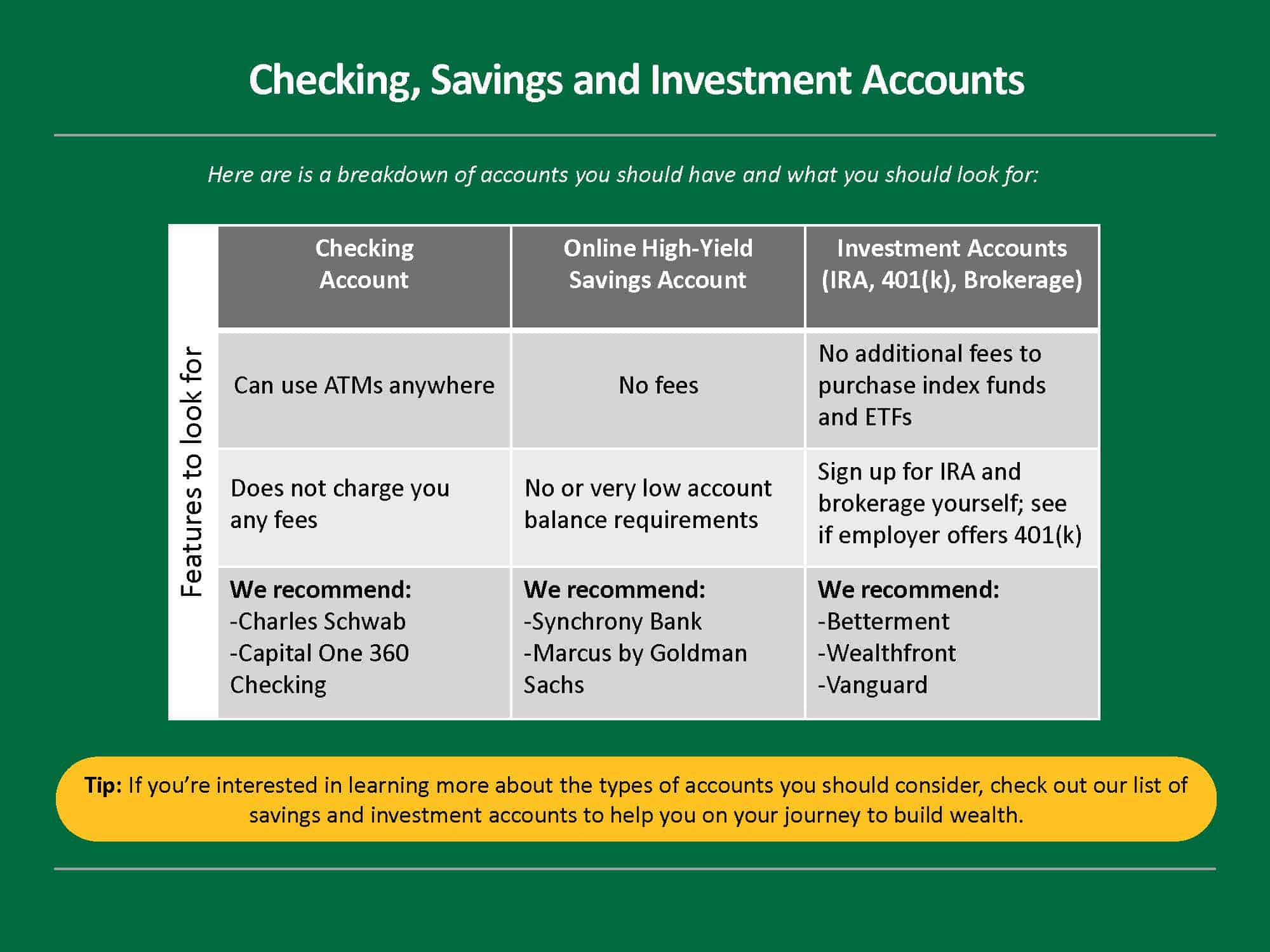

Here are is a breakdown of accounts you should have and things to consider for each:

Checking Account

- A good checking account should enable you to use ATMs anywhere and not charge you any fees

- Good options are Charles Schwab and Capital One 360 Checking

High-Yield Online Savings Account

- A good high-yield online savings account should have no fees and no or very low account balance requirements

- When the Federal Reserve Bank raises interest rates, high-yield savings account rates can be further raised to stay competitive and attract depositors

- Good options are Synchrony Bank and Marcus by Goldman Sachs

Investment Accounts (IRA, 401(k), and Brokerage)

- A good investment account should not charge additional fees to purchase index funds and ETFs

- For an IRA and brokerage account, you can sign up for them yourself

- For a 401(k), see if you can sign up for one through your employer.

