Cryptocurrency has probably gotten your attention for a variety of reasons lately. This new asset/virtual currency and financial innovation has been touted as a good inflation hedge, a decentralized way to save and invest, and the “digital gold,” among other things. One thing is for sure: it is both an emerging piece of financial infrastructure and a very volatile asset from an investment perspective compared to other asset classes.

A proliferation of new cryptocurrencies and ways to invest in the blockchain have emerged in the last few years in addition to crypto investments. While some are truly innovative, along with the blockchain technology behind them, many new cryptocurrencies have ended up as nothing more than pump-and-dump/insider marketing schemes that led many inexperienced investors to lose all their money.

The media coverage in this space has recently picked up, highlighting that more and more financial advisors, experts, and companies are investing in crypto and offering crypto services. Many larger financial institutions have started to hold crypto services. This has even started to include public companies. For example, firms including MicroStrategy, Tesla, and Coinbase have purchased billions of dollars worth of Bitcoin between them.

Many people would argue that some form of cryptocurrency investing or exposure to blockchain-backed assets has a place in a diverse portfolio, albeit a smaller one that is viewed as high-risk. While many new cryptocurrencies are unproven as an asset class (unlike stocks), there is potential for more upside than other traditional investment options. Generally speaking, crypto as an asset should be treated like any risky investment and kept to a smaller percentage (~10% or less) of your total investments.

If you are comfortable with the volatility, risk, and emerging nature of the asset, an investment strategy that includes cryptocurrency can offer an opportunity to diversify your portfolio and build wealth.

