Note: This is part II in a two-part series that breaks down my own personal finance practices. If you haven’t done so already, I highly recommend reading part I first, entitled “Accounts and Tools I Use to Build Wealth.”

As mentioned in the first part of this series, it can be hugely beneficial to look at tangible examples of what someone actually does to save money, invest, and build wealth. Since I’ve already covered the specific accounts and tools I use to save and build wealth, this article will focus on my investment strategy.

Specifically, I will cover:

- My Investing Principles

- What I Invest In: Stocks, Bonds, Real Estate, Cryptocurrency

- How I Earn My Living (so that I can invest)

My Investing Principles

There are many choices to make when you start investing. It’s easy to get overwhelmed by the number of investment options available.

For example, should I invest in crypto? Should I start trading options on Robinhood?

Questions like these are no longer daunting to me because I’ve sat down to understand what works best for me.

When I invest, I follow these guiding principles:

Principle 1: Pick low-cost investments

You can’t control how your investments will perform, but you can control which accounts you open, the commission fees you pay to buy investments, and the expense ratios on your investment choices.

I intentionally choose low-cost options whenever possible, even if it means having to juggle more accounts or take a more hands-on approach to managing my assets.

Picking low-cost investments is a straightforward way to build wealth faster since higher fees significantly reduce your returns in the long run.

Actionable tips:

- Open accounts with companies like Vanguard that give you access to the best low-cost index funds (essentially a passively managed mutual fund) and stock funds like ETFs (exchange-traded funds) without charging any account fees or trading commissions on their investment products.

- Instead of investing in individual stocks within these accounts, invest in ETFs and index funds that have expense ratios (ERs) that are at most 0.3% per year or lower, ideally less than 0.1%, are great options.

Note: If you would like to learn more about the impact of your investment costs (expense ratios), see this article. |

Principle 2: Don’t put all your eggs in one basket (aka diversify your investments)

Having a good diversity of investments means you are less likely to lose a lot of money if something unexpected happens to one part of the world, industry, or company. For example, if you invest in stocks and have no money out of the stock market, you will have lost a lot of money if there is a recession.

This is one of the golden rules for long-term investment (it’s definitely not something I’ve come up with on my own). There are many good articles on diversification.

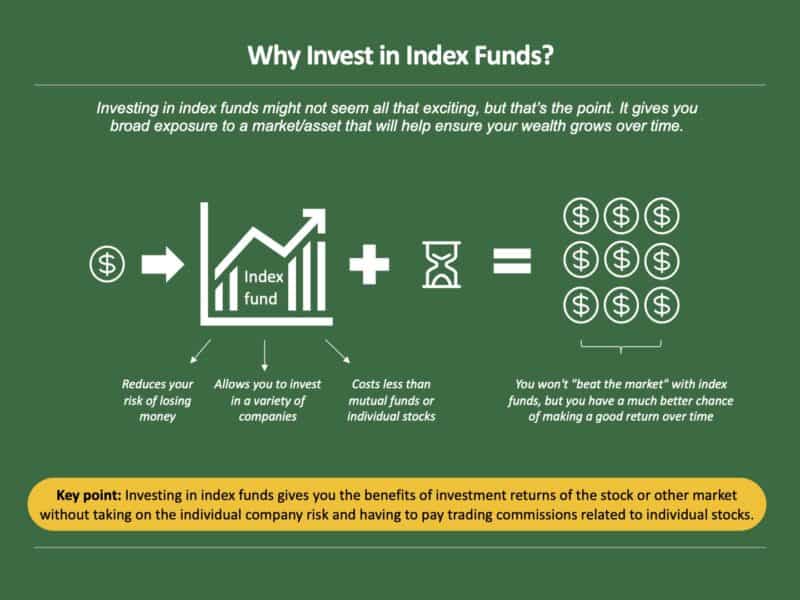

By nature, index funds and index ETFs have diversity built in, which is another reason they’re great options compared to individual stocks and other instruments. Plus, you don’t have to trade individual stocks, as index funds track a benchmark.

