Just like you can’t apply for a job without a resume, you can’t build wealth without the right accounts.

When it comes to saving and investing money, complicated investment advice can sound enticing, but starting with right accounts and tools will make your personal finances much simpler and save you money.

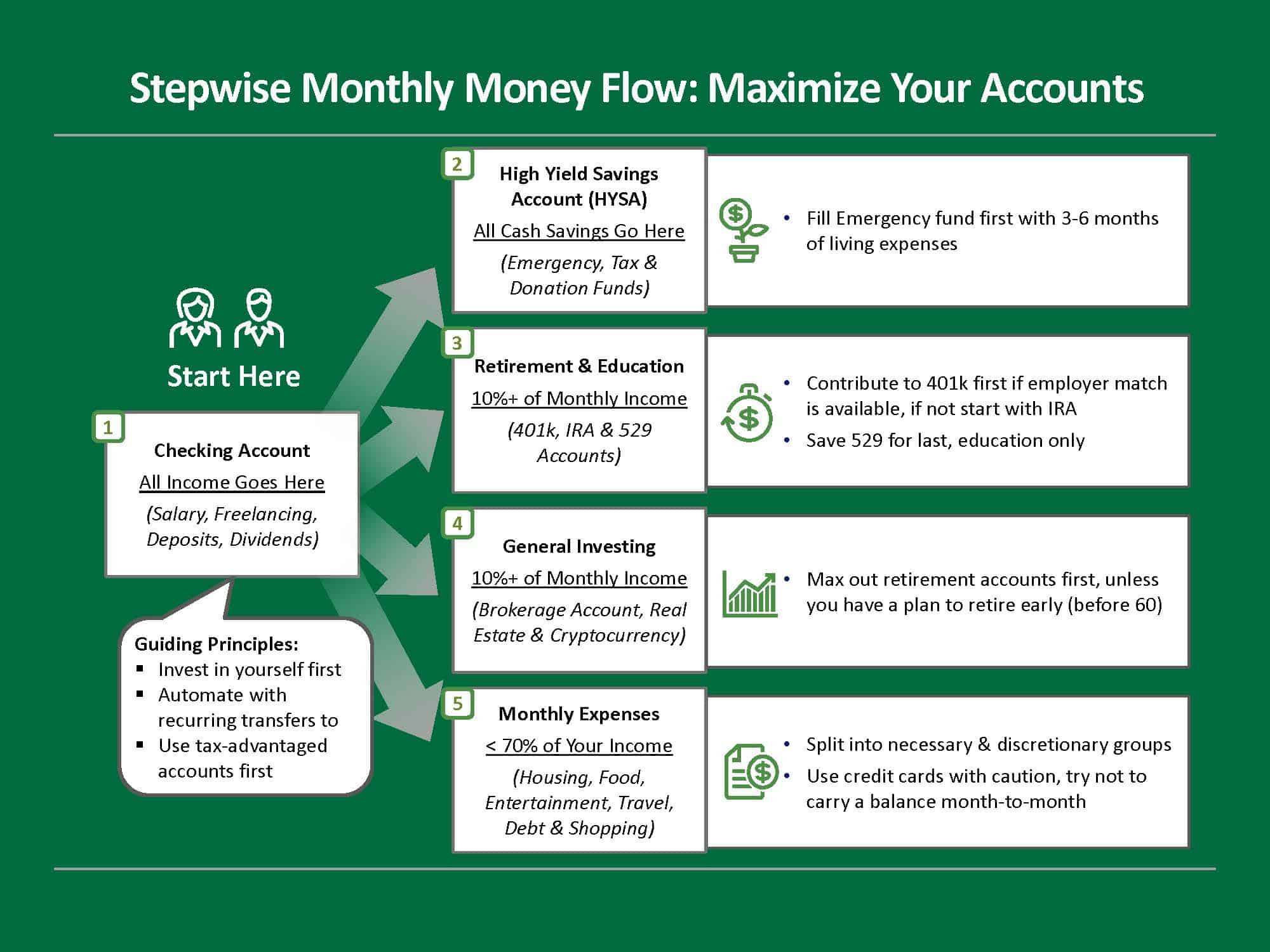

In this guide, we cover five personal finance account types that you need to save, invest and build wealth efficiently:

- Checking account

- High-yield online savings account

- IRA

- 401(k) Account

- Brokerage account

If this feels overwhelming, don’t worry, you don’t need to open all five today. Opening and starting to use just one is a big win in our book. Stepwise is here to make personal finance important, accessible, and actionable, not intimidating!

List of Personal Finance Accounts

1. Checking Account

This is where it all begins.

