|

Disclaimer: There is A LOT of information in the article below. We highly recommend reading our foundational article, “6-Step Guide: How To Save, Invest, And Build Wealth” BEFORE you read this article. All of the elements outlined below will make a lot more sense afterwards 😀. |

At Stepwise, the question I get asked a lot is: what tools and accounts do YOU personally use?

It’s a good question, because it’s one thing to read tips and information on personal finance, and it’s another to see how it’s actually implemented in a real person’s life.

So, as part of a two-part series, I’m going to break down my own personal finance practices.

In this first post, I’ll share the exact accounts, tools, and credit cards I used to go from $30K in debt at 22 to $100K saved and invested by 27.

The second article will look at my personal asset allocation and investment strategy.

My hope is that both articles will provide valuable insight and show how having the right tools, accounts and strategy can (and have been!) used to build wealth.

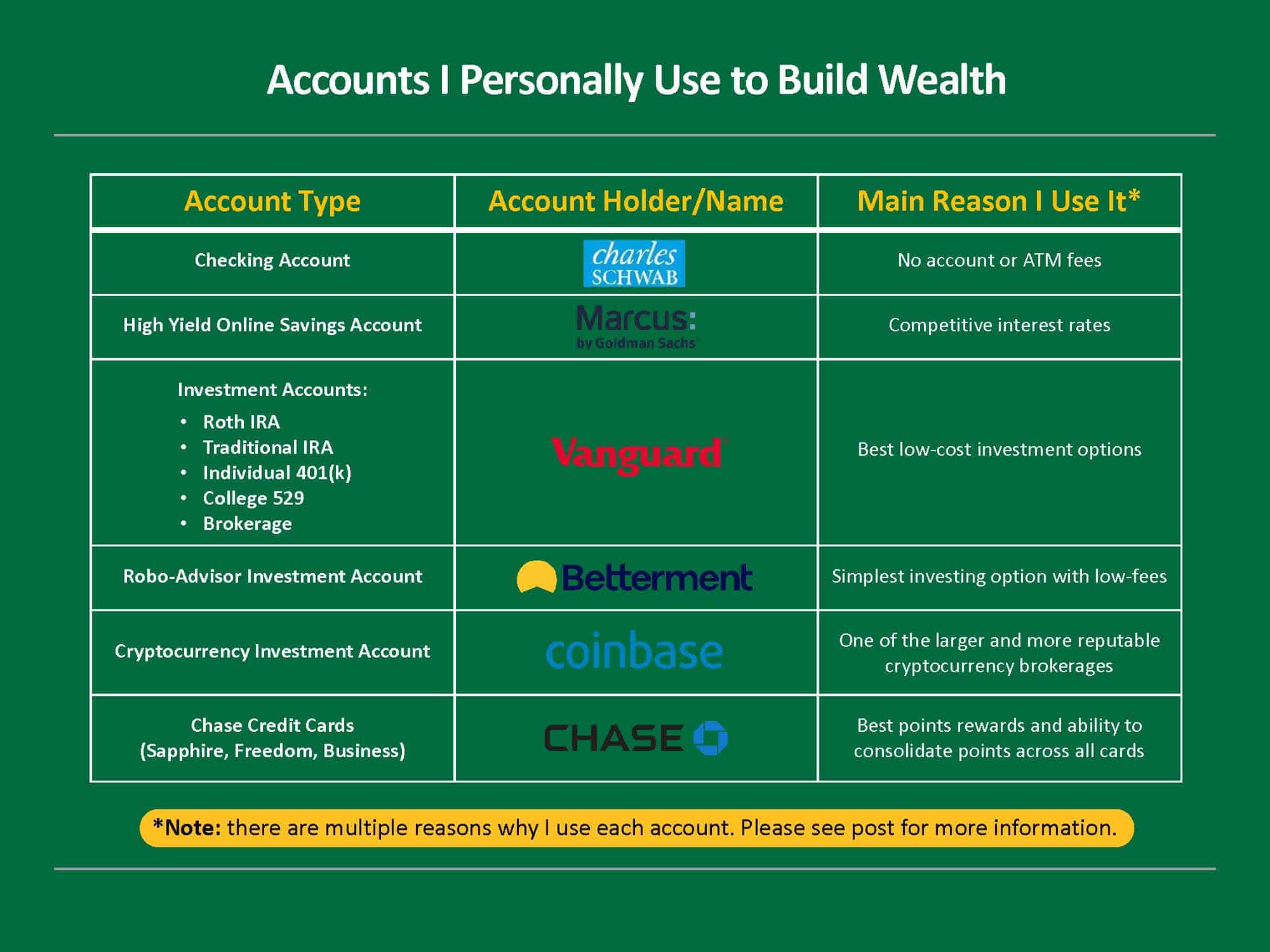

First, let’s look at my accounts and tools.

