If you feel like you’re living in a perpetual state of excitement and new experiences mixed with freak outs and the occasional nervous breakdown…congratulations, you’ve entered your 20s!

The truth is that your 20s can be filled with many wonderful and new things – like striking out on your own, starting a new job, moving to a new city, making new friends and building new relationships.

But, it’s also true that your 20s can be incredibly overwhelming because you’re trying to figure out how the f*** to be an adult.

We get it. We’ve been there.

And we hate to be the cause of another freak out, but we have to give it to you straight: the financial habits and systems you set up in your 20s are important; they will enable you to set big-picture goals and build wealth for the long term.

We get it – sometimes it can feel like you’re barely scraping by and can’t even think past today, let alone about the future or creating smart money habits.

But, hear us out. We know it’s overwhelming. Which is why we’ve put together a list of the 8 most important actions you should take in your 20s to build wealth and get on the path to financial freedom. Here they are:

8 ways to build wealth in your 20s

- Build your credit score

- Create an emergency fund

- Pay off any high-interest debt

- Automate your bill payments and savings

- Start investing for retirement

- Build job skills that align with market opportunities

- Avoid lifestyle creep and spend wisely

- Spend time learning about investing & assets

Don’t worry, each of these are easier than they may seem. We’re going to walk you through each one of these.

But, these steps are important because they’re all about establishing a solid foundation. When you have the right financial habits in place, you’ll make strategic decisions that will help you increase your wealth, in your 20s and beyond.

Alright, now let’s turn to each step in greater detail.

Tip 1: Build your credit score

Yes, we know. You’ve heard all about the importance of a good credit score. And you think…it’s just a number, right? But the truth is that a strong credit score supports your finances in many ways.

For instance, a good credit score will help you:

- Rent a desirable apartment

- Get better credit cards

- Receive better interest rates on auto loans, mortgages, or other kinds of personal loans

Your credit score matters because it’s how banks and lenders gauge your risk profile. People with a low score are seen as being riskier – meaning that they will have to pay more in interest (or may not be able to access credit at all).

In a nutshell, a low credit score = making your financial life a lot harder.

And, yup, you guessed it: the best time to get your score moving in the right direction is when you are young. So, like, now.

You can start building good credit by:

- Paying your credit card bill on time every month (hint: setting up automatic bill pay is a great way to ensure this happens)

- Repaying your outstanding loans (student, car, home, etc.), when you fully pay off any loan it significantly improves your score

- Opening at least one line of credit (e.g., a credit card or credit-builder loan) and using it responsibly

- Keeping your debt ratio (the percentage of your available credit that you’re using) under 30%

Tracking your credit score and learning what factors influence it (hint: CreditKarma.com is a great tool for this, and it’s free)

Tip 2: Create an emergency fund

We know what you’re thinking: “I’m barely saving anything right now, how the hell am I supposed to save enough money for an emergency fund?”

But, stick with us.

Having an emergency fund is especially important as you start to build wealth in your 20s. When you have emergency reserves, you can tap them as needed to cover unexpected expenses, saving you from having to rely on credit cards or other kinds of debt.

While it is ideal to have an emergency fund that can cover 6 months of living expenses, any amount is better than none.

Ok, but how do you do it?

It is best to set your emergency reserves aside in a separate bank account. We recommend high-yield online savings accounts for this purpose. They’re fully FDIC-insured, yet they offer interest rates up to 4x higher than ordinary checking accounts. For this reason, high-yield savings accounts will help you save more money over time.

Plus, if you make it a habit to set money aside for emergencies, it becomes easier to save in the future for a down payment on a home, wedding expenses, or investment opportunities.

There are many good high-yield online savings accounts out there. We like the ones from Synchrony Bank, Marcus by Goldman Sachs, and Betterment.

Tip 3: Pay off any high-interest debt

Remember when your enemy was the kid on the playground who’d throw rocks at you or pull your ponytail? The good news is you survived. The bad news is that you have a new, much larger enemy: debt.

While having a little bit of revolving debt (such as a credit card) can help you improve your credit score, a lot of debt – particularly the high-interest kind – can be one of your greatest enemies (especially if you’re looking to build wealth).