Actionable tip:

- Make sure your investing portfolio has a mix of assets that are not all correlated (i.e. they don’t all tend to perform the same in different market conditions). This could look like a mix of individual stocks, fixed income securities like bonds, real estate, cryptocurrency, precious metals, and other assets.

Principle 3: Keep it simple for 90% of your investments

What works well isn’t sexy, but it works darn well. My recommendation is to keep it simple with a few index funds or ETFs for the majority of your investments. With this, you can avoid wasting time conducting extensive research and doing due diligence. Determining the best new investment vehicle or which value stocks are primed for growth right now might be futile. Although day trading on Robinhood, investing in cryptocurrency, buying a cool NFT, etc., are all tempting (and often exciting) ways to invest money, none of these are proven paths to build wealth.

It’s okay to make a few highly risky and speculative bets with less than 10% of your money if you really want, but that is it. Anything more is financially reckless in my opinion no matter how much risk you think you can take on.

Another way to keep it simple is to make sure you’re doing the “no-brainer” investments first. This means (after building an emergency fund in a high-yield savings account) taking advantage of your employer’s 401k matching program (free money!) and maxing out your individual retirement account (IRA) account each year (because of the tax advantages) before considering other investments.

Actionable tips:

- Do the “no-brainers” first – every year:

- Collecting the 401k employer match

- Hitting the annual contribution limit for your IRA

- Across your full investment portfolio, prioritize low-cost index funds or ETFs because these vehicles are proven to build wealth long-term

- If you are interested in other options, limit these to just 10% of your investments

Principle 4: Build a foundation before you invest in new things

Before you start investing money in anything like cryptocurrency, NFTs, or even real estate, it’s important that you build a financial foundation first. Once you have a strong foundation, and if you’re still interested in investing in riskier asset classes, then be sure to spend time learning about their unique characteristics and how to evaluate them before actually investing your own money in them.

Actionable tips:

- Learn the basics of saving and investing and determine your investment objectives

- Practice good financial habits (like spending less than you make)

- Save an emergency fund with 6-months living expenses

- Build a basic investment portfolio with low-cost index funds and ETFs

- Research as much as possible before investing in non-traditional options

What I Invest In: Stocks, Bonds, Real Estate, and Cryptocurrency

Disclaimer: This section gives you an inside look into my investment portfolio, and what you’ll see isn’t perfect. My investment portfolio is more complex than I would recommend, but I’m kind of stuck with this for now. If I were to sell off assets that are duplicative of one another, just for the sake of simplifying, I would be creating a taxable event, which is something I want to avoid. |

Now that I’ve shared my guiding principles, I feel it is important to be fully transparent about how I invest and why.

Specifically, I’m going to answer:

- Which Accounts Do I Use?

- How do I Invest My Money?

- What do I Invest In?

While reading this, please keep in mind the following:

- This is NOT an investment strategy recommendation for you (since my situation and risk tolerance is unique to me).

- This is an example of what your portfolio of investments COULD look like, or some assets you may want to add to your strategy over time.

- This is NOT where I started. This is where I am in 2022 after over a decade of learning, researching, and building wealth.