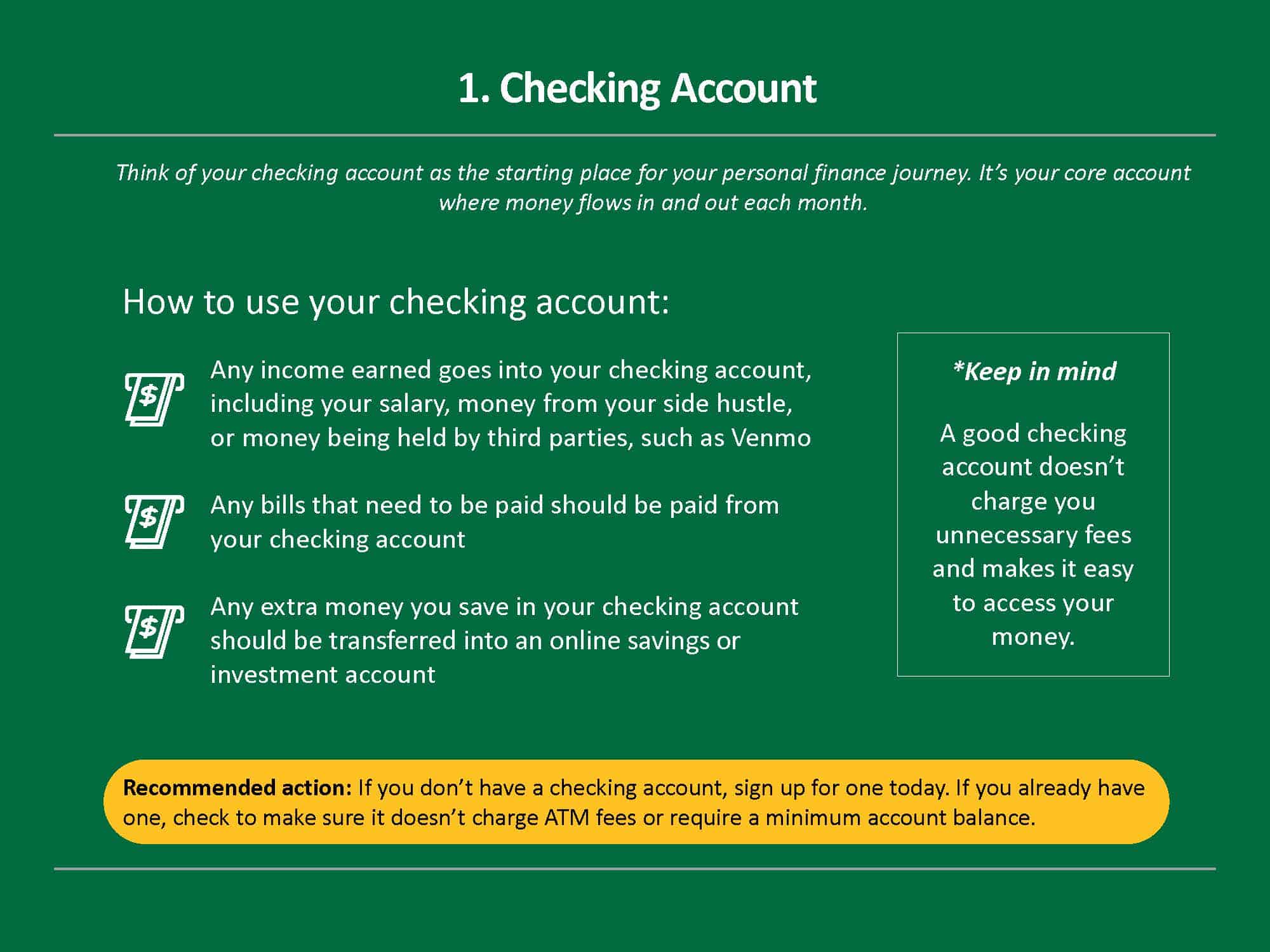

Think of your checking account as the starting place for your personal finance journey. It’s your core account where money flows in and out each month.

How should you use your checking account?

- Any income earned goes into your checking account, including your salary, money from your side hustle, or that $160 you finally remembered to transfer from Venmo.

- Any bills that need to be paid should be paid from your checking account. Ideally, they’re already on autopay. (Here at Stepwise, we’re all about automation).

- Any extra money you save in your checking account should be transferred into an online savings or investment account each month. Don’t worry, we’ll teach you exactly how to set this up.

Since your checking account is where money flows in and out of each month, it is important to ensure you aren’t being charged unnecessary fees (like an overdraft or monthly maintenance fee, for example), and that it is easy to access your money. Banks with fewer fees (or even none at all) are the best options.