Think of it this way: if you pay off any debt with an interest rate above 10%, it is functionally the same thing as earning an investment return of over 10%.

Yup. You can read that again.

The reason we recommend tackling high-interest debt before investing is that 10% investment returns are far from guaranteed.

FYI: the stock market, since its inception, has returned an average of about 8% annually.

Paying down debt, on the other hand, is a guaranteed way to put more money in your pocket.

If you don’t have any high-interest debt, great! You can move on to the next tip (even with all the other 20-somethings giving you the eye roll).

If you have any debt at all, though, you should review your situation to determine how much you owe and how much you’re paying in interest.

How can you do this?

One way is to sign up for a free budget and expense tracking tool like Mint.com. Mint lets you see all of your credit card, loan, and investment accounts in one place, helping you get a handle on the debt that’s costing you the most.

Another option is to download our free template to track your accounts and interest rates, which will help you identify which debt to pay down first.

| Note: although it may seem a bit manual, I highly recommend reviewing your accounts in the excel template first; it forces you to get comfortable with your numbers and learn where you stand today. |

Tip 4: Automate your bill payments and savings

Ok, this one should get you excited. It’s easy to do and one of the most valuable, yet under-utilized features when it comes to banking: automatic bill pay.

Didn’t even know that was a thing? That’s ok.

Whether you use an online bank or a conventional one, your account almost certainly offers automated bill pay. This happens either by your bank making an online transfer or mailing a check on your behalf when you schedule it.

Why is this so great? Well, because, once you have automation set up, you won’t miss a bill! You can set it, then forget it.

Essentially, automatic bill pay = you focusing on the things that really matter to you, like spending time with family, seeing friends, or traveling.

PLUS the benefits of automation go beyond paying bills on time. Automating your savings, in addition to your bill payments, will help you really start building wealth in earnest. This is true even if you start with a small amount like $10 or $25 every pay period.

So, how do you do this?

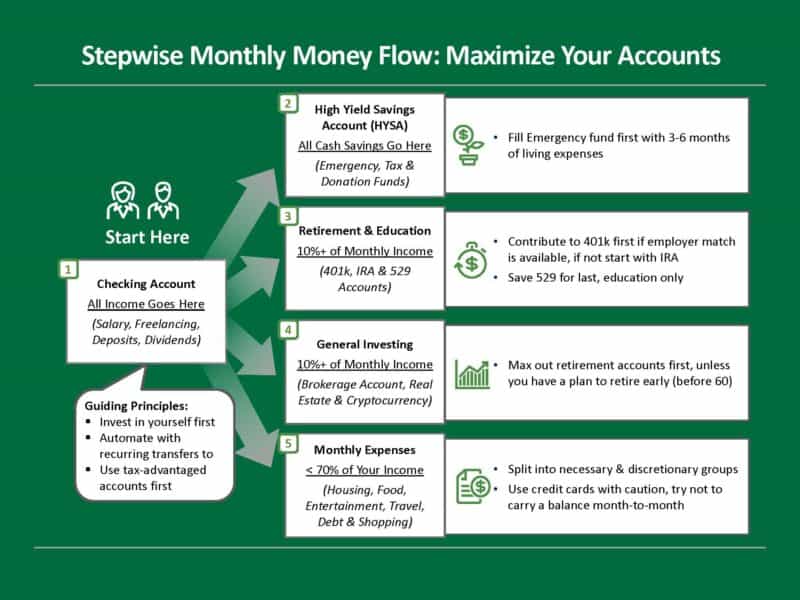

To get started with savings account automation, all you need to do is link your checking account to your high-yield online savings account. Then, simply go into your settings and set up a “reoccurring or automatic transfer” for the amount you want and the frequency.

This is a great way to build your emergency fund (refer back to tip #2…see, it all comes full circle). Over time you can increase the amount you save and ultimately add automatic transfers to your investment accounts as well.

Tip 5: Start investing for retirement

Ok, before you skip this section entirely because you feel like you’re drowning in work and won’t ever see the light of retirement, just hear us out.

Retirement may seem far off now, but the sooner you start thinking about your retirement nest egg, the better.

Or, put a little differently, the earlier you begin saving for retirement, the less you will have to save each year, and the more your life choices will expand when it comes time to actually retire (yes, you will get there).