What You Need to Know About Cryptocurrency

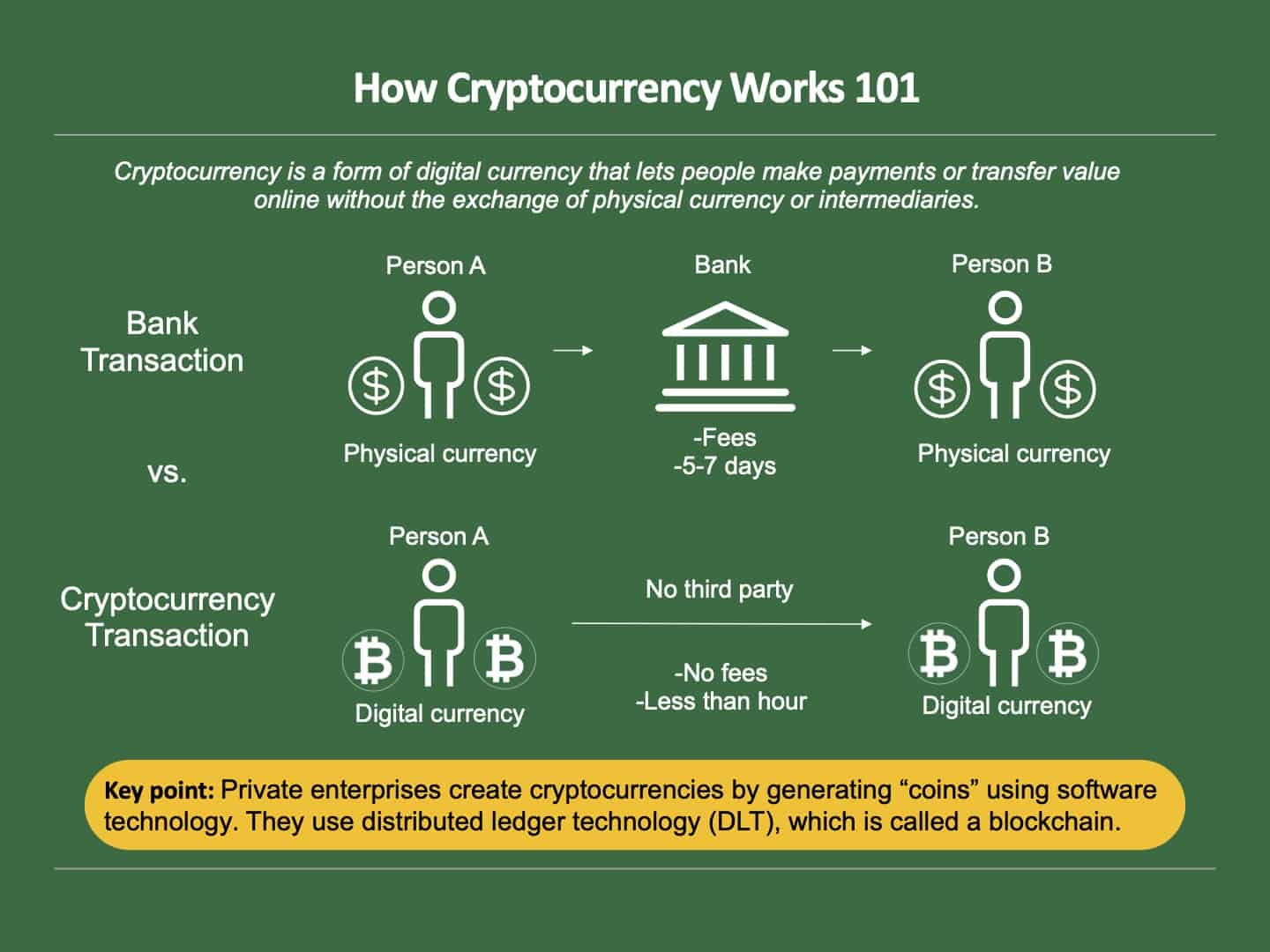

Cryptocurrency, or “crypto” for short, is a form of digital currency that lets people make payments or transfer value online without the exchange of physical currency or intermediaries (like traditional banks). However, many people also think of it as an investment akin to gold, the U.S. dollar, or other currencies. Many people buying cryptocurrencies are only buying them as speculative investments, hoping to profit as their value increases.

Private enterprises create cryptocurrencies by generating “coins” using software technology. While there are over 22,000 cryptocurrencies in the cryptocurrency market, the largest one in the world (based on market cap) is Bitcoin. The second largest is Ethereum. Some of the other more popular cryptos include Litecoin, Ripple, Tether, BNB, etc. You can use U.S. dollars (aka as fiat currency) or other cryptocurrencies to buy or sell crypto assets through platforms called cryptocurrency exchanges. The most popular exchanges are Binance, Coinbase and Kraken.

One unique element is that you can buy and sell crypto in fractions, at values of up to 8 decimal points for most of them. Their highly divisible nature makes it a type of digital currency that can be transacted and exchanged easily. Additionally, there are different crypto funds (ETFs, etc.) that investors can choose from.

From a functional standpoint, what makes cryptocurrency unique is the use of an unmodifiable public online database that can encrypt and verify transactions. Crypto markets are open for trades 24/7, 365 days a year due to their automatic and decentralized distributed processing nature (which traditional assets do not have).

In brief, cryptocurrencies are created through distributed ledger technology (DLT), which is called a blockchain. DLT permits multiple transactions and data to be recorded, shared, and synchronized across an online network with different network participants and without a central authority.

Ways to Invest in Cryptocurrency

First and foremost, if you do decide to invest in cryptocurrency, don’t put all your eggs in one basket! I’d caution you to cap your foray into a crypto investment at no more than 10 percent of your savings. Even as part of a diversified portfolio, crypto investments should be a small component.

It’s also worth noting that the Internal Revenue Service (IRS) has started to scrutinize the crypto industry more closely and treats gain and losses on cryptocurrency investing as subject to capital gains tax.

With that in mind, let’s break down some of the different ways you can access cryptocurrency investments. These are listed in rough order from the most straightforward to more complex options. Each may or may not be a good investment for you depending on your respective financial health and risk management and investment strategies.

Buy A Cryptocurrency Directly

Many people start out by buying cryptocurrencies directly on an exchange like Coinbase. Direct investing like this usually mirrors equity investing. Often this begins with a well-known crypto like Bitcoin or Ethereum. Bitcoin is the most popular and is considered more stable and credible than other available digital currencies, owing to its ~50 percent market share as of 2023.

Bitcoin was the first cryptocurrency, and it pioneered the distributed ledger concept, where instead of depending on a trusted intermediary like a bank, it relies on a peer-to-peer network that keeps an accurate record of transactions.