| Note: these are the accounts that I personally use. If you want to see the best options for each account type, read this article. |

Table of Contents: Jump Straight To

Checking & Savings Accounts

Checking Account: Charles Schwab Checking

Charles Schwab is my checking account of choice because, unlike other bank accounts, they offer a no-fee option that includes ATM fee reimbursement anywhere in the world. Their mobile app and online platform are very intuitive and they have great free and money management features like Zelle, automated bill pay, ACH & wire transfers. The account also comes with a debit card and personalized checks.

Why I use it:

- No monthly fee or minimum balance requirement

- No ATM fees worldwide

- Free services for bill payments

- Simple core bank account for my regular finance needs

- Easy access/highly liquid

How I use it:

- Receive and transfer money (includes spending money and direct deposit)

- Withdraw cash

- Set up bill pay

High Yield Online Savings Account: Marcus by Goldman Sachs

![]()

I chose to use Marcus by Goldman Sachs because they have a very easy to use and modern interface, mobile application, and industry leading interest rates for your online savings account. It’s a simple account that is a great place to store your emergency savings, short term savings, or other cash reserves.

Most high-yield savings accounts are solely online, earn more interest than other accounts do, and are usually the most attractive option for your emergency fund.

Why I use it:

- Competitive interest rate

- Online and phone app access

- Same day transfers up to $100k

- Straightforward user interface

How I use it:

- Earn a higher return on short to medium term savings, or any cash reserves

- Save cash for taxes

- Save cash for emergency fund

For more detailed information on checking and high yield online savings accounts, please see this article: “Personal Finance Starter Kit: 5 Most Important Accounts for Saving and Investing”

Investing Accounts

Investment Accounts: Vanguard and Betterment

I use both Vanguard and Betterment for my investment accounts. More details on each below.

Traditional Investment Accounts: Vanguard

![]()

Vanguard is the institution that created and became known for the best low-cost index investing and options. It has a long standing positive reputation as a firm, focused on providing index funds and ETF options to investors with very low fees. If you choose to buy these via another brokerage company, they will likely charge you additional fees (between $10-$50) per transaction.

Below are all the types of financial accounts that I have with Vanguard. While all of them can be opened at other financial institutions, I personally use Vanguard because I trust them, they have some of the best low-cost investment options, and they avoid additional fees. You don’t need financial advisors to open these accounts either; it can be very simple to get started right away as part of your wealth building journey.

Vanguard Roth IRA Account

Why I use it:

- A Roth IRA enables your investments to grow tax-free forever

- You won’t ever be taxed on the gains when you take the money out in retirement (the tax burden was incurred up front, so this is probably a better option if you think you will have a high salary later in life)

- You can also take out the money you contributed (not the gains) at any time without penalty

Vanguard Traditional IRA Account

Why I use it:

- A Traditional IRA enables you to deduct the amount you contribute from your taxable income in that year, thus lowering your annual taxes

- It allows investments to grow tax free (like a Roth IRA)

- In general, it has no income limit so it is a good option if you have a higher income

Vanguard Individual 401 k Account

Why I use it:

- As someone who runs my own small business, and doesn’t have access to an employer sponsored 401k plan, it enables me to still access additional tax-advantaged retirement investments

- There are no income limits for Roth contributions with a 401k

- Individually, you can input $19.5k (in 2021) and if your business makes enough, potentially do an employer match of another $37.5k (in 2021)

Vanguard College 529 Account

Why I use it:

- It’s a tax-advantaged investment account specifically for educational purposes

- Your money grows tax-free and funds used for qualified education expenses are not taxed upon withdrawal

Actionable tip:

- This is the best way to save and build wealth to help fund your own future educational costs or help pay for your kids’ education in the future

