Do you have debt? Do you also want to invest? Figuring out how to use any additional money after your monthly expenses can be complex.

This article will serve as a guide so you can figure out whether you should be prioritizing debt paydown, investing, or a little bit of both.

To start, let’s do a quick refresher:

- Debt is an obligation that a borrower has to a lender. Common examples are credit card debt, auto loans, or student loans.

- Investing is the process of using money to earn additional money. Common examples include investing in stocks, bonds, or real estate.

The goal is to get to a place where you can invest additional money on a regular basis, and only have a limited amount of low-interest debt or even eliminate debt altogether. But that isn’t where most of us start off. My journey started with student loans, and too much money on a credit card balance.

Not being able to pay down your debt can be a very scary thing. Having too much debt can also make your life a lot more difficult, impacting your credit score and ability to make ends meet.

You’ve come to the right place if you find yourself asking questions like “Should I focus on paying off my debt or investing first?” or “I have debt, how does this impact my ability to invest?”

This guide will help you determine what to focus on first, and how to think about the tradeoffs of paying down debt vs investing.

Different Types of Debt and How to Evaluate Them

The most common types of debt come in two forms: loans (e.g., student loans) and revolving credit (e.g., credit cards).

When you receive a loan from a lender, usually a bank, you pay back a smaller amount each month that includes principal and interest. Principal is a portion of the original amount borrowed, while interest is a percentage of the principal the lender charges for taking on the risk of the loan in case you become unable to make payments, or default.

Revolving credit works a little differently than loans do. With revolving credit, you are allowed to take up to a certain amount of debt, known as a credit limit. Once you pay that debt back with interest, you can borrow up to that amount again…hence the term ‘revolving.’

Okay, we’ve covered different forms of debt, what else should you know?

The reality is that debt is a tool – it can be very beneficial, or it can hurt you if you don’t know how to use it. You may have heard the phrase ‘good debt vs. bad debt’. This distinction refers to how you are using debt, and the terms of the loan.

Examples of ‘bad’ debt are high-interest credit card debt and some automotive loans. These types of debt require you to pay higher interest rates and usually involve the purchase of discretionary goods that lose value over time.

Examples of ‘good’ debt are mortgages and student loans. In these cases, taking on debt will allow you to build equity in an appreciating asset (real estate) or develop tangible skills that you can use to increase your income in the job market.

So, what should you take away from this?

Debt, if managed properly, can be a net positive, but you have to be very careful about the types of debt you use.

Now that we’ve covered some basics, the rest of this article will teach how to properly manage your debt so you can invest as well.

Understand Where You’re Starting From

Before we scrutinize debt management and investing practices, let’s talk about some personal financial essentials first.

At Stepwise, we recommend that you save and invest 10-20% of your paycheck.

To begin, these funds should first go toward building an emergency fund in an online high-yield savings account that covers 6 months of your expenses. If you don’t have 6 months of your expenses saved up yet or don’t even have a fund set up at all, that’s okay. This should be your first priority.

If an emergency expense does come up, you don’t want to have to take on debt or incur tax penalties for taking money out of your retirement accounts to cover it.

We don’t recommend allocating any money into investment accounts unless you’ve fully built this emergency fund, with one exception.

In the scenario that you have a 401(k) match option at your job, it likely makes sense to take advantage of this even if you have some debt or don’t have an emergency fund set up. This is literally free money. If you want to learn more about how to build a good financial foundation, click here.

Another thing to think about is your credit utilization rate. This rate is the amount of revolving credit you are using expressed as a percentage of the credit available to you. Keeping this number below 30% is usually good practice – it shows that you can make timely payments and take on appropriate amounts of debt.

Here are three “no brainer” actions to start with:

- Build an emergency fund that covers 6 months of your expenses

- Max out any employer contributions available to you as part of a 401(k) matching plan

- Pay off your high-interest credit card debt or keep your credit utilization rate below 30%