Avoid financial institutions that are notorious for screwing over their customers (i.e. Bank of America, Wells Fargo, etc.) Banks that are “too big to fail” are not always the best option. Plus, up to $250,000 is federally insured in every account in America by the Federal Deposit Insurance Corp! (Banks and credit unions are very different in this regard: credit unions are not insured by the FDIC.)

Recommended Checking Accounts:

Charles Schwab

Why:

- Unlimited fee rebates at ATMs worldwide

- No monthly fees

- No minimum balance requirements or minimum deposit

- Free overdraft transfers from linked account

- Can easily pay bills

Betterment

Why:

- Integration with your investment accounts for simplicity of money management

- No ATM fees worldwide

- No monthly fees

- No minimum balance requirements

Axos Bank

Why:

- No monthly fees

- No minimum balance requirements

- Unlimited domestic ATM fee reimbursements

- Option to earn up to 1.25% APY on your balance

Recommended Next Steps

- If you don’t have a checking account, sign up for one today.

- If you have a checking account, check if it charges you ATM fees to have an account or requires a minimum account balance. If it does, we recommend you sign up for a new checking account.

2. High-yield Online Savings Account

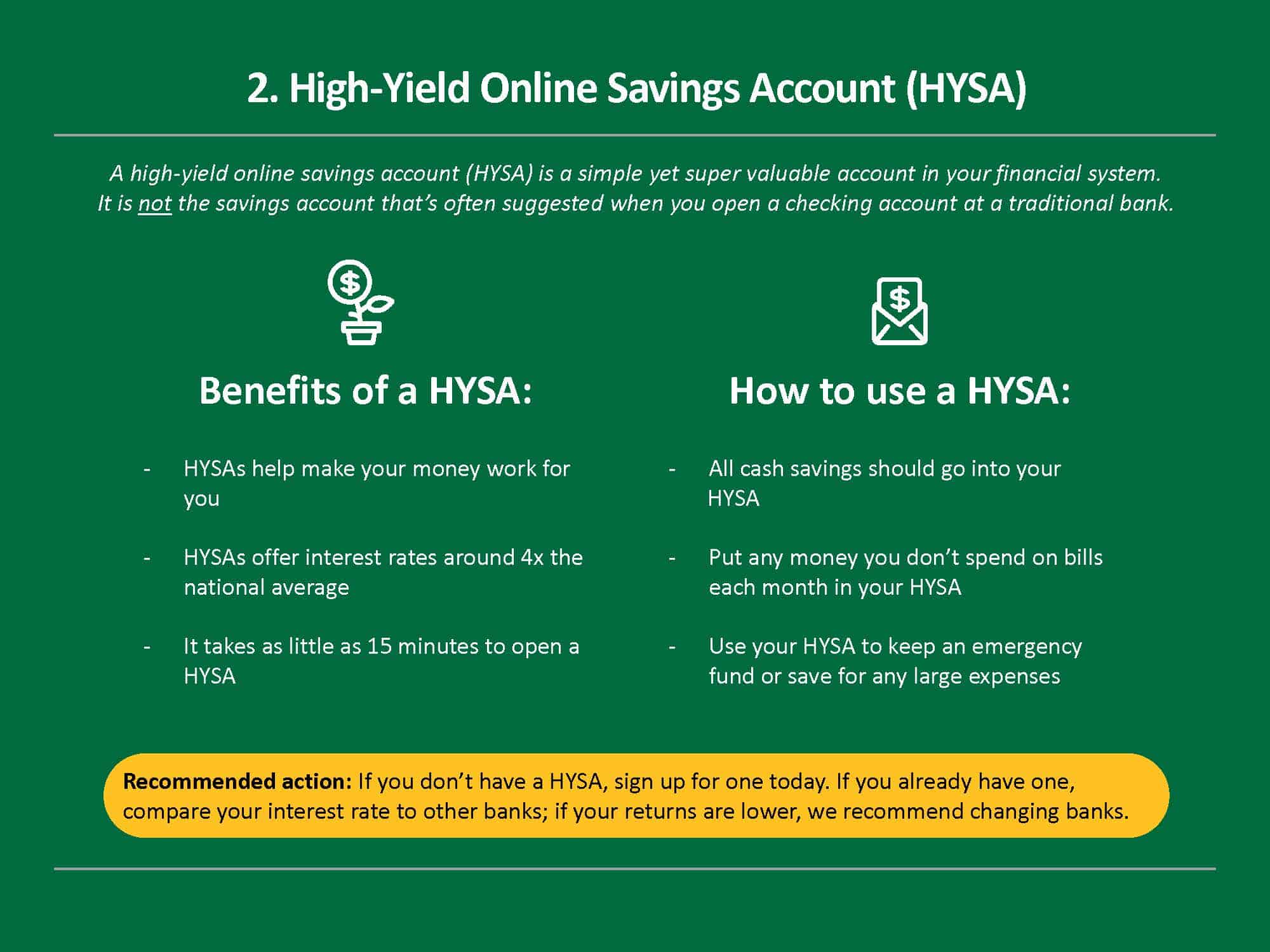

Often referred to as “HYSA”, a high-yield online savings account is a simple yet super valuable account in your financial system.

Remember your checking account? That account only earns you a national average interest rate of 0.04%. After you have paid your bills, why deposit money there?

That’s why you want as little money in your checking account as possible. Instead, make your remaining money work for you and deposit cash into a high-yield savings account. Savings account interest rates are much higher. Plus, when the federal reserve raises interest rates, some high yield savings accounts will increase theirs as well to remain competitive. Historically, during times like these, an average savings account earns almost 5%. Capitalize on compound interest and let the cash grow!

|

Note: HYSA is not the savings account that’s often suggested when you open a checking account at a traditional bank. It’s an entirely separate bank account from your checking account. |

In return for being online-only, high-yield online savings accounts typically offer savings rates around 4x the national average. Since they don’t have to open hundreds of physical locations like your traditional brick and mortar bank, the money that the financial institution pays goes directly back into your pocket. These online savings accounts don’t always come solely from online banks; some traditional banks have their own high yield savings accounts.

Furthermore, a high-yield savings account is the perfect place to keep your emergency fund, a downpayment for a house, savings for taxes, or other large expenses. Opening one can take as little as 15 minutes, so there is no reason not to incorporate it into your personal finance journey.

To recap, the money you don’t spend on bills each month should be kept in your HYSA and used to build your emergency fund (around 6 months of expenses). As an added bonus, it also helps you form a great habit.

Recommend high-yield online savings accounts:

Marcus High Yield Savings by Goldman Sachs

Why:

- Competitive interest rates to make you more money

- Online and app access

- Same-day transfers up to $100k

- No minimum balance requirement

- No minimum deposit requirement

Synchrony Bank High Yield Savings

Why:

- One of the highest interest rates

- No monthly maintenance fees

- Online and app access

- No minimum balance requirement

- No minimum deposit requirement

Betterment

Why:

- Competitive interest rates

- Integration with your investing and checking accounts for simplicity of money management and financial planning

- User-friendly phone app with robo advisor for investment advice

Recommended Next Steps

- If you don’t have an online high-yield savings account, sign up for one today.

- If you do have an online high-yield savings account, compare your interest rate to other banks. If your returns are lower, we recommend changing banks.

3. Individual Retirement Account (IRA)

Now that you’re all up to speed on where to save your money for maximum returns, let’s talk about investment accounts.