Vanguard Brokerage Account

Why I use it:

- It’s a taxable (no special tax advantages) investment account with no monthly income, contribution, or other limitations to invest money and build wealth

- It is the flexible account for general investing, so I know I can access funds or sell as needed in the future

- Good place to make investments if you are considering early retirement since you can access these funds before retirement age

Actionable tip:

- This is the best place to invest and save for medium and long-term pre-retirement needs, like a down payment for a house or wedding expenses because there are no restrictions on these funds

- If you have maxed out all your tax-advantaged options above, this is where you should start investing any additional money that you want to put into stocks, bonds or public REITs

Betterment Robo-advisor Investment Account

![]()

Betterment is a robo-advisor, which is essentially an automated investing service. They use computer algorithms to make investment decisions based on your financial plan and personal goals. They charge a small fee for the simplicity and automation (~.15-.35% annually). I opened a brokerage account with Betterment in 2015 to try the robo-advisor approach first hand.

Why I use it:

- I enjoy it because of its simplicity and hands-off investing approach (i.e. I set my goals and contribute money and don’t have to worry about the rest)

- They do a great job of picking a portfolio of low-cost funds from Vanguard that match my investing timeline and risk tolerance

| Note: Betterment is especially beneficial if you prefer having your IRA, Brokerage, Checking and High-yield Online Savings Accounts all in one location for ease of access and transfers between accounts. |

Coinbase Cryptocurrency Investment Account

![]()

Coinbase is a brokerage account for buying/selling different cryptocurrencies and exchanging cash or other fiat currency for crypto options.

There are two options: Coinbase and Coinbase Pro. Both are great platforms. Coinbase is more user friendly and intuitive, but has slightly higher transaction fees. Coinbase Pro is designed for more advanced or institutional users, but has a more complex interface and lower transaction fees.

Why I use it:

- I opened a Coinbase account because they are one of the larger and more reputable cryptocurrency brokerages

- Although more speculative and volatile, I wanted to diversify my investments and put a small amount of my net worth into cryptocurrency investments

- It has a good mobile app, online platform, and is easy to use by directly linking your bank account

For more detailed information on investment accounts, please see this article: “Personal Finance Starter Kit: 5 Most Important Accounts for Saving and Investing”

Credit Cards

Credit cards are important because they allow you to build credit and earn points or cash back, which can accelerate your wealth building journey. However, you should always pay off your account balance each month. While they are a valuable tool, it’s important to use them wisely or you can end up sabotaging your credit score and paying a lot of money in interest.

Credit scores are very susceptible to being damaged if you default on debt, whether it’s credit card debt with a high interest rate or student loan debt.

Below are the credit cards I personally use.

Main Credit Card: Chase Sapphire Reserve

Why I use it:

- One of the best rewards and points programs for spending on flights, hotels, taxis, and dining (3x per dollar spent)

- Easy to transfer and combine points across my other chase credit cards

How I use it:

- I use this card regularly when I make purchases like flights, hotels, Airbnb, rental cars, meals at restaurants, Uber rides, etc. because you earn 3x points for these categories

- It also offers great free insurance for rental cars, and trip protection

Secondary Credit Card: Chase Freedom Unlimited

Why I use it:

- No annual fee and 1.5% back on all spending points (I can combine these points with my Chase Sapphire Reserve points)

- I opened this as the Chase Sapphire Card, but to reduce annual fees after I used the signup bonus, I converted it to this option after the first year (this is an example of “credit card hacking”)

How I use it:

- I use this card regularly when I make purchases like Amazon, gas, groceries, clothing

- Essentially, I use this for everything that isn’t travel related

My Business Credit Card: Chase Ink Business Unlimited

Why I use it:

- No annual fee card for my business that gets 1.5% back in points on all spending.

- Easy to keep business expenses separate and no need to track spending categories to get the full benefit of rewards

- Can combine these points with my Chase Sapphire Reserve points

How I use it:

- I use this card regularly when I make any business expense purchases to keep things well accounted for

- This makes my life so much easier when it’s time to prepare for taxes

Personal Finance Tools

Now, let’s look at some of the personal finance tools I use, which are important because they enable me to track my entire financial situation. I strongly believe that if you can’t see it and measure it, you can’t improve it.