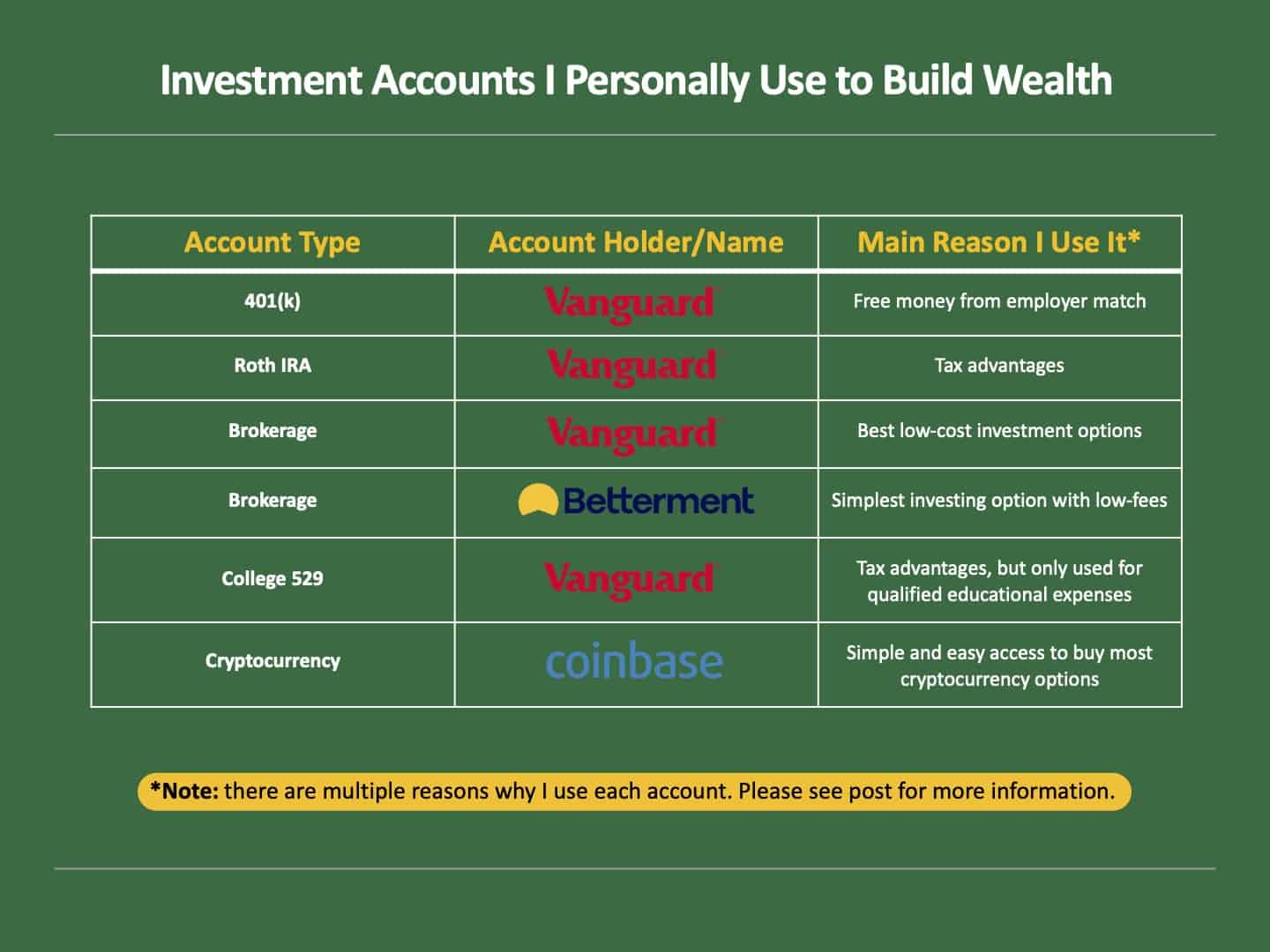

Which Accounts Do I Use?

While Part 1 of this series goes over the different accounts in-depth, here I want to share which types of investment accounts I opened first and why.

Here are the different types of accounts in the order that I opened them:

- 401(k)

- IRA

- Brokerage

- College 529

- Cryptocurrency brokerage

I’ve experimented with both hands-on account providers (like Vanguard, where I choose exactly which funds I want and buy stocks) and hands-off ones (like online broker Betterment and their robo-advisor management services). While I primarily use Vanguard and pick my own investments, I’d recommend a robo-advisor account for most people as a simpler and therefore better choice. With robo-advisors, beginning investors can get financial planning advice without having to pay actual financial advisors.

My first account was a 401(k) because my job at the time offered a matching program. Even though I could only invest in expensive mutual funds (~1% expense ratios) through this account, it still made sense because of the free money from the employer match.

