Part III: The How: Ways to Invest, What to Consider and How to Apply

In Part I and Part II of our Investing 101 guide, we’ve learned why investing is so important and defined key investing concepts. Now we’re going to put our knowledge to use by examining how to invest and what investment questions to ask before beginning.

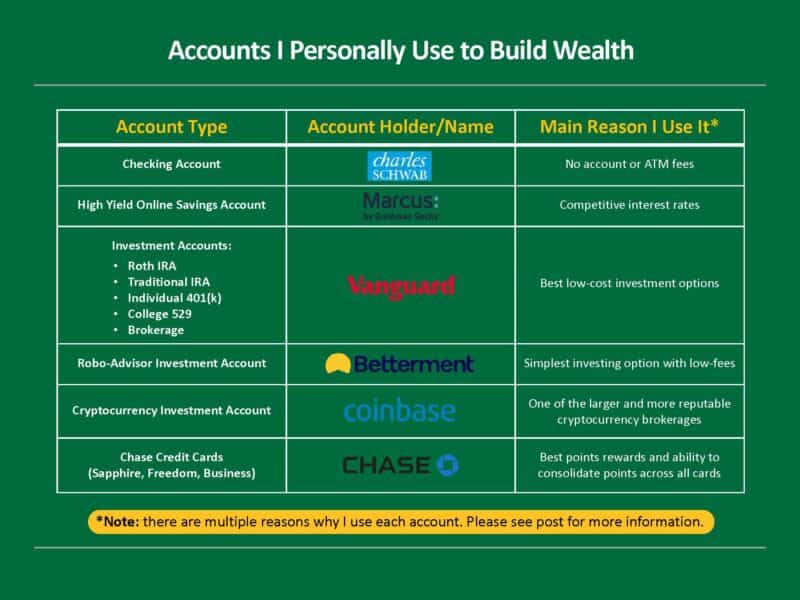

There are thousands of ways to invest, but most people start by investing in the stock market. Investing in stocks, particularly those of public companies, is more accessible than ever before. A lot of people think that you need to consult a financial professional to begin, but you don’t – and we don’t recommend this. Platforms like Vanguard and Betterment allow anyone to get started with stock investing – or buying shares of mutual funds or exchange-traded funds (ETFs).

Mutual funds, particularly those that track the value of the broader market (a.k.a. index funds) are some of the simplest and best stock investments for the long-term. Many investors comprise their retirement savings with these types of investments. They typically have lower management fees than actively managed funds and are less volatile than individual stocks, thus providing more potential financial security. Additionally, they are already well diversified since they represent a group of different companies all in one investment.

There are many other ways to invest beyond index funds that can help you build a diversified portfolio. Other common assets you can invest in include: real estate, cryptocurrency, private businesses, certificates of deposit, royalties, and peer-to-peer lending.

Don’t worry about trying to understand all the different investment options at first. Many people invest successfully only by buying index funds.

Things to Consider Before Investing

There are three factors that you want to consider to ensure you are picking the right investment for your financial situation, personality, or objectives.

- Risk tolerance

Risk tolerance refers to your comfort with changes in the value of your investment assets.

If you know big value swings will give you anxiety and make you want to sell your investments, you probably shouldn’t invest in riskier or more volatile things like cryptocurrency. On the other hand, if you can separate your emotions from your investment decisions, you may be comfortable with a higher level of risk.

Taking more risk can make sense if your primary objective is wealth appreciation and you have a longer time horizon to invest. If you’re investing for the short-term and are primarily focused on wealth preservation, you may want less risk and volatility in your portfolio.

The goal is to pick investments that align well with your personal risk tolerance. Don’t worry about what others may say; it is most important to pick your investments based on the person you are and the goals you have.

- Liquidity

Liquidity refers to the ease with which assets can be bought or sold.

A public stock bought in the stock market or bond would be an example of a very liquid asset. A piece of real estate, which likely takes longer to buy or sell, would be an example of an illiquid asset. Cash is the most liquid asset of all.

If you may need to access the money you’ve invested on short notice in the future, it would not make sense to stack your portfolio with illiquid investments. However, some more illiquid investments, like private equity, can have great returns and help diversify your investments. The trade-off is that your money may be untouchable for up to 10 years.

The goal is to match your investments to the level of liquidity that meets your needs. If your future financial needs are less certain, it is best to be honest about that and stick to more liquid investments so you have enough money available if any unexpected expenses arise.