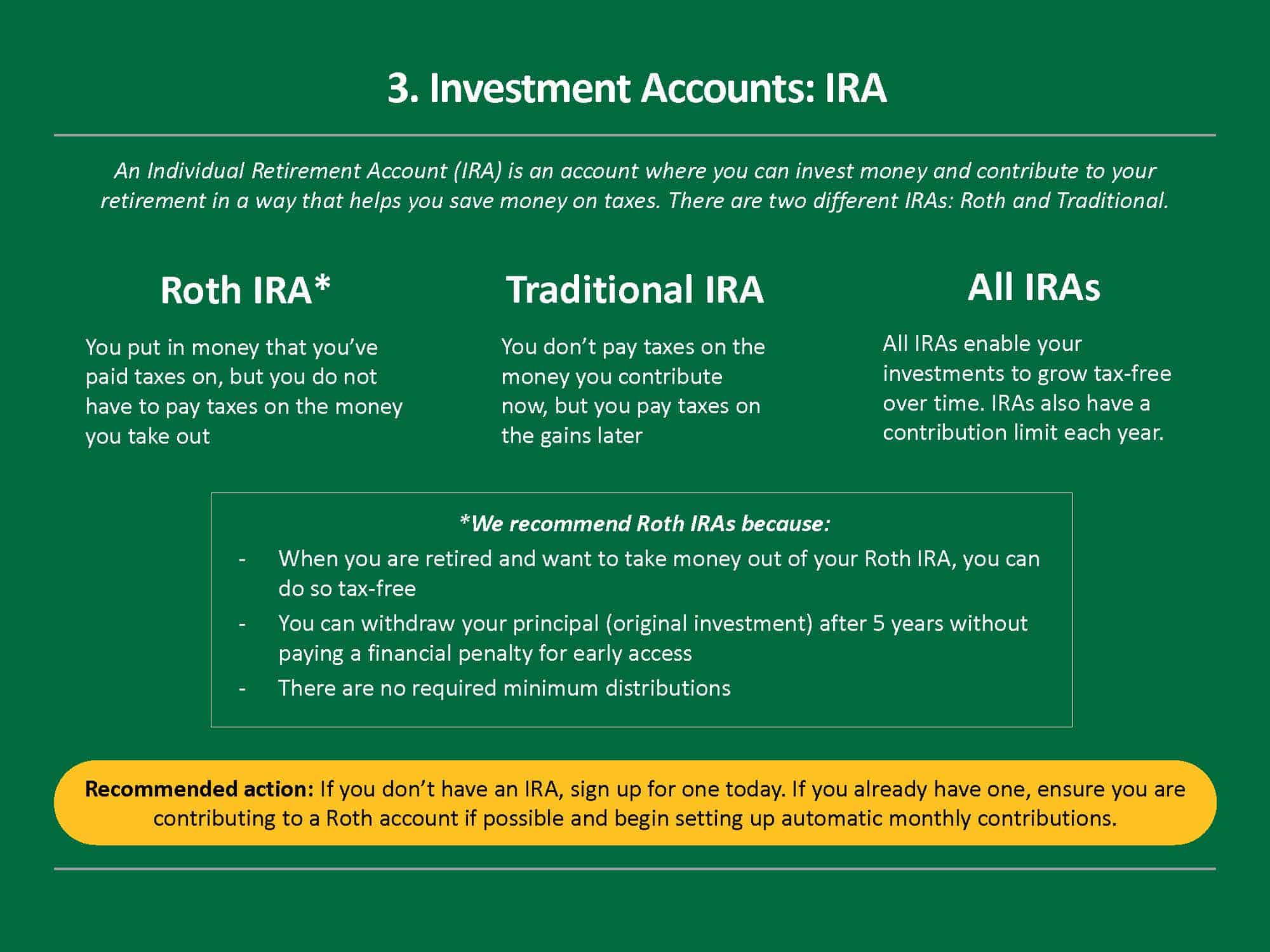

You’ve probably heard about this thing called an “IRA”, which stands for “Individual Retirement Account.” Simply put, an IRA is an account where you can invest money and contribute to your retirement account in a way that helps you save money on taxes. Any good tax advice will encourage you to open an IRA, depending on your income level. Some IRAs do charge monthly service fees, but this is nothing to worry about. The monthly fee will usually be very low.

Although retirement may be a very long way off and feel very abstract right now for young investors, investing in an IRA is crucial if you want to ensure you can enjoy your future retirement. Most traditional, low-risk investments like index funds and money market mutual funds have a steady annual percentage yield which can help you build financial stability over time.

There are two types of IRAs:

- Roth IRA: With a Roth IRA, you put in money that you’ve paid taxes on, so it is not a taxable account when you take your money out later.

- Traditional IRA: Traditional IRAs are the opposite of Roth IRAs: you don’t pay taxes on the money you contribute now, but you pay taxes on the gains later.

IRAs have contribution and income limits depending on your financial situation:

- IRAs offer great tax benefits but have a contribution limit each year ($6,000 in 2021).

- If you meet the taxable income limits for Roth IRAs (you make less than $139k single, $206k married as of 2021) we highly recommend you contribute to a Roth IRA.

All IRAs enable your investments to grow tax-free over time.

Roth IRAs have a few unique benefits:

- When you are retired and want to take money out of your Roth IRA, you can do so tax-free

- You can withdraw your principal (original investment) after 5 years without a penalty that costs money

- There are no required minimum distributions

|

Note: If you are over the income limits for Roth IRAs, you can still access these benefits through either contributing to a Roth 401(k) at work OR doing a backdoor Roth IRA process |

How should you think about contributing to an IRA?

- Your IRA is the first place to start investing your money, unless you have a 401(k) matching program at work. In that case, your IRA is the second place. There are many investment options available within an IRA (mutual funds, ETFs, CDs etc.), so you can adjust depending on your risk tolerance.

- If you have any reason to believe your taxes will be higher later in life (tax law changes, income, life situation) then a Roth IRA is a good bet to save you some money long-term.