How to Decide If You Should Pay Down Debt or Invest

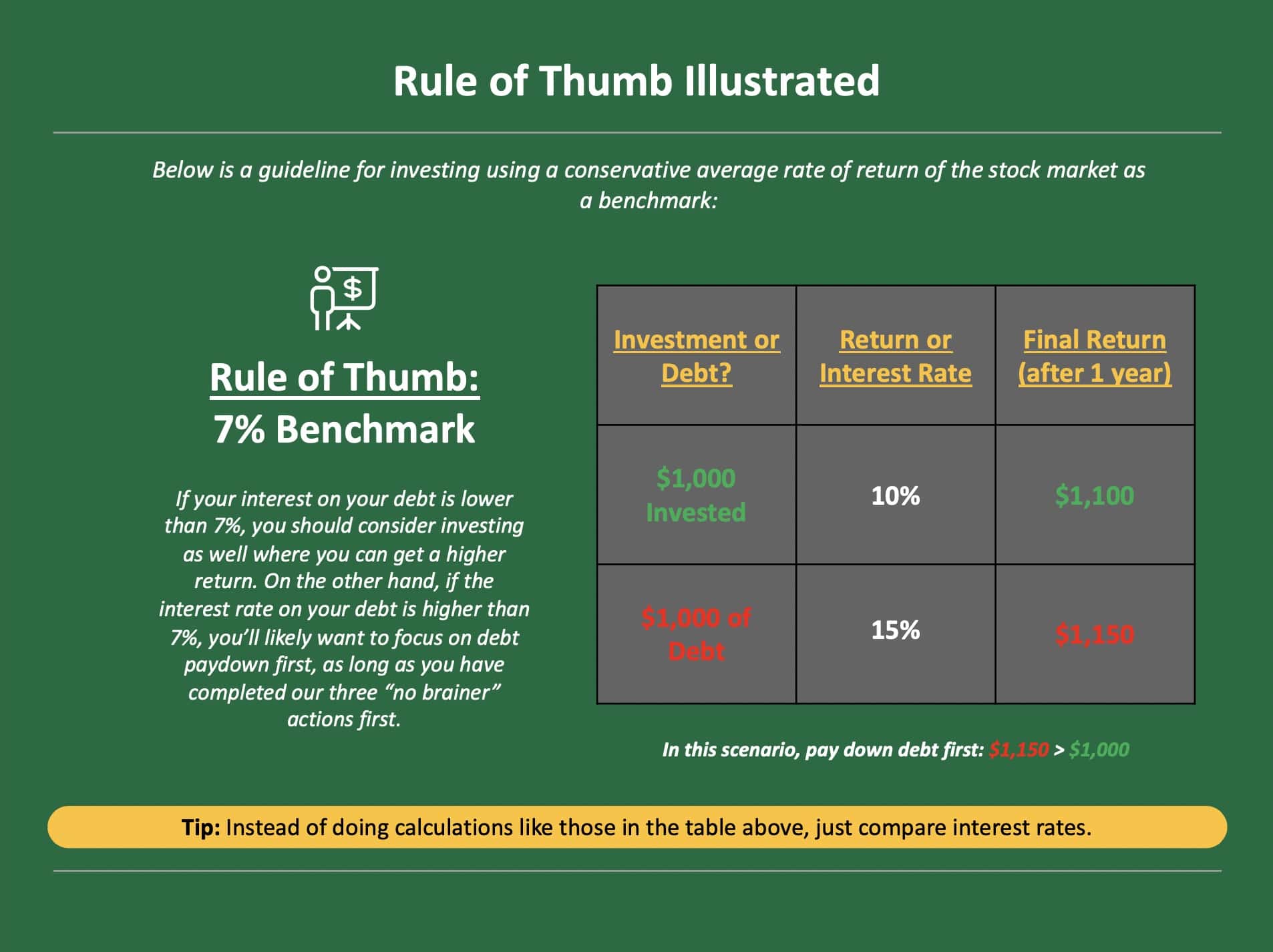

If you are considering the tradeoffs between paying down different sources of debt vs investment opportunities, many people compare the interest rate on the debt to the expected return on an investment.

As a benchmark, the historical return of the stock market (S&P 500 Index) is between 7-10% over the last century.

Most people take the conservative average of 7%. Therefore, if you have debt with an interest rate higher than 7%, it makes sense to pay off debt first.

If you have very low interest debt (e.g., some student loans or mortgages) it can make sense to invest first.

If you have any high-interest credit card debt, it is a no brainer to pay this off first. Interest rates for credit card debt average around 15% and often are up to 30%.

Think about it this way: if you pay down debt that is charging you 15% interest on your balance, you are effectively saving 15%. It is very difficult to find a 15% return consistently with any investment, so take the sure bet and get rid of your high-interest debt.

Additionally, there are many reasons to focus on paying down debt, both emotional/mental and financial/practical. Once you do pay off a debt completely, it helps increase your credit score since you are proving to financial institutions that you can manage your money properly. Higher credit scores usually correlate with better terms on loans.