My second account was a Roth IRA account that I opened with Vanguard, which I contributed to each month up until my income increased above the Roth income limits. When this happened, I opened a Traditional IRA account with Vanguard and started making the same monthly contributions into this account as I had been with my Roth account.

Tip: When it comes to an Roth IRA and the tax advantages it offers, there are two reasons why the early career years are truly the most valuable years to contribute:

Looking back, I wish I had opened a Roth IRA account sooner. Unfortunately, there’s no way to contribute for the years that have already passed. Don’t wait: start taking advantage of the tax-advantages of an IRA account as soon as possible. |

My third account was a Brokerage account, which is also considered a taxable account. I opened two, one with Vanguard and one with Betterment, as a test to see which I liked better and try out a robo-advisor offering. A brokerage firm is a business where these accounts are held. Brokers invest money on your behalf/at your direction. However, as soon as I learned about the tax advantages of the IRA, 401(k), and 529 accounts, I significantly reduced my investments into my brokerage account and focused primarily on my IRA and 401k accounts. However, both allow for the same investing in stocks and other instruments.

Tip for those looking to retire early: Having income and assets outside of your retirement accounts is critical to retiring early because you will need money that you can access penalty-free before you reach retirement age. If you plan to retire early, then I recommend contributing to a brokerage account in parallel to contributing to your retirement accounts each year. |

My fourth account was a college 529 account. Like IRAs, 529s also have tax advantages, but, unlike IRAs, the funds from a 529 can only be used for qualified educational expenses. I started contributing to the College 529 account in my mid 20s when I thought I might go back to school to get an MBA. Although I haven’t gone to grad school, it’s still been a great way for me to save, and now I’m planning on using that money (and contributing more) for my kid’s future educational expenses.

My fifth account was a cryptocurrency brokerage account with Coinbase. I did this many years after starting my investing journey and only after I had built up an investment portfolio of $100k+. While I hope (and believe) cryptocurrency will be a good investment, it is by its nature a risky and less stable investment so this is a smaller, high-growth potential investment.

Outside of my crypto brokerage account, each investment account I opened allows for fixed income, real estate, and stock investing.

How Do I Invest My Money?

Now that you know which types of accounts I use to invest, let’s turn to the question of how I invest. The biggest factor is called asset allocation strategy.

Simply put, an allocation strategy is how you decide to split up your money into different asset classes and investment vehicles (stocks, bonds, cash, real estate, cryptocurrency, etc.), knowing that each asset category has different characteristics. For example, investing in stocks makes you a shareholder. Companies have to create value for their shareholders.

Asset allocations can either be aggressive (riskier, potential for bigger reward) or conservative (less risk, a foreseeable amount of reward).