- Diversification

Diversification is a strategy used to manage risk in your investment portfolio.

When you diversify – i.e., mix and match different investment types – you are aiming to balance risk and return. You can create diversification by splitting your money across companies, industries, and asset classes.

If executed well, diversification allows you to make intelligent bets on assets like cryptocurrency or startups that have greater risk but higher growth potential. If market conditions change and one of these investments loses its value, diversification ensures you still have other investments to support you.

For example, if you only have 5% of your portfolio in Bitcoin and it loses all its value, that would be painful but not terrible, because the other 95% of your investments would retain their value.

Diversification limits your exposure to market downturns, preserving your money better than if you had put ALL your money in Bitcoin.

How to Apply Investment Knowledge

The Importance of Clear Goals

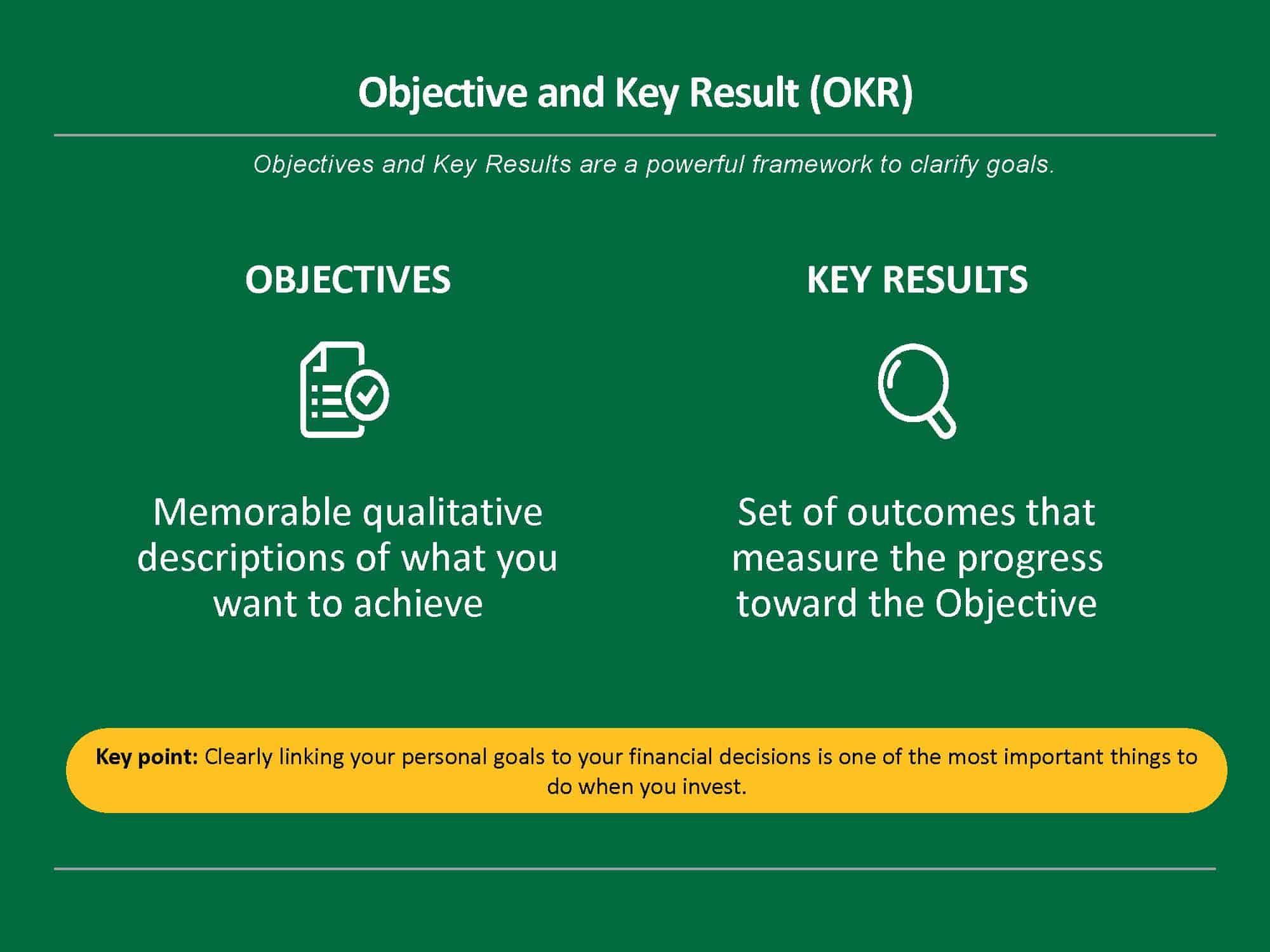

If you don’t know where you want to go or what you want to achieve, how can you possibly get there? This applies to your finances as much as any other area of life. Clearly linking your personal goals to your financial decisions is one of the most important things to do when you invest.