Recommended IRA Providers:

Vanguard

Why:

- Best low-cost and diversified index fund and ETF options

- Options for both robo-advisor investing or self-management

- No commissions for buying Vanguard funds

Betterment

Why:

- Hands-off investing at a low cost, input goals and they pick the ETFs

- Integration with your other investing and checking accounts for simplicity of money management

Recommended Next Steps

- If you don’t have an IRA, sign up for one today

- If you have an IRA, ensure you are contributing to a Roth account type if you can

- Set up automatic monthly contributions so that your retirement investing is on autopilot. Start with whatever amount you can afford (as little as $10 a month makes a difference)

- Overall, your goal should be to set up a monthly contribution/investment so that you max out your annual contribution each year (in 2021, that is $500 a month for a total of $6,000 annually)

4. 401(k) Account

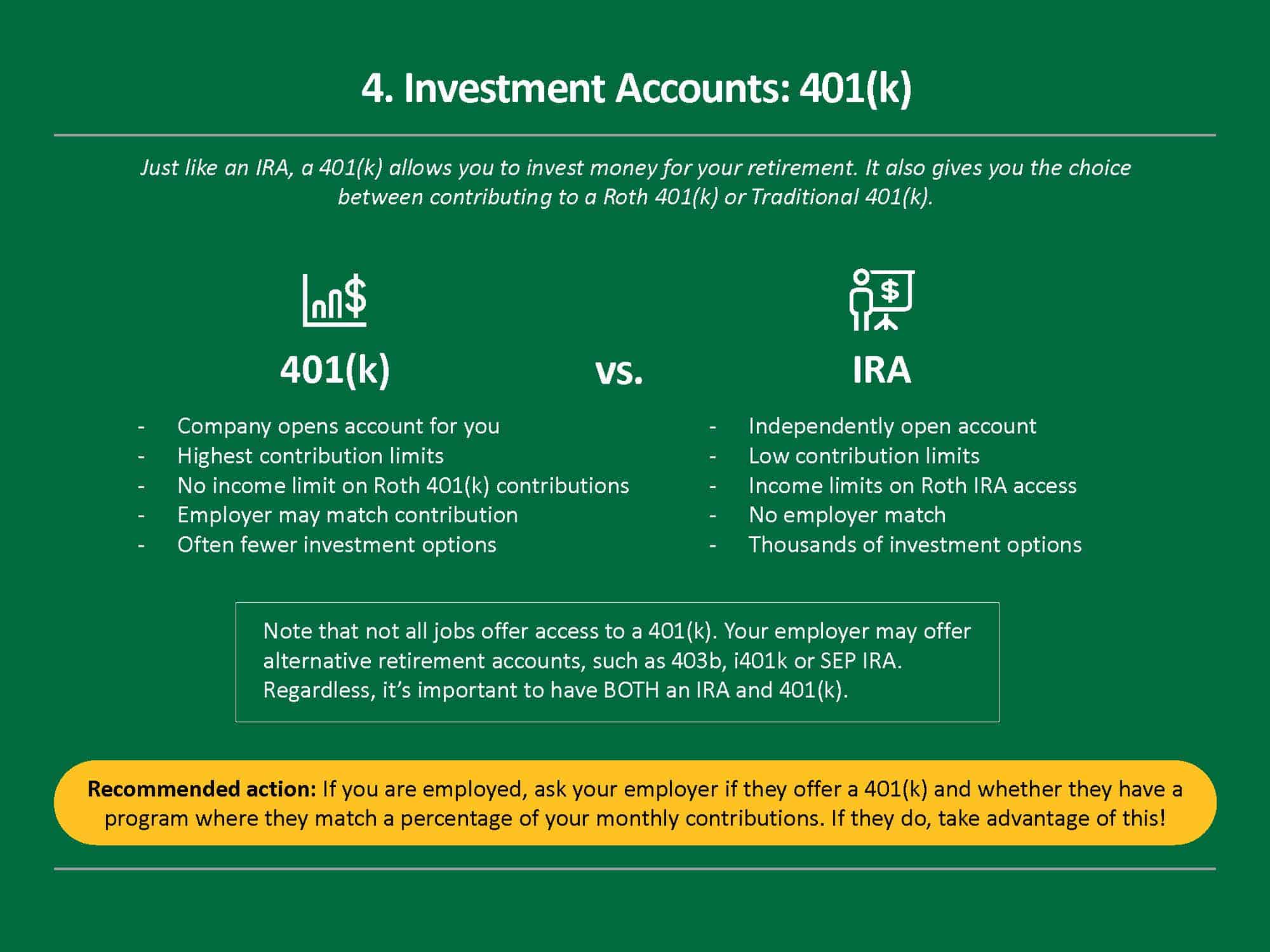

Just like an IRA, a 401(k) allows you to invest money for your retirement. It also gives you the choice between contributing to your Roth 401(k) or Traditional 401(k).