While there can be many other nuances to your personal situation, the above is a simple guideline you can use to help decide which course of action makes the most sense for you.

Nuanced Debt Paydown and Investment Options

Okay, let’s say you have built an emergency fund, are taking advantage of the 401(k) matching plan available to you, and have either eliminated your credit card debt or are actively keeping your credit utilization rate below 30%. What now?

This is where things get more personal, and can feel a little like a toss up. If you have ‘good’ debt, like a mortgage or student loans, that have interest rates lower than what the average stock market return is, you can consider investing if you are comfortable with a bit more risk.

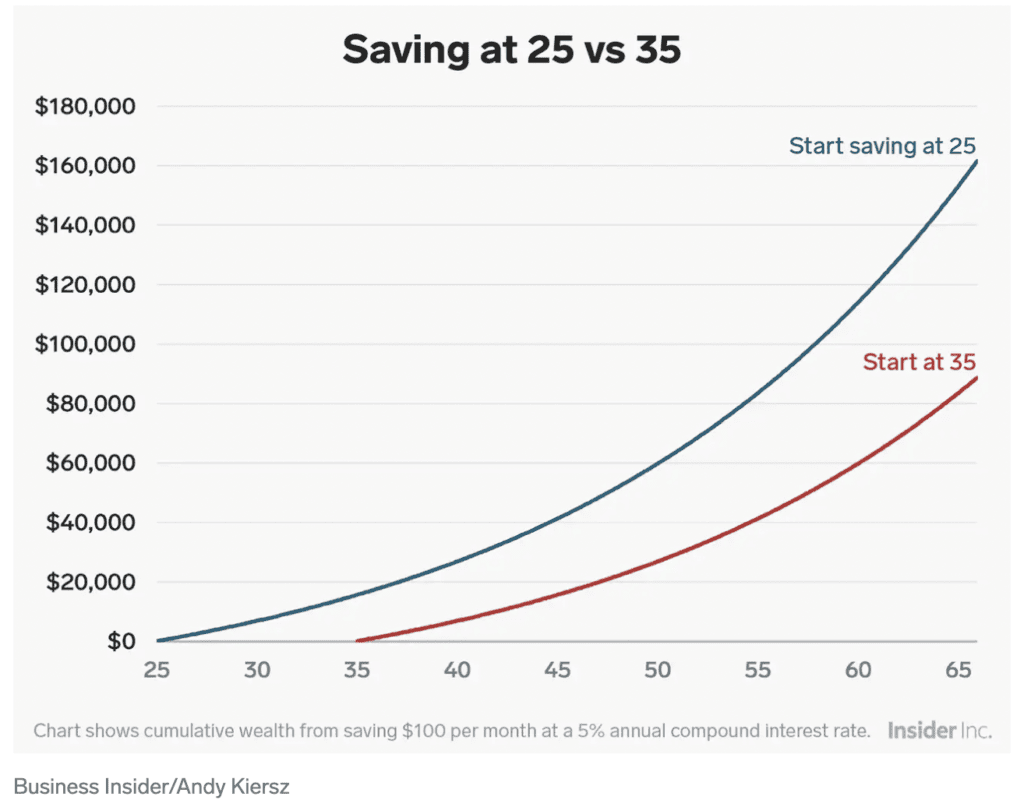

The main argument for starting your investing journey as soon as possible is to take advantage of compounding returns. Here is an example of how valuable it is to start investing earlier:

According to a report from the Milken Institute, Americans should start saving no later than 25 years old if they want to retire as a millionaire. The report forecasts that investing $100 a week starting by the age of 25 results in around $1.1 million 40 years later. This is the power of compound interest!

Additionally, for tax advantaged accounts like a Roth IRA, you have a limited amount you can contribute each year. If you don’t contribute in that year, you cannot go back and do so later on.

So, in this case, you may want to put some money into investments and pay down your low-interest debt more slowly, especially if that debt has an interest rate below 7%. If the interest rate on your debt is between 7-10%, you may or may not come out ahead since no one can predict how the stock market will do in the future.

Note: There are some scenarios where you may have ‘good’ debt and choose to pay it down as slowly as possible. For example, if you bought an investment property where the monthly rents from tenants cover your mortgage interest payments and all expenses. In this case, debt payoff wouldn’t be a good use of your money: you used debt as a tool to buy an income producing asset and have no reason to pay it down and tie up more cash, since your tenants will pay off the loan for you over time. |

Optimize For Your Future and Personal Preferences

The guidelines and examples we shared above are good general rules to follow, but we understand everyone has different goals and starts from a different place.