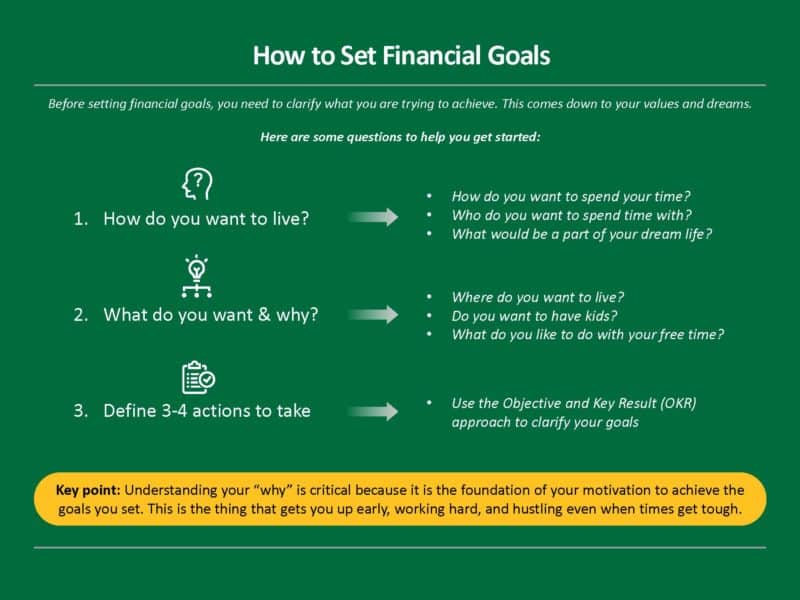

How to set financial goals

My favorite goal-setting structure is the Objective and Key Result (OKR) approach because it acts as a simple and powerful framework to clarify your goals.

Objectives are memorable qualitative descriptions of what you want to achieve.

Key Results are a set of outcomes that measure progress towards the Objective.

Each Objective you have is supported by a few specific key results that clarify how the goal will be achieved.

Here is a Personal Finance OKR Example:

Objective: Create a financial/job situation that enables me to spend lots of time with my kids

- Key result 1: Support our family’s needs (housing, food, healthcare, etc.) while working less than 40 hours a week

- Key result 2: Invest in a diversified mix of income-producing assets/investments with a return above the rate of inflation

- Key Result 3: Achieve financial freedom with an investment portfolio that is 25x larger than our annual expenses

What does this personal OKR tell me practically?

- I need to aim to dramatically increase my net worth by investing in high-growth opportunities.

- Taking more risk for higher potential returns aligns with my goals.

- I should focus on assets that require less direct involvement so I have free time to spend with my family — things like index funds (low effort) and real estate (rental income).

How to translate your goals into asset allocation

Translating your goals into your strategic asset allocation comes down to picking asset classes that align well with your personal situation. A new financial goal may arise with each milestone in your life, so your asset allocation may change over time.

Factors to consider when picking assets:

- Investment horizon: when do you expect to need the money?

- Stability of your current income: do you have other income?

- Need for liquidity: do you need to be able to access your money quickly?

- Alternative options: if something changes in your financial life, could you meet your financial needs in other ways?

Here is how these factors might lead to different allocations.

Note: for the purposes of this example, we are only considering 5 different asset types: stocks, bonds, cash, real estate, and cryptocurrency.

Investor Goals & Situation | Aggressive wealth building | Conservative wealth building | Mix of wealth building and preservation | Wealth preservation |

Investment horizon |

|

| Medium term (10-20 yrs); getting closer to wealth goals | Either short term (<10 yrs) and/or already met wealth goals |

Income Stability | Relatively stable income (e.g., early career) | Relatively stable income (e.g.,mid- career) | Stable income | Less income (e.g., retired or very close to retirement) |

Liquidity Need | Limited liquidity needs | Limited liquidity needs | Some liquidity needs | Liquidity |

Alternative Options | Family and/or spouse as fallback | No family or spouse as fallback | Family and/or spouse as fallback | No family or spouse as fallback |

Potential Allocation | 70%Equities 5% Bonds 10% Real Estate 15% Crypto 0% Cash | 60% Equities 15% Bonds 15% Real Estate 10% Crypto 5% Cash | 50% Equities 25% Bonds 10% Real Estate 5% Crypto 10% Cash | 35% Equities 30% Bonds 20% Real Estate 0% Crypto 15% Cash |

There are many different permutations possible; the goal of the above illustration is to highlight how different personal goals could translate to asset allocations.