- Good investment accounts are Betterment, Wealthfront, and Vanguard

All-in-One:

- If you want to set up your checking, high-yield savings, IRA, and brokerage accounts all in one place, a good option is Betterment

If you’re interested in learning more about the types of accounts you should consider, here is a list of savings and investment accounts to help you on your journey to build wealth. The accounts described are Stepwise’s recommendations, but an account with very similar characteristics from any other financial institution is usually fine if that’s what you prefer.

To recap, here are some action items:

- Ensure that your checking account doesn’t have high fees or account balance requirements. If you are unsure about monthly fees, call your bank.

- Open a high-yield online savings account with a competitive interest rate.

- Open an investment account if you don’t already have one.

- Open an IRA, 401(k), and Brokerage account if you don’t already have one. In step 5, we walk you through how to invest in each account.

Step 4: Build an emergency fund in a high-yield online savings accounts

Now that you’ve laid the foundation and have the right accounts, you can start building wealth.

Your first goal? Build an emergency fund that will cover 6 months of living expenses.

What is an emergency fund?

An emergency fund is money you’ve set aside for an unexpected event, like a job loss or an economic downturn. If an unforeseen expense pops up and you don’t have an emergency fund, it might force you to go into debt.

If you don’t go into debt, it could force you to sell any investments you have to cover the cost. This often results in fees, taxes, and lost future earnings (especially if you sell investments from your retirement account). In other words, having an emergency fund helps prevent worst-case scenarios.

Remember that thing we said about making your money work for you? Store your emergency fund in a high-yield online savings account instead of your standard checking account (which only gets you 0.04% interest on average). This will help you earn more money over time compared to your checking account since high-yield savings accounts have a higher interest rate.

The term “interest rate” is used a lot in the finance world. Let’s break it down:

- When it refers to your checking and savings accounts, a higher interest rate is better, because you earn more.

- When it refers to the interest you pay on loans, credit cards, or debt, higher is worse because you pay more over time.

High-yield online savings accounts are also a good place to save cash for medium-term goals (~5 years), including:

- Making a down payment for a home

- Buying a car

- Paying your taxes

- Saving for a wedding

We recommend you sign up with Synchrony Bank or Marcus by Goldman Sachs. They’re FDIC insured AND can offer up to 4 times the national average interest rates (this is largely because they’re online-only, so they don’t spend your money on physical bank locations).

To recap, here are some action items:

- Using our net worth template from step 1, check to see if you have 6 months of expenses saved in your emergency fund. If you don’t have enough money saved, make a plan for how much money you will save.

- If you don’t have a savings account, sign up for a high-yield online savings account with Synchrony Bank or Marcus by Goldman Sachs.

- If you have a savings account, ensure your account has a competitively high interest rate. If it doesn’t, open one of the above accounts.