For example, if you have high-interest credit card debt, but want to take out a mortgage soon to buy a home, you should definitely focus on improving your credit score first by paying down your debt quickly.

On the other hand, if you are getting constant returns above 10% from a rental property or index fund, doing something like paying off your lower interest student loans early might not be the best move.

It is important to note that stock market investments do not actually appreciate 7-10% every single year in a linear fashion. Some years it is up 40% and some years it can be down 20% – the rate of return averages out to be 7-10%. If you can mentally handle this type of volatility, then the strategy we outlined – making consistent investments while you have outstanding debt and keeping them in the market for a long time – is a good strategy.

However, if you do not have the risk tolerance for this type of fluctuation and think making timely, fixed payments will make you feel more financially and mentally secure, then paying off your debt should be where you start.

Ultimately, how you balance paying down debt and investing is a personal choice. You should take some time to reflect on what feels good to you, and what your goals are for the next few years. If you’re looking for some help setting clear financial goals that can help you make a decision, check out this article.

3 Scenarios To Illustrate The Best Course of Action For You

The following hypothetical scenarios and personas are designed to give you some tangible examples of the three most common approaches and paths people take when they have both debt and a desire to invest.

Debt Paydown First

Jessie works part time at a large restaurant chain. Because she has been at the company for less than a year, her employer will not match any 401(k) contributions she makes. She wants to buy a house in the next year, but has $7,000 of credit card debt she racked up with a 16% interest rate. Jessie should not invest any of her income right now – she should pay off her high-interest credit card debt and focus on improving her credit score. Any returns she could make in the stock market would not cover the costs of her outstanding credit card debt and having the balance will impact her ability to get a good rate on a mortgage in the future.

Debt Paydown with Limited Investing

Ben has been working at a marketing firm for 7 years. His employer will match any 401(k) contributions he makes, up to a total 10% of his overall salary. He has a full emergency fund and just took out a car loan with very favorable terms so he can commute to work, but does have $2,000 of credit card debt with a 15% interest rate. Unlike Jessie, Ben should invest right now – he should take advantage of his employer’s 401(k) matching while he pays down his credit card debt. Once his credit card debt is paid off, he could also start putting a little of his income into other retirement accounts, like a traditional or Roth IRA.

Debt Paydown with More Investing

Sally has been working as a nurse for 12 years. She is taking advantage of her employer’s 401(k) matching program and has no credit card debt. Her husband has built an emergency fund for both of them. Sally’s largest expense is her student loans which have an interest rate of 5.7%. Each month, she has $500 left over after paying standard expenses. She decides to split this money 70/30 between investing and paying down her student loan debt. She is comfortable with this because she has a secure financial foundation with her husband, is taking advantage of employer 401k match, and the average returns on the stock market are higher than the interest on her student loans.

Exception: No Debt Paydown, All Investing

Tom has an emergency fund, no high-interest debts, and a mortgage on a rental property. He is in a unique scenario where paying off debt should be done as slowly as possible, i.e. only paying the absolute minimum debt payments each month. This is because his mortgage has an interest rate of only 4%, and the rental income from the property leaves him with an extra $200 each month after all expenses. It makes more sense for him to invest that extra cash into other assets than to use it to pay down the mortgage faster, since he can easily get a better return than 4% in other places.

Bottom Line

In an ideal world, no one would ever have to take on debt to accomplish goals or make important purchases, but that is not feasible based on the incomes and expenses most of us have.

Overall, as long as it’s managed properly, debt can be a pathway to a better financial future and doesn’t have to be a barrier to investing, which is one of the most important ways to build wealth.

Tailor the process below to your preferences and situation as needed, but try to stick to it as a general guideline.

Once you have:

- Built an emergency fund that covers 6 months of your expenses

- Maxed out any employer contributions available to you as part of a 401(k) matching plan

- Paid off your high-interest credit card debt or kept your credit utilization rate below 30% for a long period of time

Then you can:

4. Simultaneously pay down your lower interest debt by making your monthly debt payments, while contributing a portion of your paycheck to other investments

Over time, you will hopefully get to a point where you are free from debt and have significant savings that are appreciating in the form of investments.

Following this strategy will give you peace of mind so you can focus on the things that really matter to you in life.

Looking for more information on investing, how to invest, and investment options? Don’t pay a financial advisor exorbitant fees for advice! Check out this 3 part series here.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.