There are two big reasons to begin planning for retirement in your 20s:

#1 You can get massive tax advantages with the right kind of investment account.

There are two kinds of accounts designated for retirement savings: individual retirement accounts, or IRAs, and 401(k) accounts. Both provide big tax benefits and offer Roth & Traditional contribution options.

Here is a quick overview of Roth vs Traditional contributions:

- Roth IRA or 401(k): you contribute after-tax money but you won’t pay any taxes on your investment earnings when you take them out in retirement

- Traditional IRA or 401(k): you make contributions using pre-tax dollars, helping you lower your tax bill today, but you will have to pay taxes on earnings when you take money out in retirement.

We generally recommend contributing to a Roth IRA or 401(k) while you can, since they have additional flexibility. See our post: 6-Step Guide: How To Save, Invest, And Build Wealth for more details.

Note: both account types limit how much you can contribute each year. That means you cannot go back and contribute to an IRA or 401(k) once a tax year has passed. This is why it’s so important to start saving early. Even though you may have more money to invest later, you can’t rewind the clock and contribute for past years if you miss them.

#2 You can take advantage of compound interest, or as Einstein once said,

“The eighth wonder of the world. He who understands it earns it ... he who doesn't ... pays it.”

What a great line; it’s so true.

Compound interest creates a multiplier effect on your money over time. When you take advantage of compounding, what you invest will grow much faster and the longer you save, the greater the impact.

If you’re a little overwhelmed right now and do better with visuals, check out this article that illustrates the power of compound interest and why starting as soon as possible is so important.

Tip 6: Build job skills that align with market opportunities

One of the most exciting parts of your 20s, in between the minor meltdowns, is that you get to invest in yourself.

To the extent that you advance your skills when you’re young, you can pick a career path that is not only enjoyable but offers more options and opportunities moving forward.

After all, the world of work is always changing. When you commit to learning tangible professional skills, you’ll increase your value on the job market. Then as you become more experienced and continue to develop your unique skill set, you can expect significant income growth in your 20s and 30s.

There are a number of different actions you can take to advance your career:

- Spend time online or in-person learning new technical skills (e.g., coding or design)

- Read books that focus on leadership, business, or other professional skills

- Attend conferences or meetups in fields or professional areas that interest you

- Join a group that will develop your “soft skills” (E.g., Toastmasters)

- Go back to school to pursue graduate-level education

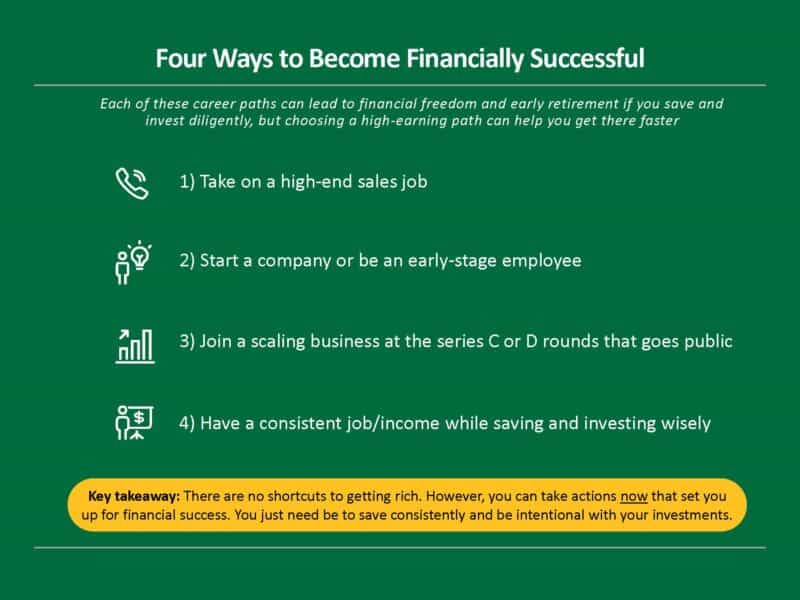

Many people think that building wealth is just about making the right financial decisions. But keep in mind that a big part of the basis for your financial health is your career.

You should aim to build skills that align with the broader job market and get good enough at what you do that your skills will be in demand. If you do, your earning potential will be much higher, and your wealth-building journey will become much easier.