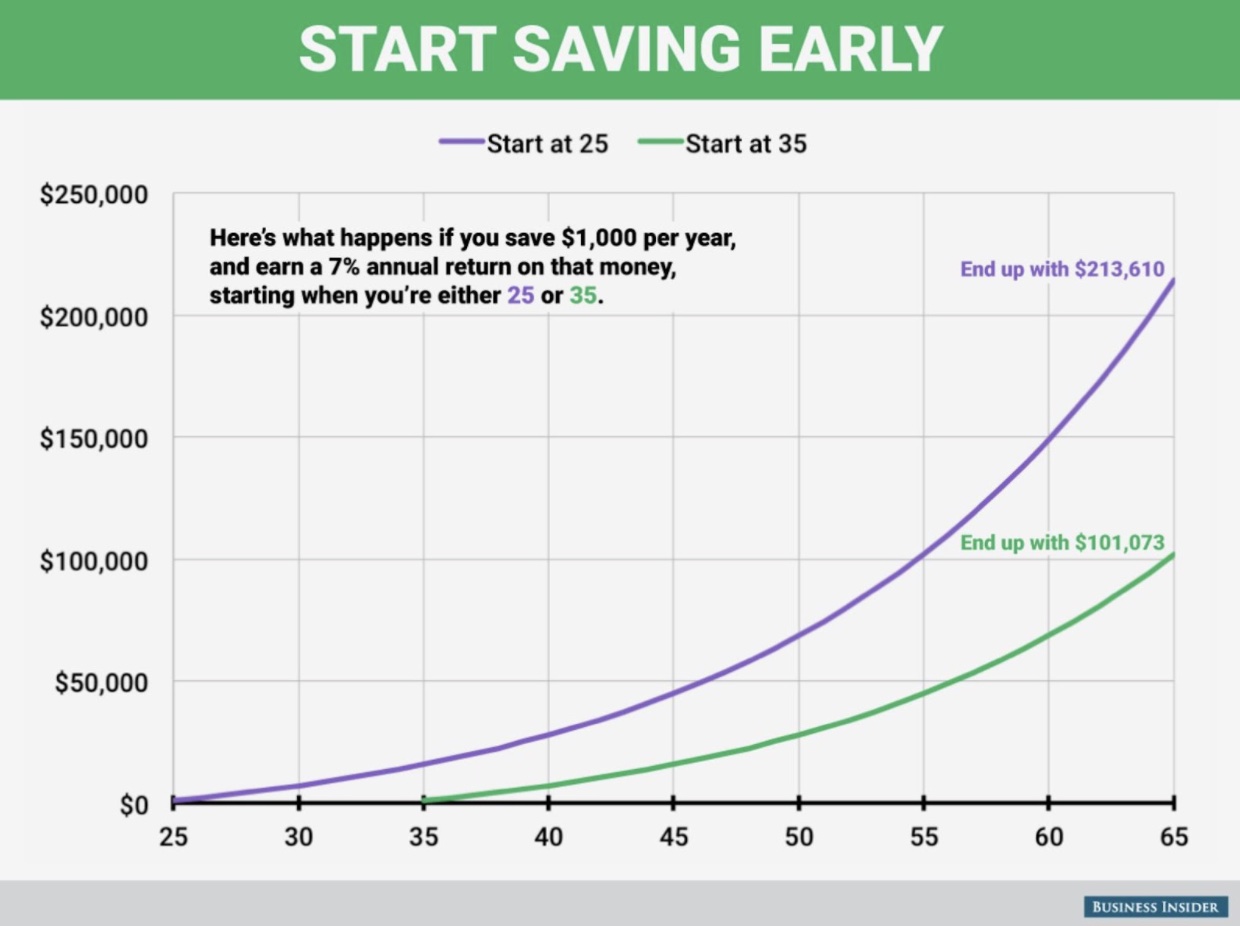

Step 5: Start investing your money

Often the hardest thing about investing is figuring out where to start.

Depending on your risk profile and how your parents raised you, investing can feel either really scary or natural to you. With so much contradicting advice online, it’s important to stay grounded. Despite what many people think, you don’t need to pay a financial advisor exorbitant fees – in fact, we don’t recommend this.

If you follow our simple process, you’ll learn the same step-by-step tactics the top 1% uses to build wealth responsibly.

First, start with retirement planning: max out your retirement accounts (IRA and 401(k)) to benefit from tax-advantaged investing.

Not all investment accounts are created equal. For instance, did you know that retirement accounts have tax advantages? The most common retirement accounts are a 401(k) or IRA (Roth IRA or Traditional). For this reason, your first investments should go into one of these two accounts.

If your employer offers a matching program with your 401(k) option, you should use this account first. Why? Because “matching” is code for free money. It’s like earning passive income.

If you don’t have a matching program with your 401(k), then we recommend using your IRA account first because they tend to have better investment options.