Net Worth and Investment Tracking: Personal Capital

Personal Capital enables you to see all your accounts and monitor and analyze assets you are invested in across providers. This is the single best free tool that I use, so I highly recommend signing up and linking your accounts.

Why I use It

- Easy to compare your asset allocation to the recommended allocation based on your personal situation, using modern portfolio theory

- Great features like an investment fee analyzer to see if your costs are above average

Actionable Tip

- First, sign up and link all of your accounts to get the most out of the tool.

- Before I invest additional money, I use the “Investment Checkup” feature

- This shows my current allocation and what I should potentially invest in to maintain a balanced and diversified portfolio

Budgeting Tool: Mint

![]()

Mint is a tool for day-to-day money management and budgeting. It enables you to set personalized goals, review your cash flow, track spending and monitor your credit score.

Why I use it:

- This is the most efficient way to understand my spending habits, analyze it by category, and input my actual numbers into the Stepwise templates

- This level of visibility enables me to actually change my behavior

Actionable tip:

- Use the “Trends” tab to analyze and see your historical spending, by month and category (e.g., groceries, travel, entertainment, etc.)

Credit Score Tracking: Credit Karma

![]()

Credit Karma is a free tool that allows you to easily understand your credit score, get detailed information about the factors that impact your score and plan for how to improve it.

Why I use it:

- It is a great educational tool to understand what actions I can take to improve my credit or to monitor changes (like before applying for a credit card or a loan)

Actionable tip:

- Before applying for a loan or new credit card, check your credit score to make sure everything is accurate and you meet the requirements

- If you are intentionally opening 1-2 new credit cards to get the signup bonuses, use them, then convert it to a no-fee option (aka credit card hacking) using this tool to monitor your current credit score is crucial

Savings & Investment Tools I Have Tried (but no longer use)

Investing is a long term practice. And you learn a lot along the way.

Sometimes, you’ll make investments that work and sometimes, you’ll make investments that don’t. Over time, you’ll accumulate more financial information. It’s all part of the learning process!

But knowing what doesn’t work can be just as valuable as knowing what does. To that end, below are several accounts and investments I’ve tried and the reasons I no longer use them.

Robinhood:

- I deleted it because it’s more of a “day trading” app which is against my long-term investment philosophy, as shown by their role in the “meme stock” trading fad

Bank of America Checking Account:

- This was my first ever account, but it had lots of hidden fees, limited functionality, and restricted ATM use

LendingClub:

- I stopped using it because it was time-consuming and the overall returns weren’t very good

Status Money:

- I realized I could get the more relevant personal information by combining Mint & Personal Capital and didn’t want to pay the monthly fees

Fidelity:

- They have more limited options for investors in index funds and ETFs, and charged me a commission to buy the Vanguard Index Fund & ETF options that are best for building a low-cost & diversified investment portfolio

Conclusion

At Stepwise, we understand that setting financial goals and developing a wealth building strategy is important before actually acting upon your financial decisions. We also understand that investing involves risk, so understanding your net worth, creating a monthly budget, and setting up an emergency fund in a high-yield savings account is key if any investments go awry.

However, Stepwise’s philosophy is all about making sound investments by opening the right accounts and using low-risk investment products and instruments for financial security.

Accordingly, I cannot emphasize this enough: utilizing the right tools and accounts is crucial to saving money and building wealth. As helpful as recommendations are, I’ve always found tangible examples of what someone actually does even more helpful. There is a big difference!

So, although not all of the specific account types or credit cards above will be perfect for your personal situation, they hopefully do a good job of showing you how I use each to get the most out of my personal financial system.

Over time, I will likely keep updating and iterating on my approach, but the above is tried and true. It is exactly what I used to go from $30K in debt at 22 to $100K saved and invested by 27.

If you’re interested in looking at other options, check out the “5 Most Important Accounts for Saving and Investing”, which not only lists the types of accounts to have, but provides a couple of recommendations for each account. Additionally, if you are looking for more of a step-by-step process to follow check out our “6-Step Guide: How to Save, Invest and Build Wealth.”

Finally, keep your eyes out for part two of this series, where I’ll discuss the specific investments I have and the strategy behind my choices. Specifically, I’ll outline:

- How I earn my living and make money to invest

- My asset allocation strategy

- Specific investments that have performed well

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.