Satoshi Nakamoto, the creator of Bitcoin, set the total amount of Bitcoins at 21 million, thus turning it into a finite asset. Like other traditional investments, you can calculate the market capitalization of Bitcoin by multiplying its current price by outstanding circulation – in this case, 21 million.

Buy a Crypto ETF

As previously mentioned, there are thousands of cryptocurrencies in the market, along with companies that provide services and equipment to the cryptocurrency industry, such as crypto financial services companies, crypto mining firms, and crypto mining equipment suppliers.

So, instead of buying cryptocurrency and then selling it when the price increases, you could buy a crypto ETF (Exchange Traded Fund) just like mutual funds in the finance world to give yourself indirect exposure to crypto.

A crypto ETF is linked to the price of one or more digital tokens, or cryptocurrency stocks (companies that are a part of the space). It lets you invest without you having to spend time and energy on the process of trading in the crypto. These ETFs offer diversification by letting cryptocurrency investors own a small part of the different companies involved in the underlying blockchain technology. Plus, you don’t need a wallet to store it or remember a complicated password (keys).

Some popular blockchain ETFs are BLOK and BITQ. It’s worth noting that cryptocurrency or blockchain-specific ETFs tend to have higher expense ratios than traditional index funds, partly due to the more “active management” strategies they deploy within the fund.

Crypto Saving Accounts & Interest-Bearing Accounts

Cryptocurrency savings accounts are one way to simultaneously store your cryptocurrency and earn a higher rate of interest than offered by a bank account. It requires you to first purchase crypto directly and then hold it in an account designed for this.

An easier (but still risky) alternative is to earn more “passive” income through an interest-bearing cryptocurrency account like BlockFi on crypto-powered peer-to-peer lending platforms. There are many different options to do this, as outlined here.

Be aware, though, that, unlike traditional bank accounts, your crypto deposits are not insured by the Federal Deposit Insurance Corporation (FDIC) and the interest rates you earn can fluctuate dramatically over time.

Crypto Staking

Another way to earn passive income is to buy proof-of-stake coins like Ethereum, Cardano, or Solana and hold or stake them in a crypto wallet. Essentially, in this form of investing, you receive new crypto coins in exchange for securing the network and processing transactions through staking. Crypto staking is seen as the crypto world’s equivalent of earning interest or dividends for performing an important service as part of the underlying infrastructure and protocol that makes decentralized finance work.

Some crypto exchanges also offer staking programs that handle the technical details for a cut of the proceeds, though these arrangements have been under increased regulatory scrutiny in the U.S.

Other ways to Invest in Cryptocurrency

There are numerous other ways to start your cryptocurrency investing journey, including new and old approaches that are now being applied in this space. For example, there are crypto derivatives, crypto options, and perpetual contracts, just like you would find in traditional equities investing. However, these are much more advanced strategies, requiring deep knowledge and very active engagement in the investment process. For these reasons, I would avoid investing in these ways unless you are very knowledgeable in the space and in personal finance in general.

5 Steps for Investing in Cryptocurrency

Let’s pause here and ask ourselves a few questions:

- Why do you want to invest in crypto?

- How does this fit with your overall strategy to save, invest and build wealth?

- How much time and effort do you want to put into this?

- Are you in a financial position to make a riskier bet?