Translation: you will be better off financially in the long term.

Tip 7: Spend wisely and avoid “lifestyle creep”

Ok, so we already know this tip is going to piss you off. And we get it – it’s not something you want to hear. But, we promise you’ll thank yourself later for listening to it now.

Simply put: if you want to build wealth in your 20s, it is very important to live below your means.

Translation: don’t spend money you don’t have!

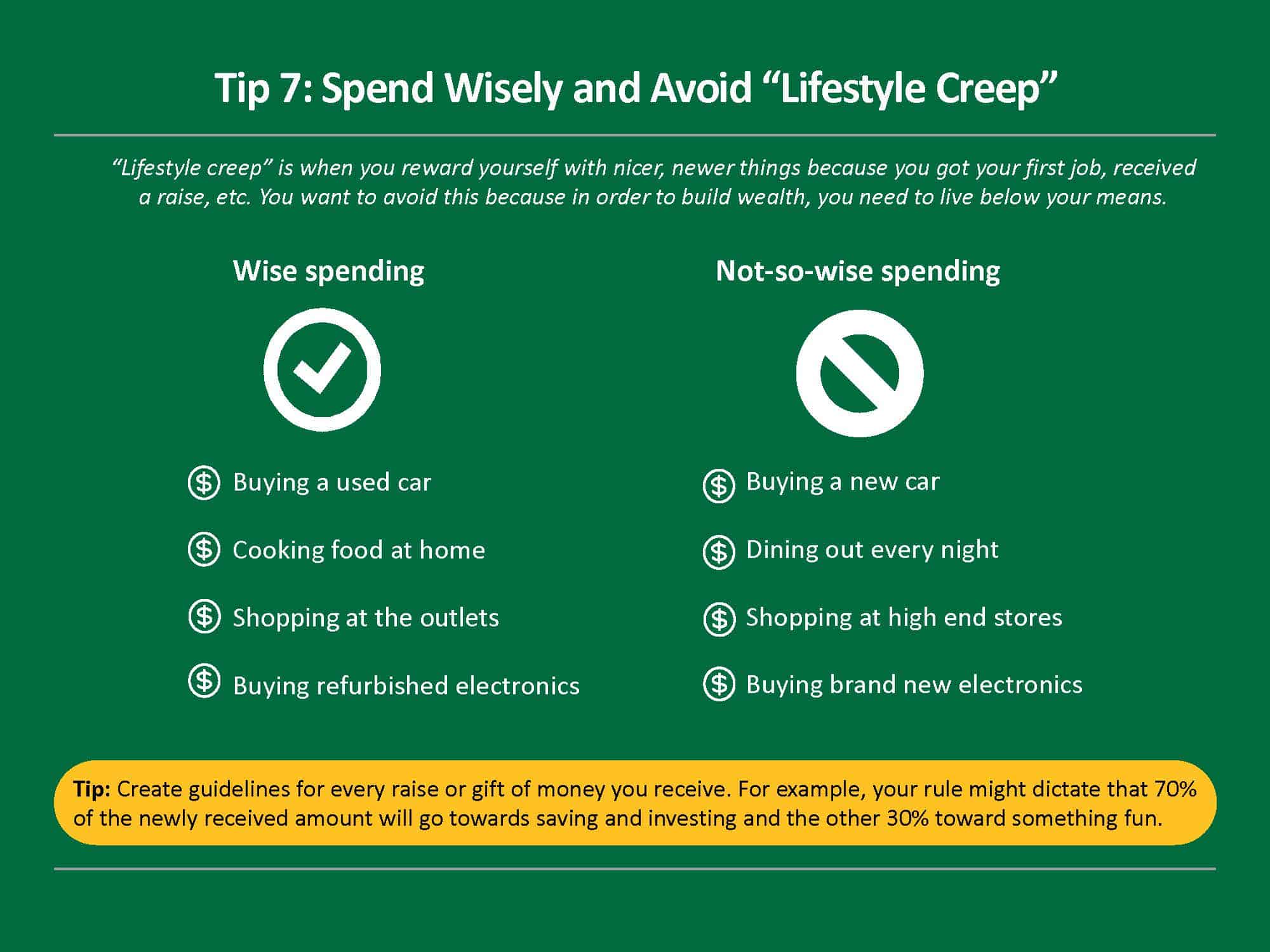

And trust us, we know how exciting it is once you get your first job or your first raise; it can be so tempting to reward yourself with fancier clothes, a new car, or a nicer apartment – a phenomenon called “lifestyle creep.”