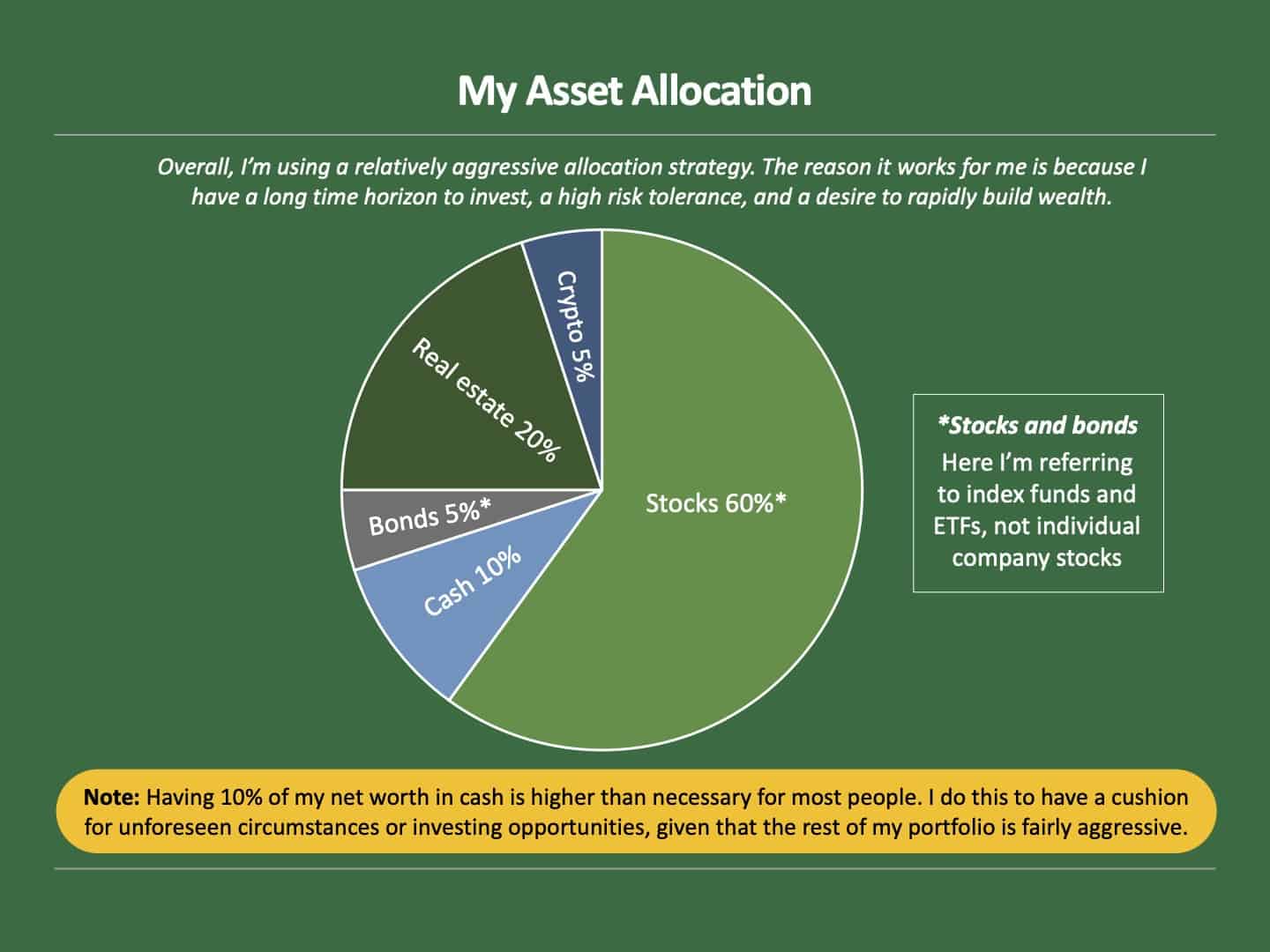

Overall, I’m using a relatively aggressive allocation strategy. The reason it works for me is because I have a long time horizon to invest, a high risk tolerance, and a desire to rapidly build wealth. You don’t necessarily need a financial advisor to determine which strategy you want to pursue.

So here’s how I split my money across different categories:

My Asset Allocation

- 10% Cash

- 60% Stocks

- 5% Bonds

- 20% Real Estate

- 5% Cryptocurrency

Important Context:

- Having 10% of my net worth in cash is higher than necessary for most people. The reason I do this is to provide a cushion for unforeseen circumstances or investing opportunities, given that the rest of my portfolio is fairly aggressive. Having this reserve improves my risk tolerance.

- When I say I have 60% of my money in stocks, I’m referring to index funds and ETFs, not individual company stocks.

- I have 20% of my wealth in real estate, which can provide consistent cashflow, diversification, and a hedge against inflation.

The percentages above are both my targets and my actual current allocation as of this post.

As things change each year (e.g., my stock index funds increase in value, changing my actual allocation from 60% –> 70%), I make a point to redirect my future investments to be more fixed income securities like bonds, real estate, and crypto to naturally rebalance things over time. This is a better strategy than selling some of my stocks in my investment account and exchanging them for other assets because selling them would trigger a taxable event.