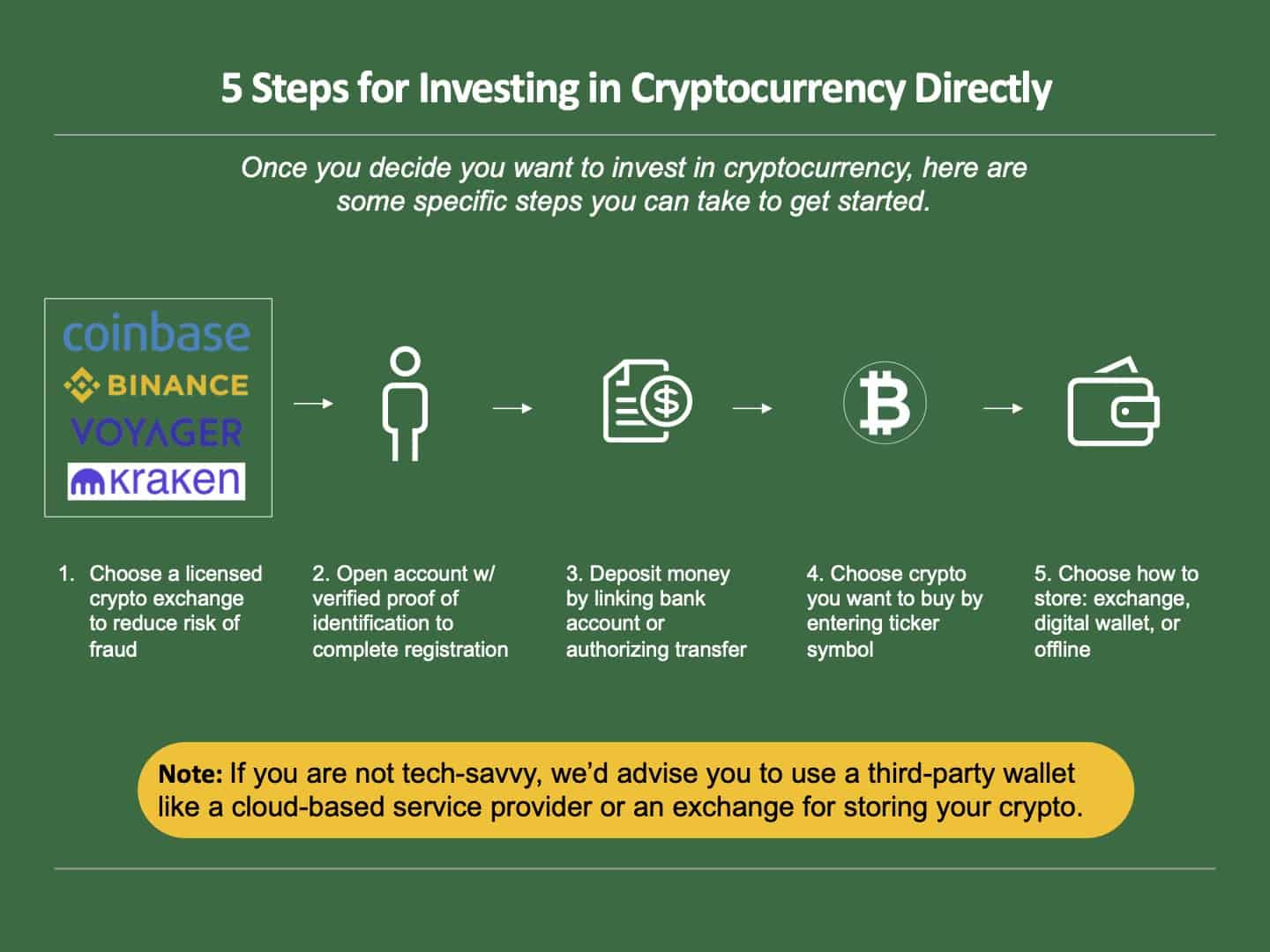

If, after some reflection about your risk tolerance, it feels like you want exposure to cryptocurrency, here are some specific steps you can take to get started.

The below assumes you want to buy some cryptocurrency directly. If you want to start with an ETF fund (which is the easiest entry point), you can buy that via your traditional investment brokerage and have it sit in your brokerage account.

Step 1: When choosing which cryptocurrency exchange to buy through, try to use a licensed crypto exchange like Binance, Coinbase, Voyager, Kraken, etc., that is regulated (ideally where you live), as this reduces the risk of fraud. These companies usually offer financial apps for conducting transactions and monitoring your crypto portfolio.

Step 2: Open an account with the cryptocurrency exchange with verified proof of identification to complete the registration process.

Step 3: Deposit traditional money (or fiat money) into your crypto account by linking your bank account or authorizing a transfer.

Step 4: Choose the cryptocurrency you wish to buy by entering its ticker symbol. For example, if you want to purchase Bitcoin, the symbol is BTC. Specify how many coins you’d like to purchase or the amount of money you want to invest.