Now, the question is which type of account: Roth or Traditional?

While there are many differences, generally speaking, Roth is the best choice for building wealth and accessing your money. Two big benefits of Roth accounts are that you don’t pay taxes when you take money out and you can access the money you contributed before you retire, if needed.

Second, invest any extra money in your brokerage account.

Contribute to your brokerage account(s) last.

A brokerage account is an investment account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and exchange traded funds (ETFs).

You might have heard of the following ones: Public, E-Trade, Robinhood, Fidelity, or Vanguard. Although brokerage accounts get a lot of press and attention, they are actually the last step in the investment process. Why? Because these accounts don’t offer any special tax advantages.

You shouldn’t worry about brokerage account investments until you are already maxing out your annual retirement accounts, IRA, and 401(k) contributions.

|

Disclaimer: One exception to this rule is if you have a plan to retire early (before the age of 60). In this scenario, contributing to your brokerage account in parallel with your retirement accounts (i.e. before maxing them out) may make sense. Any money you withdraw from a retirement account before retirement age (~60 years old) is subject to a 10% early withdrawal penalty. If you plan to retire early, it may make sense to build investments in non-retirement accounts as well. |

In terms of what to invest in, you might feel tempted to invest in individual stocks. We get it, it feels more “fun.” But that’s called “speculating”, not “investing.” You’ll experience very little financial stability this way.

When investing, stick to index funds and exchange traded funds (ETFs) for 80%+ of your portfolio, if not the whole thing. Why? Because they are well-diversified and low-cost – two things you want in any investment strategy.

You can keep it very simple by using a robo-advisor, which can help pick ETFs for you. If you want to be a bit more involved, you can buy a target-date retirement index fund, or just a total stock market index fund to get started, via a brokerage account like Vanguard.

To recap, here are some action items:

- Max out your IRA and 401(k) contributions first.

- Only after you max out your tax-advantaged accounts, put money in your brokerage investment account.

- When picking investments, stick to low-cost and diversified index funds and ETFs.