I often hold financial assets of each type in all of my different accounts (IRA, 401(k), brokerage, etc.). This helps mitigate portfolio risk and makes it easy to rebalance and get back to my target allocations at any time, especially at the end of the year when I’ve already exceeded the annual limits of my IRA contributions.

What do I Invest in?

My asset allocation strategy tells you how my money is split up across different types of assets (stocks, fixed income, etc.), but let’s zoom in one step closer now. Within each of these categories, what exactly am I investing in? I’ve included the ticker symbol for each asset in parentheses.

Actual Stock Market Investments (in order of importance and weighting)

Vanguard Total Stock Market Index Fund (VTSAX or VTI ETF)

- Note: If you are just starting, or want to keep things simple, this could serve as the only fund in your stock portfolio and you would be in great shape.

Vanguard Total Stock Market Except US Index Fund (VFWAX)

- Note: A good way to intentionally diversify your stock investments outside of the U.S., since diversification (principle #2) can come in many forms (aka asset type, or geography).

Vanguard Total International Stock Index (VTIAX)

- Note: This works for all international exposure, it is duplicative with VFWAX, you only need one or the other, since both provide exposure to international stocks.

Vanguard Small Cap Stock Index Fund (VSMAX)

- Note: I didn’t add this until after I had built a $100k+ portfolio. I use this as a smaller slightly higher risk and growth bet.

In general, if I were to start all over again, I would invest in fewer stock market funds, so that it would be easier to keep them balanced across my different accounts.

Bonds

Total Bond Market Index or ETF (VBTLX or BND)

- Note: This is my primary way to get diversified bond exposure.

Total International Bond Market (VTABX)

- Note: This fund provides international bond exposure. I wouldn’t say this is something critical to include in a diversified portfolio, but like with the stocks above it is one way for me to adjust my geographic focus.

Tip: If zooming down to the individual fund level feels overwhelming, then a hands-off approach may be best for you. For a super simple and hands-off way to invest and build wealth, I recommend Betterment’s robo-advisor management service. I set up two Betterment brokerage accounts back in 2010 when I was just getting started investing. Both accounts have performed well and charge low management fees compared to accounts at other financial institutions, so I’ve kept them even as I learned to do the management myself. Robo-advisors provide investment advice by using historical data and algorithms. Here’s what these accounts look like for me:

|

Real Estate

Vanguard Real Estate Investment Trust ETF (VNQ)

- Real Estate Investment Trusts (REITs) are like stock mutual funds but instead of company stocks, these trusts hold real estate. I like Vanguard’s REIT ETF because of its low expense ratio compared to other REITs.

Tip: Vanguard’s REIT ETF is a good starting place if you want to keep it simple and make a diversified investment without all the market research and efforts to directly buy a property. |

Direct Real Estate Investments

My wife and I currently own four rental properties: one is a 4 unit residential building in Florida and the other three others are duplexes in Kansas.

Our personal strategy is to focus on properties that provide good cash flow, meaning that the monthly rental income is greater than all expenses. We research and select second tier markets that are stable and ideally growing in population and jobs. We also focus on small multifamily properties so we can get the best financing available (30-yr fixed mortgages).

In general, I highly recommend direct real estate investments for a variety of reasons, including:

- Greater control

- Tax advantages

- Multiple forms of return (cash flow, appreciation, debt paydown)

- Good inflation hedge

It’s worth noting, however, that direct real estate investments take more work and diligence to find, buy, and manage than traditional “paper” assets like stocks and bonds. If you want to learn more about how to invest in real estate, start here.

Cryptocurrency

I have Bitcoin investments through a Coinbase account. I do not day trade my crypto, and only invested with the intention of holding it for the long term (10+ years) based on research and belief that Bitcoin will increase in value. Furthermore, I fundamentally believe in the value of blockchain, decentralization, and other elements of cryptocurrency. If you want to learn more about how to invest in cryptocurrency, start here.