Upon first glance, an IRA and 401(k) are similar. However, they are separate accounts and have many differences.

What are the differences between a 401(k) and IRA?

- An IRA is something you set up yourself while 401(k) is employer-sponsored.

- For a 401(k), the annual contribution limit in 2021 is $19,500 vs $6,000 for an IRA.

- For a 401(k), there are no income limits that stop you from contributing to a Roth 401(k), unlike an IRA which has income limits for Roth account types.

- For a 401(k), some employers offer programs that match a percentage of your monthly contribution. IRAs do not have this.

How should you think about contributing to a 401(k)?

- First, you should have BOTH an IRA and a 401(k).

- Second, ask your employer if they offer a 401(k), and if so whether it includes a matching program.

- Third, if you have matching, make sure to contribute enough to get the full match each year. If not, start by contributing to your IRA.

What if you don’t have access to a 401(k)?

Not all jobs offer access to a 401(k). If not, your employer may offer an alternative.

Alternative retirement accounts to a 401(k) include the following:

- 403b

- i401k

- SEP IRA

Here is how you know what account type you likely have access to:

- If you work for a business: 401k Account

- If you work for a non-profit, school, or healthcare institution: 403b Account

- If you are self-employed or run your own business: i401k or SEP IRA

Recommended Next Steps

- If you are employed, talk to your employer about how to set up your 401(k) or 403b. Also, see if they have a program where they match a percentage of your monthly contributions.

- If you have matching, set up your monthly contributions to take full advantage of this as it is literally free money.

- If you are self-employed, we recommend using Vanguard to set up your own i401k or SEP IRA.