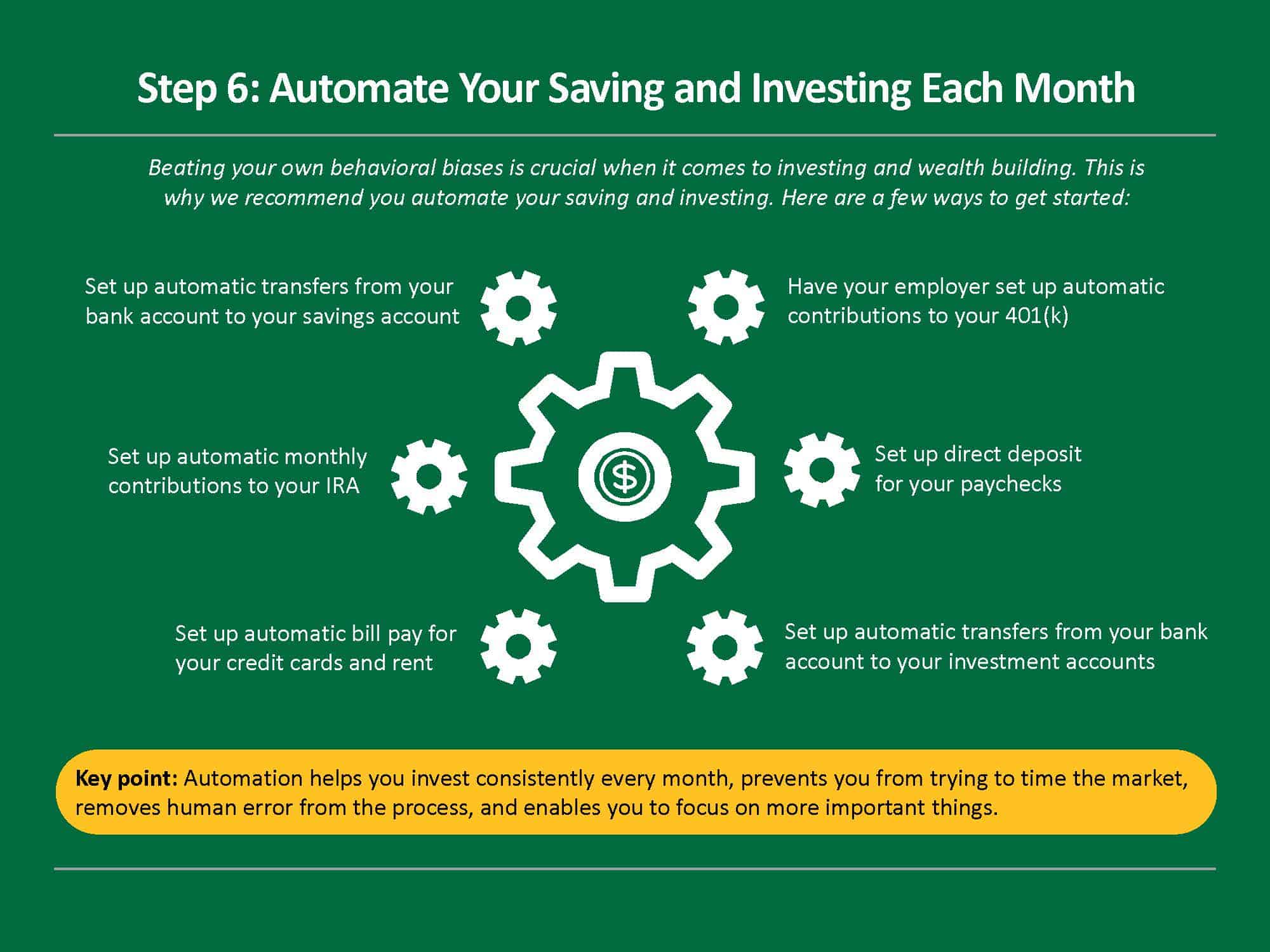

Step 6: Automate your saving and investing each month

Now to the final step of building wealth, which is essentially making your money work for you…on autopilot.

Beating your own behavioral biases is crucial when it comes to investing and wealth building. This is why we recommend you automate your saving and investing.

Why is automation so important?

- It helps you invest consistently every month, aka dollar-cost averaging

- It prevents you from trying to time the market (which does not work)

- It removes human error from the process and enables you to focus on more important things like seeing friends, riding your bike, traveling, or spending time with your family

How can you get started? Here are a few ways to automate your financial life:

- Set up direct deposit for your paychecks

- Set up automatic bill pay for your credit cards and rent

- Set up automatic transfers from your bank account to your savings account

- Set up automatic transfers from your bank account to your investment accounts (IRA and Brokerage) every month

- Have your employer set up automatic contributions to your 401(k)

Take small beginnings seriously. As little as $25 is a great start. Once you have everything set up and running smoothly with the right amounts, it is a wonderful feeling to go live your life and not spend hours checking your accounts each month. And before you know it, you’ll be meeting your financial goals.

To recap, here are some action items:

- Check and see how much money you have leftover after you pay all of your bills next month. Take this amount and decide how much of it you can contribute to your savings and/or investment accounts.

- Login to your checking account and set up automatic monthly contributions (based on the amount you calculated above) into your savings account, retirement and, when possible, brokerage account.

Final Thoughts

This wealth building guide was designed to present you with a blueprint for financial success. Hopefully, it equipped you with some financial literacy skills as well. We are confident that if you truly follow these 6 actionable steps, you will build wealth and achieve financial freedom.

The most important thing to remember is that building wealth doesn’t happen overnight; it takes time and intentional action. The nice thing is that, unlike other parts of life, if you set things up well and automate monthly activities, you can reach a point where you don’t need to spend a lot of time managing your finances each month.

Regardless of how you’ve handled personal finances in the past, it’s never too late to get started. Click here for a free checklist to help you track action items from this post

Want More Actionable Advice To Build Wealth?

We are currently building a detailed course on how you can invest and build wealth. Want to be the first to know about it?

When you sign up, we’ll also send you one email every month where we share financial knowledge, tools, templates, and lessons for building wealth.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.