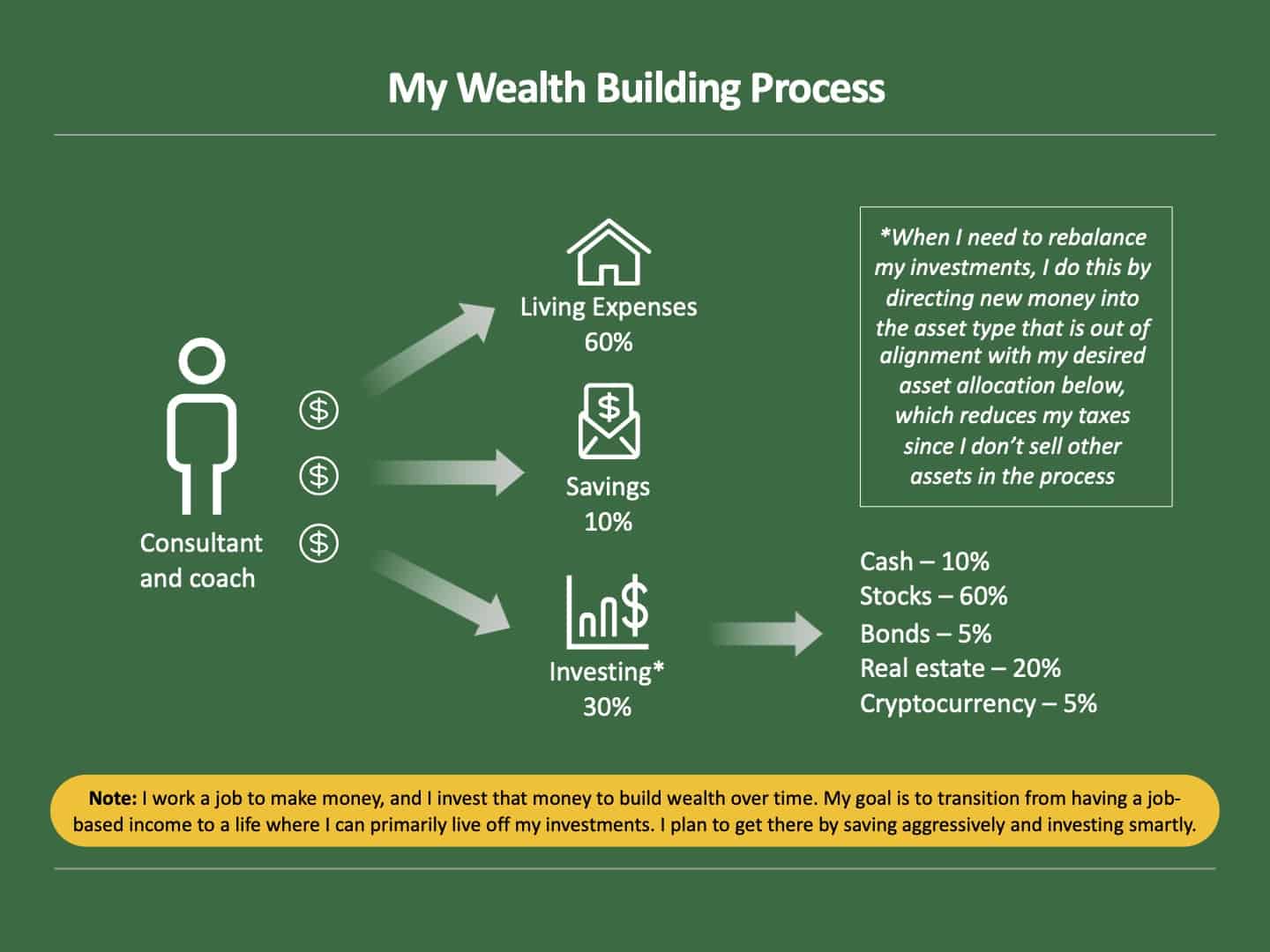

How I Earn My Living (so that I can invest)

I put this because I do not make my living by investing, yet 🙂 . This is VERY important to know.

While my goal is to build a portfolio of income-producing investments and assets, I am still on the journey to get there. Thus, stock market investing is a great place to start.