The problem, however, is that once you become accustomed to new comforts, it is very hard to go back.

So, in order to create wealth in your 20s, try to avoid lifestyle creep and spend wisely.

What specifically does this mean? Well, to put it bluntly, it means:

- buying a used car instead of a new one

- cooking food at home instead of dining out

- shopping at outlets

- getting a refurbished TV or computer, and so on.

Saying no to new cars is a particularly effective way to rein in your spending. On average, a new car loses 9% of its value in the first minute you drive it, and ~20% of its value in the first year. Yet there are many used cars available with a factory warranty, the latest safety features, and years of reliable service ahead.

What are some ways to help you avoid lifestyle creep?

One practice that can help is to set guidelines for saving vs. fun spending when you get a raise or promotion. (Side note: if you need help creating a budget, download our budget template for free).

To keep building wealth as you earn more, create a rule for what you will do with raises or monetary gifts before you receive them – and then stick to it! No ifs, ands or buts.

Recommended action: create guidelines for every raise or gift of money you receive.

For example, your rule might dictate that 70% of the newly received amount will go towards saving or investing, and the other 30% toward something fun.

At the risk of sounding like your parents and really pissing you off, we’re going to repeat this point because that’s how important it is: if you want to be successful at building wealth, you’ve gotta live below your means.

It’s not that we’re trying to prevent you from enjoying your life. In fact, we think it’s really important to celebrate and allow yourself to enjoy some of your extra earnings…

…as long as you are doing so wisely!

If you are doing smart things with the majority of your money and are on a good track to building wealth, you should enjoy spending some of your income without any guilt! The key point here is being smart with the money you have.

Tip 8: Spend time learning about investing and assets

Knowledge and information are power. There’s a reason this is an old saying…

…because it’s true!

Building your knowledge of financial concepts, investing, and different types of assets will enable you to make smarter decisions and take advantage of opportunities that come before you.

And before life gets even crazier, as you get older and think about starting a family, having kids, etc., now is the time to start building that knowledge.

How?

One of the most important things you can do in wealth-building is to be curious about the world of personal finance. Building wealth, and becoming a sophisticated investor, takes time.

Just start by finding an area that interests you and spend time learning about it. This could be real estate, stocks, cryptocurrency, economics, behavioral psychology, negotiation strategies, etc.

Then, find a format or medium you enjoy. This could be a podcast, documentary, Youtube channel, Instagram, or TikTok account. What matters is that you enjoy it enough to come back and learn more over time.

For ideas and inspiration, check out some of our favorites:

- Personal Finance Club Blog

- Money Under 30 Blog

- Small Step Finance Instagram

- I Will Teach You to Be Rich Book and Blog

- Money Coach: Ellyce Fulmore Instagram

- Bigger Pockets Podcast

- Naval Ravikant on Twitter & Podcast

Now, Time to Start Building Wealth

We realize that digesting all of this at once can be a bit overwhelming. There’s a lot to it.

But, you don’t need to do all of these things at once. Start with what feels manageable and you will be surprised by how many of these steps naturally lead to others.

First and foremost, building wealth in your 20s is about establishing good financial habits, so be patient with yourself. New habits take consistency, time, and conscious effort.

Many people get distracted by the latest financial fads (e.g., meme stocks).

Don’t be one of them!

Instead, practice tried and true ways of building wealth, such as spending within your means and dedicating a portion of each paycheck to savings and investments. Yeah, we know they’re not “sexy”, but, well…they work!

If you have read this far, thanks for sticking with us; you are already on the right track. If nothing else, pick one of the tips above and set yourself a reminder to incorporate it later this week. Small actions and steps are the keys to building wealth over time.

As fun as your 20s can be, we know adulting can be hard. But we hope this guide has helped you gain confidence and clarify how to build wealth in your 20s.

Questions or comments? Drop a note below and we’ll get back to you!

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.