5. Brokerage Investment Account

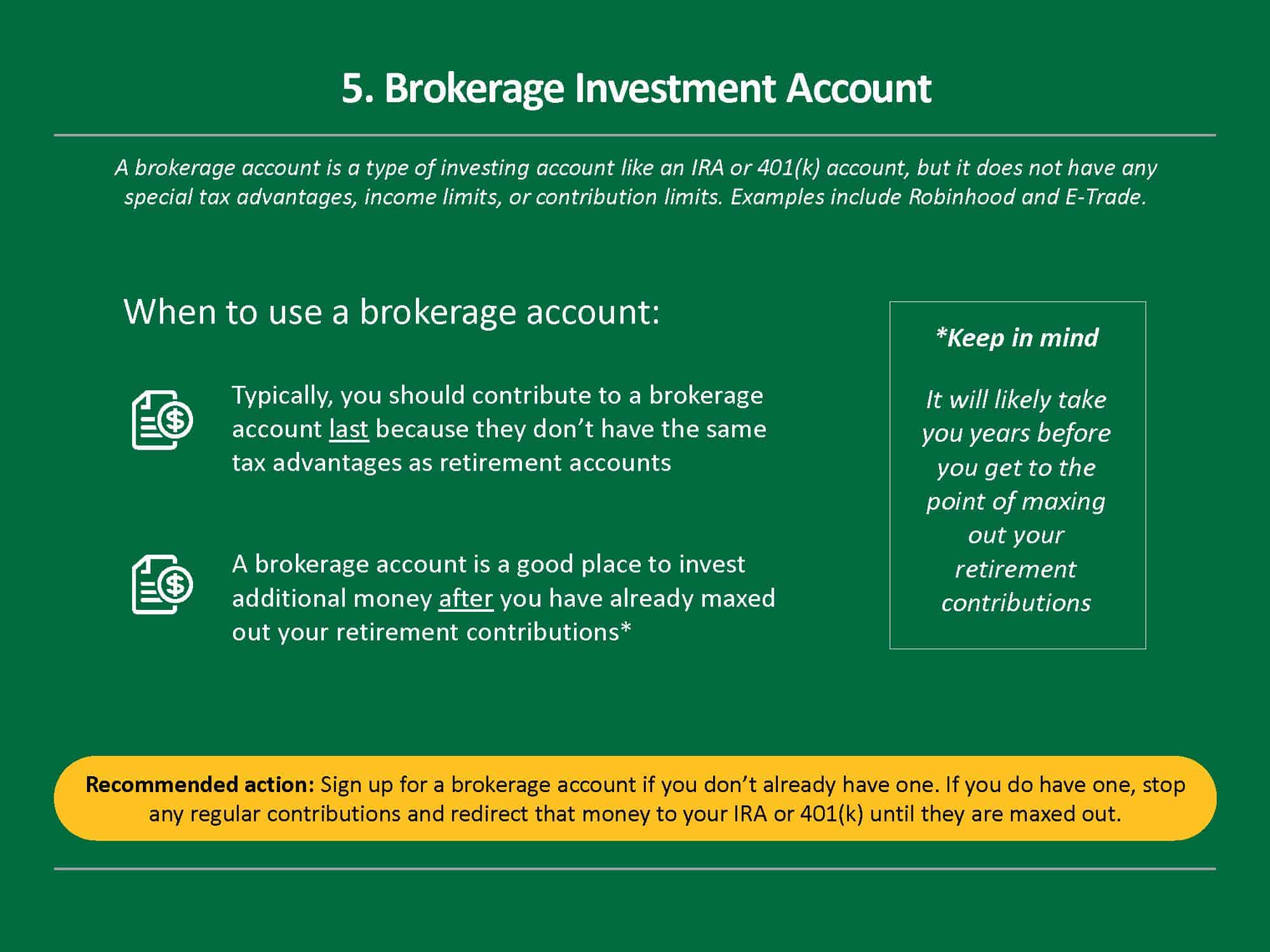

A brokerage account is a type of investing account like an IRA or 401(k) account, but it does not have any special tax advantages, income limits, or contribution limits.

You’ve probably heard of one because they get the most press coverage. Does Robinhood, E-Trade, or Vanguard ring a bell? They allow you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs.

Many investors end up investing in these accounts first because they are flashy and can provide instant gratification.

While these accounts are important, you should contribute to them last because they don’t have the same tax advantages as retirement accounts.

A brokerage account is a good place to invest additional money after you have already maxed out retirement contributions. It will likely take you years before you get to this point.

|

Disclaimer: There are some scenarios where contributing to a brokerage account before maxing out retirement accounts CAN make sense. For instance, if you have a shorter term investing goal such as making a down payment on a home or are aggressively working toward early retirement, you will need some money before you can access savings in retirement accounts. In that case, it would make sense to also contribute to an investment account in parallel with your retirement accounts. |

Recommended Brokerage Accounts:

Vanguard

Why:

- Best low-cost and diversified index fund and ETF options

- Options for both robo-advisor investing or self-management

- No commissions for buying Vanguard funds

Betterment

Why:

- Hands-off investing at a low cost, input goals and they pick the ETFs

- Integration with your other investing and checking accounts for simplicity of money management

Recommended Next Steps

- If you don’t have a brokerage investment account, sign up for one today.

- If you already have one and have been investing money here regularly before maxing out your IRA or 401(k), stop any regular contributions and redirect that money to retirement accounts

Other Personal Finance Tools

Once you open all five accounts, you can use free online tools, like those listed below, to monitor your monthly budget, net worth, and investment performance across each account all in one place.