Step 5: Once you have cryptocurrency, you need to decide how you want to store it. At a high level, your options are: keep it in the exchange you purchased it from (e.g., Coinbase), move it to a digital wallet provider like MetaMask, or hold it “offline” in a cold storage option like Trezor. If you are not tech-savvy, I’d advise you to use a third-party wallet like a cloud-based service provider or the crypto exchange through which you’re trading and investing.

There are tradeoffs to each storage option, more on this in the next section.

How to Store Your Cryptocurrency

Crypto wallets contain your private and public keys, which are the passwords required to send and receive crypto. If you disclose your private key to someone, it’s like giving them direct access to your cryptocurrency.

Hot Wallets

In crypto jargon, a wallet can be “hot” or “cold.” A crypto exchange or a cloud-based hot wallet service will usually furnish you with a hot wallet. You access your wallet through an app or a website, so hot wallets are also called “software wallets.” While these wallets are easy to access and convenient, there are risks involved, particularly “hacking,” since your devices are connected to the internet.

One advantage of using an established exchange like Coinbase is that it offers a digital wallet on its servers for your cryptocurrency holdings which is protected by its insurance policy.

Cold Wallets

A “cold” wallet is a USB flash drive device designed to hold your keys digitally. These have some basic options and software installed and can be connected to your computer to initiate transactions. These are also called “hardware wallets.” While they give you complete control of your keys, the loss of the device and the keys means that your funds are lost forever.

Hot vs. Cold Wallets

Transactions with hot wallets are executed quickly compared to those with cold ones. A cold wallet is a hardware device on which you download your cryptocurrency to take it “offline.” While cold wallets are considered to be more secure, until recently, they could accommodate only a limited number of crypto.

Depending on your requirements, you can decide whether you want a cold wallet or a hot one. If you value privacy and security above all else, then a cold wallet like Trezoe is likely best for you. The advantage of a hot wallet is that it is fast, online, easily accessible and doesn’t require additional steps of moving your crypto to a USB drive.

How Safe is it to Invest in Cryptocurrencies?