For Reflection: Which of the above examples feels closest to your own goals and personality?

General Guidelines for Asset Allocation:

The longer your time horizon, the greater your allocation to higher risk/higher return assets can be:

- E.g., a higher percentage of equities, likely some crypto or other higher growth/higher risk assets

The closer you get to reaching your own personal finance goals (the amount you need to retire, etc.), the more conservative you should be:

- E.g., a higher percentage of bonds, real estate, and cash

The more conservative you are and the lower your risk tolerance, the higher your holdings of bonds and cash should be.

The more risk-tolerant and aggressive you are about building wealth, the higher your holdings of equities and cryptocurrency should be.

Smart investors who have opened a retirement account, settled on a rough retirement age, and developed long-term goals to get there will be able to more appropriately allocate their assets as they approach their target date of retirement than those who have not.

Overall, as you save for retirement or save money for another purpose, having already gone through the OKR process to determine your preferred asset allocation is very important.

Tip: We highly recommend using Personal Capital’s free investment tracking service to review and monitor your asset allocation. Personal Capital’s insights enable you to make strategic adjustments as you invest more money over time.

Stepwise Guiding Principles

Here are four of our favorite investing principles:

- There is no such thing as free lunch (free money): Understand the risks and beware of offers that appear too good to be true.

- Nothing ventured, nothing gained: There is a direct relationship between investment risk and expected return.

- Don’t put all your eggs in one basket: Diversification is the best way to reduce investment risk.

- Invest in what you know: Your best option is to invest in things you have experience with or have spent time learning about.

Where do I start?

We recommend you apply these principles by starting your investing journey with a very simple mix of three assets: cash, equities (stocks), and bonds.

Until you have a basic portfolio in place with a balanced mix of cash, equities, and bonds, you don’t need to worry about real estate, crypto, or other assets. We didn’t do anything beyond a basic 90/10 equity-to-bond asset allocation for the first decade of our investing journey.

Many people stick with equities and bonds for the duration of their investing journey. While asset diversification is valuable, you can start with a portfolio of only stocks and bonds. You can, and arguably should, keep things very simple if you want to build wealth consistently. Over time, as your net worth and investments grow, you can slowly expand your allocations to other assets.

If making any of the above choices still feels a bit daunting, the easiest way to align your asset allocation to your goals is investing with a robo-advisor service like Betterment or Vanguard Digital Advisors. With a robo-advisor, all you have to do is input your time horizon and risk profile to generate a suggested asset allocation that aligns with your goals. You can expect to pay a slightly higher expense ratio (~0.25%-0.4%) for the convenience of a robo-advisor.

If you are excited about being more involved in your investment choices, you may want to build your own investment portfolio. A great way to start is to pick a few index funds.

Time Saving Tip: Personal Capital makes it very simple to review your asset allocation, understand how much you’re paying in fees, and add other investment types over time. Whether you use a robo-advisor service or do things yourself, this tool is the best way to track how you are doing.

Recommended Action:

Create a version (either on paper or mentally) of your investor profile as a “North Star” to guide your investment decisions and/or account setup.

These questions will either help you set up a robo-advisor account or guide your own investment choices:

- How long do you have to invest?

- Do you need liquidity (a.k.a. an ability to access your money on short notice?)

- Is your primary goal to build/increase wealth or to preserve/maintain it?

- Are you comfortable taking higher risks to get bigger rewards?

- How stable is your primary income (and thus how much risk can you take with your investments)?

- Do you have any fallback supports available if needed?

This guide can be used to evaluate your asset allocation and specific investment opportunities so that the next time “Dogecoin is going to the moon”, you can remember why it is (or likely isn’t) something you should worry about.

It’s vital to set up a good investment process and nail the basics. A little time understanding the key concepts of investing 101 can go a long way, potentially adding up to millions of dollars over your investing lifetime.

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.