Net Worth and Investment Tracker

It’s hard to monitor your money across different accounts. To help you have better visibility over your finances, we recommend using a free online personal finance tool called Personal Capital.

It helps you track your budget, spending, net worth, investment portfolio, and investment allocation all in one place.

Want to learn more? Here is our review of Personal Capital.

Recommended Next Steps

- If you don’t have Personal Capital, sign up today.

Budgeting Tool

Tracking your expenses sucks. We’re not going to sugarcoat it. However, it’s essential that you do it.

Mint.com provides the best automatic way to understand how much you spend across different categories. A few years ago, we weren’t a fan of them, but they completely revamped their tech and it’s solid now.

Mint will give you visibility into exactly how much you spend each month and enable you to input numbers into your monthly plan in a much simpler and faster way.

Most importantly, it will help you be accurate when you identify how much money you have left to save and invest each month.

Want to learn more? We break down both tools in our post Personal Capital vs Mint.

Recommended Next Steps

- If you don’t have Mint, sign up today.

Summary of Accounts

This table is a summary of each account type and what we recommend.

|

Account Type |

Account |

Recommended Accounts |

|

Essential Accounts |

Checking account (aka bank account) |

|

|

Online high yield savings account |

|

|

|

Investment Accounts |

Roth or traditional IRA (Individual Retirement Account) |

|

|

401(k) Retirement Account or 403(b) Retirement Account |

|

|

|

Brokerage account |

|

|

|

Free Financial Management Tools |

Best Free Budgeting Tool |

|

|

Best Free Net Worth and Investment Monitoring Tool |

| Note: If you don’t want a bunch of different accounts and would rather have everything in one place, you can open a checking, high yield savings, IRA and brokerage account with Betterment (4 out of 5 accounts in one place). |

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.

It’s nearly impossible to find educated people in this particular subject, however, you seem like you know what you’re talking about! Thanks