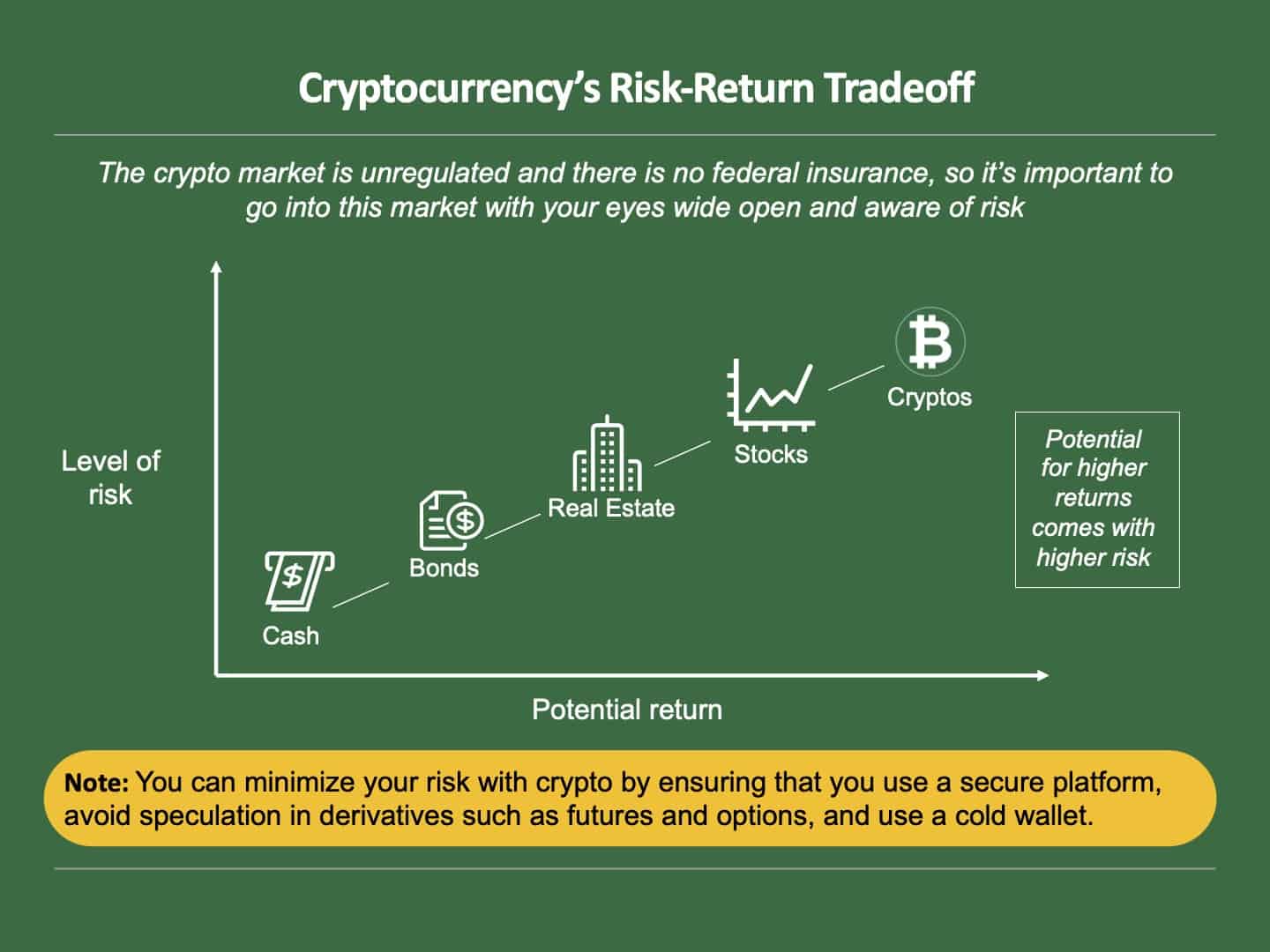

Some people hesitate to invest in cryptocurrency because of security, volatility and other concerns. The crypto market is unregulated, and there is no federal insurance, so it’s important to go into this market with your eyes wide open.

You can only minimize your risk by ensuring that you use a secure platform, avoid speculation in derivatives (such as crypto futures and options), and use a cold wallet – a hardware device on your computer on which you download your crypto. When buying cryptocurrency on a large exchange like Coinbase, for example, the company holds your wallet with them and has your private keys. While it makes your life easier, remember that it is susceptible to hacking.

Keep in mind that stock market volatility is usually less than crypto volatility. Unlike the traditional financial markets, crypto values can rise and fall by 30% or more in a day. Its value is based on its supply and demand, and the macroeconomic trends, investor sentiments, news stories, and other factors similar to the price fluctuation of equities, commodities, gold, currencies, and other assets.

For example, one tweet from Elon Musk on May 12, 2021, said that Tesla was going to stop accepting Bitcoin due to the impact of energy usage on the environment; as a result, the value of Bitcoin dropped by 15 percent.

No investment is “safe” and cryptocurrency is considered an asset on the riskier end of the spectrum (higher risk with potential for higher reward). That said, as long as you limit your exposure, have a solid financial foundation, and take time to learn about the process, there is a strong case to be made for having a small allocation to this new, exciting, and emerging asset class and technology.

Let’s Recap:

- A cryptocurrency is a form of digital currency that can be bought or sold in fractions, at values of up to 8 decimal points, by exchanging U.S. dollars or other cryptocurrencies through platforms called cryptocurrency exchanges.

- Cryptocurrencies are created by private enterprises by generating “coins” using software technology. They use distributed ledger technology (DLT), which is called a blockchain.

- There are lots of ways to invest in or get exposure to cryptocurrency. Two of the most common are to buy the most popular ones like Bitcoin and Ethereum on an exchange, or to buy some of an ETF fund that holds a variety of cryptocurrency and companies investing in blockchain technology.

- If you buy crypto directly, you need to make a choice about how you store it, either in your exchange, a digital wallet or offline in a “cold” storage option.

- Ensure you have a solid financial foundation and start small if you feel investing in cryptocurrency is something that fits with your overall goals and situation.

As always, I’m happy to answer any questions you have. Comment below and I’ll be sure to get back to you.

Here’s to your crypto investing!

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.