I work a job to make money, and I invest that money to build wealth over time. My goal is to transition from having a job-based income to a life where I can primarily live off my investments. Simply put, I plan to get there by saving aggressively (yes, I do have a savings account) and investing smartly.

I have two main jobs:

My Primary Source of Income: Consulting

I specialize in organizational and operational improvement at fast-growing companies.

My clients include private equity firms and their portfolio companies, as well as leadership teams at middle market and early stage companies.

My consulting work is split between helping investors analyze the operations of companies and identifying how they can invest to scale the business sustainably. I also help execute improvement projects at these companies.

My Secondary Source of Income: Leadership & Personal Finance Coaching

As a coach, I work with executives, entrepreneurs, and individuals helping them develop skills and tools to achieve new levels of success, fulfillment, and clarity.

I bring expertise in organizational development/design, goal setting, operational excellence, financial management, and career transitions.

Take a look at my coaching website for more information.

Conclusion: Wealth Building Process

My goal with this two-part series was to provide a tangible example of what I personally do to save money, invest, and build wealth. Being able to see what someone does can be incredibly valuable because it not only shows the what and the why, but more importantly, helps us understand how to put it into practice.

But because we’re all different, with unique personal circumstances, jobs, etc., it doesn’t necessarily mean my approach will work for you. Receiving the advice of a financial advisor can be costly and time-consuming, so some of this may require trial and error, which is okay (again, depending on your risk tolerance).

The underlying principles that I’ve outlined in both this piece and Part I, however, can be applied (with your own personal tweaks) to help you achieve your financial goals. For instance, while you might choose to have different checking, investing, and savings accounts, ensuring you at least have these accounts is vitally important.

Similarly, your investment portfolio might look different than mine, but following the investing principles I outlined above can help you determine what’s best for your personal financial situation and help you achieve your investment objectives on the way to financial freedom.

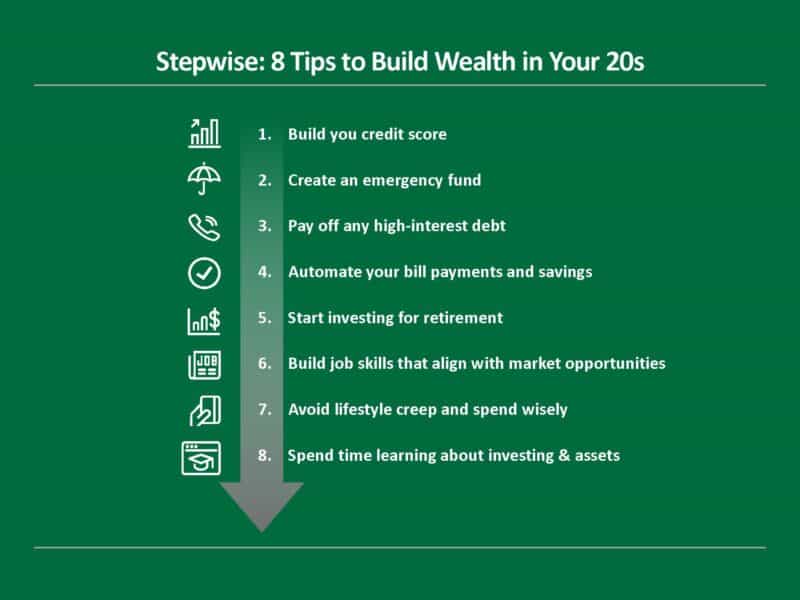

If you want a refresher on some of the core habits and tools, I’d begin by:

- Opening these 5 accounts

- Following these 6 steps to building wealth

- Learning about the fundamentals of investing

As always, I’m happy to answer any questions. Comment below and I’ll be sure to get back to you.

To your financial future!

Seavron Banus

Co-founder of Stepwise & passionate personal finance educator. My happy place is in the mountains with my wife and kids, whether on a board, bike, or my own two feet.

Thanks for sharing your thoughts!